[Asia Economy Reporter Hyunseok Yoo] DSC Investment is the 11th largest venture capital (VC) firm in South Korea based on assets under management (AUM). Recently, with Coupang's entry into the New York Stock Exchange raising expectations for a reevaluation of domestic companies' valuations, DSC Investment's investment history in companies such as Market Kurly and Musinsa has also attracted attention.

Founded in 2012, DSC Investment is a venture capital firm specializing in early-stage company investments and was listed on the KOSDAQ in 2016. It focuses on investing in companies that have been in business for less than three years or had sales of less than 1 billion KRW in the year prior to investment. In 2017, it strengthened its early-stage investment expertise by establishing its subsidiary accelerator, Schmitt.

Currently, DSC Investment operates a portfolio by investing in a total of 13 operating funds, including DSC Dream 3rd Youth Startup Investment Association and KT-DSC Creative Economy Youth Startup Investment Association. Last year, it also established the DSC Tech Value-Up Fund No. 2 and DSC Early-Stage Company Scale-Up Fund. As of the end of last year, its total AUM was 611.2 billion KRW, ranking 11th in South Korea after Smilegate Investment. Additionally, last year, it was selected by the global economic magazine Forbes as one of the ‘2020 Asia’s 200 Best Under A Billion’ promising small and medium enterprises.

Among the companies DSC Investment has invested in are firms well-known to both investors and the general public. Representative examples include Musinsa and Market Kurly. Musinsa is South Korea’s 10th unicorn company (a startup with a valuation exceeding 1 trillion KRW) and operates an online fashion community and platform. Its sales, which were 63 billion KRW in 2019, surpassed 110 billion KRW last year. DSC Investment invested 1.8 billion KRW in Musinsa.

Market Kurly is an online grocery shopping mall. It has rapidly grown in South Korea through its ‘dawn delivery’ service, increasing sales from 425.9 billion KRW in 2019 to 952.3 billion KRW last year. DSC Investment invested a total of 4 billion KRW in two rounds: the seed round in 2015 and Series B in 2017. At the time of investment, Market Kurly’s valuation was 52.5 billion KRW. Following Coupang’s listing on the New York Stock Exchange, there are forecasts that Market Kurly’s valuation could reach up to 5 trillion KRW, nearly 100 times the valuation at the time of investment.

In addition, DSC Investment has invested in various companies such as Pharos iBio, a new drug development company using artificial intelligence (AI) (3.5 billion KRW); SM Lab, a secondary battery cathode material company (8.5 billion KRW); Phantom AI, an autonomous driving platform developer (4.2 billion KRW); Furiosa AI, a semiconductor startup (2.5 billion KRW); Brandi, a fashion tech company (5.6 billion KRW); Neuromeka, a collaborative robot development technology company (6 billion KRW); Ridi, a content company operating Ridi Books (2 billion KRW); and Manna CEA, an agricultural venture company (9 billion KRW).

Some companies invested in by DSC Investment have recently gone public. Last year, SCM Lifescience, Kainos Medicine, Ngenbio, and Genome & Company were listed consecutively. The companies that were invested in have shown significant growth in performance following their listings.

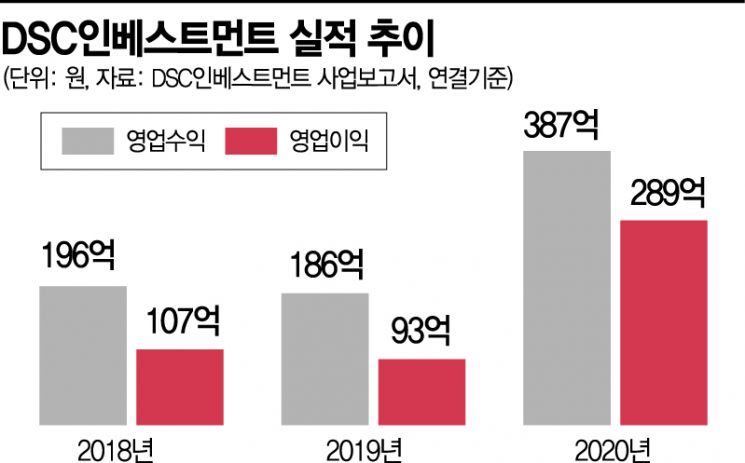

DSC Investment recognizes revenue (operating income) from investment association income, private equity company income, and other operating income. Last year, it recorded operating income of 38.7 billion KRW, operating profit of 28.9 billion KRW, and net profit of 24 billion KRW. Compared to the previous year, operating income increased by 107.4%, while operating profit and net profit rose by 210.8% and 190.6%, respectively.

Specifically, equity method gains from associations increased significantly. They were 2.2 billion KRW in 2019 but surged to 18.6 billion KRW last year. Along with this, performance fees from associations rose from 4.9 billion KRW to 5.6 billion KRW. Management fees from associations remained similar to 2019 at 7.3 billion KRW.

The company explained, "Performance fees increased due to the formation of new associations and exceeding the benchmark returns of existing associations. Equity method gains increased due to fair value evaluations following the listing of investee companies within the associations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)