Examining the Korea Post Headquarters' 'Voice Phishing Damage Prevention Casebook'

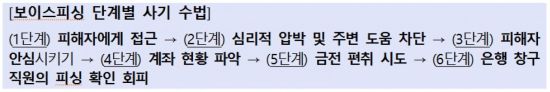

[Asia Economy Reporter Kim Bong-su] The so-called voice phishing (telephone financial fraud) techniques are evolving day by day, producing numerous victims. The naive days of overusing specific dialects are gone. People may scoff, saying, "Who would fall for such tricks?" but because scammers cleverly exploit advanced technologies like malicious apps and psychological weaknesses, many fall victim even with their eyes wide open. The Korea Post, under the Ministry of Science and ICT, recently analyzed cases of telephone financial fraud and published a data book that can 'scientifically' prevent such damage. It categorizes scammers' methods by type and also informs about the latest techniques.

▲ Government-supported low-interest refinancing loans + malicious apps

Mr. L, a man in his 30s struggling financially due to COVID-19, was scammed after believing a text message advertising "low-interest loans from government support funds" sent under the name of Bank A. When he called for loan consultation, he was induced to click a specific internet address (URL), which led to a malicious app being installed on his phone. Another scammer impersonating an employee of his existing loan bank called and threatened him, saying, "Taking a loan from Bank A violates the Financial Transactions Act, and all financial transactions will be suspended." Soon after, a group impersonating Financial Supervisory Service (FSS) employees called, instructing him to "undergo an investigation."

Suspicious, he even called the FSS call center, but due to the malicious app, his calls were intercepted. Instead, another group told him, "You did violate the Financial Transactions Act. To delete the criminal record, you must deposit your existing loan amount in cash." Mr. L ultimately had no choice but to hand over cash to the scammer impersonating the FSS employee.

There are many cases where financial information is preemptively identified and threatened due to personal information leaks from banks. Mr. M, a man in his 50s, was told by a scammer impersonating a police officer, "Someone opened a shell account under your name at Bank B's branch and used it for money laundering crimes." He was instructed to withdraw all his bank deposits and hand them over to an FSS employee to avoid property damage. Believing this, Mr. M withdrew 40 million won from the bank and handed it over.

Some of the criminal proceeds from a voice phishing organization seized by the International Crime Investigation Unit of the Seoul Metropolitan Police Agency. (Photo by Seoul Metropolitan Police Agency)

Some of the criminal proceeds from a voice phishing organization seized by the International Crime Investigation Unit of the Seoul Metropolitan Police Agency. (Photo by Seoul Metropolitan Police Agency)

▲ False product purchase payment text messages

Ms. P, a woman in her 50s, was baffled after receiving a payment completion text for a kimchi refrigerator she never bought. When she called the sender's number, she was scammed. The scammer, pretending to be a customer service agent, kindly offered help, saying, "It seems your identity was stolen; I will report it to the police for you." This was the bait that made her trust the scammers. Soon after, a scammer impersonating an FSS employee instructed, "The police say your account was used for criminal money laundering. To prevent damage, withdraw all your money and deposit it." Terrified, Ms. P even prematurely canceled her fixed deposit at the bank and handed over all the money to the scammer impersonating the FSS employee.

▲ Loan shark impersonation, child kidnapping and threats

Ms. G, a woman in her 60s, received a call from a scammer claiming, "I am a loan shark. Your child guaranteed a friend's 60 million won debt but hasn't repaid it, so we kidnapped them." The scammer played a woman's scream and threatened, "If you don't pay immediately, we will harvest and sell their organs." Since Ms. G's daughter was home at the time, she was easily deceived and canceled a 20 million won fixed deposit at the bank to send to the scammer.

▲ Text messages impersonating family or acquaintances

Ms. A, a woman in her 50s, received a text saying, "My phone screen is broken, so I left it at the repair center. I'm texting through the message service I made before under my name. Mom, if you have time, I have a favor to ask. Can you go to the convenience store for a moment?" Then she was asked, "Gift cards can only be purchased with cash, so withdraw cash and say you're buying them because gift cards are scarce and staff might not want to sell. After buying, send me the code numbers." Ms. A bought four Google gift cards worth 200,000 won each and sent the code numbers, but the sender was actually scammers.

Ms. K, also in her 50s, fell for the same scam and even clicked on a URL address as requested by the criminals, resulting in personal information theft. The scammers opened a new phone line under Ms. K's name, opened a non-face-to-face bank account, transferred and withdrew new loan funds and balances from other financial institutions, and then disappeared without a trace.

▲ Romance phishing - SNS impersonation of U.S. military (doctor/professional) marriage lure

Ms. O, a woman in her 50s, received a friend request from a stranger foreign man while using Facebook. Upon acceptance, the man introduced himself as a general in a special forces unit deployed in Iraq. Ms. O, who was divorced at the time, exchanged photos and frequently communicated with him. Their conversations through a translator deepened, and they developed a romantic relationship. Ms. O believed she would marry him.

One day, the man asked for money, saying, "To leave Iraq, I need to pay a fee through a diplomat." Trusting him completely, Ms. O sent about 30 million won in three installments, but the man cut off contact afterward. This is a typical case of so-called 'romance phishing,' where scammers approach online via SNS or email, express affection, build trust through wealth or appearance, and then demand money citing customs fees, delivery charges, or immigration costs. Recently, phishing emails claiming, "I am a lottery winner worth billions living in the U.S. doing charity work. Contact me for help," have also been spreading like a trend.

Photo by Getty Images

Photo by Getty Images

▲ If careless, you become an 'accomplice' in an instant

Many people are deceived or recruited into telephone financial fraud to earn small amounts of money and end up facing legal consequences. Often, bank account numbers are leaked due to personal information breaches. Scammers deposit money extorted from other victims into these accounts and then call, saying, "The deposit was made by mistake," asking for re-transfer or cash withdrawal. Responding kindly to such requests can make you an accomplice to telephone financial fraud. Another common method is asking to borrow bank accounts under the pretext of short-term high returns or purchase/exchange agency. Scammers impersonate financial institutions and approach loan seekers, saying, "Your credit is low, so you need to increase transaction records," and ask to transfer money to a specified account.

Below are guidelines to prevent such fraud damage.

① Always refuse if prosecutors, police, FSS, or financial companies demand money

● If they ask you to deliver funds in person or store funds at a specific location, it is 100% fraud

② If you receive loan offers via phone or text, always refuse any money requests such as low-interest refinancing, credit rating upgrades, or advance loan fees

● Scammers induce many people to lend or transfer bank accounts, promising daily high returns over 100,000 won

③ Never provide copies of ID cards, account numbers, or credit card numbers when requested

④ If you receive kidnapping or threat calls, first confirm your child's safety

● Keep contact information of your child's friends, teachers, and relatives in advance

⑤ If family or acquaintances request money or gift card numbers via KakaoTalk or text, always call to verify identity before responding

● If they avoid verification citing inability to talk, do not respond to gift card codes or transfer requests until identity is confirmed

⑥ Never click on remote control apps (like TeamViewer), unknown apps, internet addresses (URLs), or emails

● This includes URLs in texts about loan programs, delivery tracking, holiday greetings, mobile gift cards, tickets, or event reservations without verified sources

⑦ Emergency disaster relief fund texts do not include URL links; delete such texts immediately without clicking any links

⑧ Never enter or disclose personal or financial information when asked under the pretext of security enhancement or updates

⑨ Install antivirus programs provided by mobile carriers and keep them updated with real-time monitoring

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.