Active Small and Mid-Cap Funds Achieve 7.8% Monthly Return

Highest Among Domestic Equity Fund Types

[Asia Economy Reporter Minji Lee] As the KOSDAQ index surpassed the 1000-point mark for the first time in 20 years and 7 months, continuing its rapid rise, 'small and mid-cap' funds, which had been relatively underperforming compared to large-cap stocks, are posting high returns.

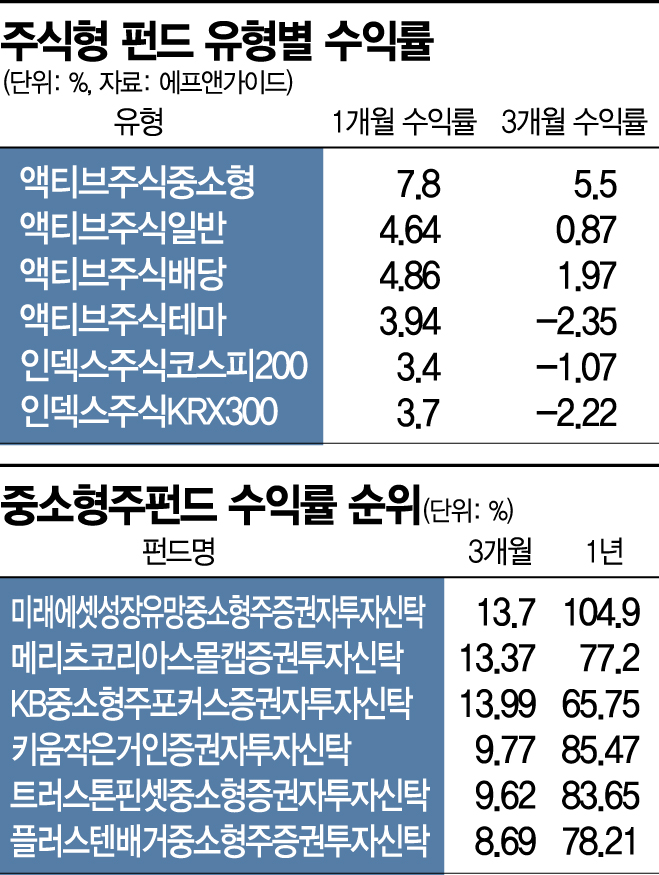

According to financial information provider FnGuide on the 13th, as of the 12th, 55 active small and mid-cap equity funds set up domestically posted a 7.8% profit over the past month, achieving the highest returns among domestic equity fund categories classified by FnGuide. During the same period, the average one-month return of all active equity funds was 4.9%, and the average return of index equity KOSPI200 funds tracking the KOSPI200 index was only 3.4%. Even when extending the period to the recent three months, small and mid-cap funds (5.54%) outperformed index equity funds (-2.41%) and active equity funds (0.9%) in average returns.

It is interpreted that demand has concentrated on small and mid-cap stocks as large-cap growth stocks such as secondary batteries, internet, and gaming, which had led the domestic stock market, have failed to regain their footing following a sharp rise in interest rates due to inflation concerns. With the notable rise of small and mid-cap stocks, those listed on the KOSPI market are also showing strength compared to large-cap stocks. Over the past month until the day before, the KOSPI200 small and mid-cap index rose by 9.25%, significantly outperforming the KOSPI50, which includes the top 50 by market capitalization, with a return of 1.48% during the same period. Kang Daeseok, a researcher at Eugene Investment & Securities, explained, "With the relative underperformance of emerging markets and Asian stock markets, the KOSDAQ index, which has good trading volume, is showing strength, so interest in small and mid-cap stocks is expected to continue for the time being."

Analysis of the top active small and mid-cap funds revealed that semiconductor-related companies significantly boosted returns. The ‘Mirae Asset Growth Promising Small and Mid-Cap Equity Investment Trust,’ which recorded the highest return of 13.7% over the past three months, included IT and semiconductor-related stocks such as Park Systems (6.5%), PI Advanced Materials (4.7%), Seoul Semiconductor (4.6%), Dongwoon Anatech (4.5%), and Sanga Front Tech (4.2%). The ‘Meritz Korea Small Cap Equity Investment Trust,’ which posted similar returns, mainly held system semiconductor and semiconductor materials companies such as Rino Industrial (5.16%), TCK (4.98%), Wonik IPS (4.71%), Kakao (4.4%), and Hansol Chemical (4.4%). Kim Kyungmin, a researcher at Hana Financial Investment, said, "Semiconductor-related indices are showing favorable returns supported by vaccine distribution, strong exports from Taiwan, and expectations for the U.S. government's response to semiconductor supply shortages," adding, "The upward trend of semiconductor equipment stocks continues due to expectations of relocating U.S. production facilities domestically and expansion of facilities in various countries."

Meanwhile, although favorable returns are being maintained, investors' fund redemptions show no signs of slowing down. Historically, as the index has reached a peak, this seems to reflect investors' psychology to realize profits from funds. Looking at the trend in fund assets, over the past three months, 270 billion KRW has been withdrawn from active small and mid-cap funds, contrasting with inflows into active sector funds (166.3 billion KRW) and active thematic funds (217.5 billion KRW) during the same period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)