Expansion of Domestic Stock Proportion in National Pension

Operating Principles Shaken for the First Time in 10 Years

Demand for Shareholder Return Policies from Companies

Revised 3% Rule Also Empowers Retail Investors

[Asia Economy Reporter Park Jihwan] Since last year, the Donghak Ant Movement has increased the influence of individual investors, bringing significant changes to the management strategies of companies and institutional investors. Companies are trying to appease individual investors through unexpected dividend increases and bonus stock issues, while the National Pension Service (NPS), a major player in the capital market, has shaken its management principles for the first time in 10 years in response to the Donghak Ants' call to expand the domestic stock holding ratio.

According to the financial investment industry on the 12th, the NPS held a Fund Management Committee meeting on the 9th and changed the domestic stock target ratio maintenance rule (rebalancing) to expand the target range for domestic stock holdings. This is the first change to the NPS's target ratio maintenance rule since 2011.

Even Influencing the NPS Target Ratio

As of the end of last year, the total funds managed by the NPS amounted to 833 trillion KRW, of which the domestic stock ratio was 21.2%, or 176.7 trillion KRW. Compared to this year's target ratio of 16.8%, it is 4.4 percentage points higher. The NPS's consecutive net selling in the stock market for 51 trading days from December 24 last year to February 12 this year was due to this reason. However, individual investors have strongly opposed the continuous stock selling by the NPS and have demanded a change in investment strategy.

With this decision, the strategic asset allocation (SAA) range for domestic stock holdings by the NPS has been expanded from ±2.0 percentage points around the previous target ratio to ±3.0 percentage points. The upper limit of the NPS's strategic investment ratio in domestic stocks, which was previously up to 18.8%, has risen to 19.8%. Assuming that the majority of the 15.5 trillion KRW net selling by pension funds this year was conducted by the NPS, the current stock holdings of the NPS are estimated to be around 160 trillion KRW, approximately 19-20%. This decision means that the NPS no longer needs to mechanically sell stocks in the domestic market.

Enforcing Shareholder Return Policies on Companies

The Donghak Ants are actively engaging in shareholder activism toward general companies. They are demanding proactive shareholder return policies such as bonus stock issues, cash dividends, and share buybacks.

Seegene, the leading diagnostic kit company, formalized the introduction of quarterly dividends and a 30 billion KRW share buyback plan at its general meeting of shareholders last month. Last week, it also announced a bonus stock plan allocating one new share per one common share and plans to transfer its listing to the KOSPI soon. Seegene's stock price surged from the 10,000 KRW range in January to the 300,000 KRW range in August last year due to performance growth from COVID-19. However, with news of vaccine development and vaccination rollout this year, the stock price steadily declined to the 120,000 KRW range in February. As Seegene's stock price plummeted, minority shareholders took collective action, demanding CEO Cheon Jong-yoon's resignation, the recruitment of professional management, transfer to KOSPI listing, and share buybacks.

Yusoo Holdings, a KOSPI-listed company, approved shareholder return measures such as dividend increases and share buybacks at its shareholders' meeting held on the 30th of last month. This dividend is the first in five years since 2016, and the dividend per share was set at 500 KRW, double the 250 KRW per share initially proposed by the board. The company pledged to return more than 30% of consolidated net income to shareholders over the next three years and to pay dividends of 10-30% of free cash flow annually. This came after minority shareholders criticized the owner family for securing cash through building sales before the shareholders' meeting while paying themselves high compensation.

3% Rule Also Empowers Ants

The revised 3% rule also empowers small investors. According to the amended Commercial Act effective this year, listed companies are required to separately elect at least one audit committee member apart from the board of directors. In this process, the voting rights of major shareholders and their special related parties are limited to a maximum of 3%. In the case of Daehan Textile, candidate Ahn Hyung-yeol, recommended by shareholder proposals, was appointed as a non-standing auditor due to the 3% rule. Although shareholder proposals for appointing inside and outside directors and approving auditor remuneration limits were rejected, minority shareholders succeeded in introducing a new auditor with a three-year term to the board. The Korea Corporate Governance Service commented, "Analysis of agenda items for 647 listed companies during this regular shareholders' meeting season shows an increase in shareholder proposals from 25 last year to 30 this year," adding, "Meaningful results were achieved, including the approval of shareholder proposals for separately electing outside directors as audit committee members at some meetings."

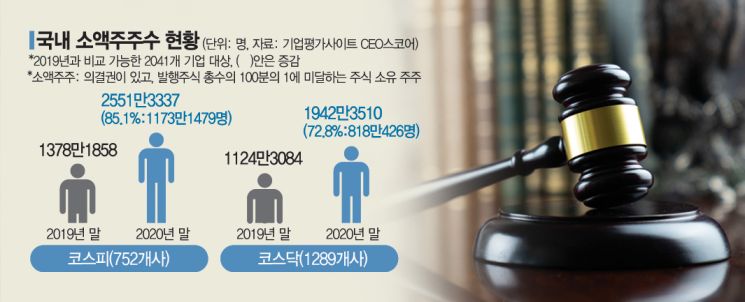

The securities industry expects collective actions by Donghak Ants to increase further. According to CEO Score, a corporate evaluation site, the number of minority shareholders in 752 KOSPI-listed companies reached 25,513,337 at the end of last year, an 85.1% increase from 13,781,858 the previous year. During the same period, minority shareholders in 1,289 KOSDAQ-listed companies also increased by 72.8% (8,180,426). A financial investment industry official said, "As the number of individual investors is rapidly increasing, collective actions to reclaim shareholder rights are expected to grow, and demands will become more diverse."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.