[Asia Economy Reporter Minji Lee] The KOSPI turned downward as the net selling by foreigners and institutions increased during the morning session. At 10:43 a.m. on the 9th, the KOSPI was at 3,136.69, down 0.21% (6.57 points) from the previous trading day. The KOSPI started the day at 3,147.51, up 0.10% (3.25 points) from the previous day, maintaining an upward trend before turning downward shortly after.

This is because foreigners and institutions increased their net selling during the morning. Foreigners and institutions sold stocks worth 115.2 billion KRW and 137.7 billion KRW, respectively. Individual investors alone bought stocks worth 250.5 billion KRW.

By sector, the highest gains were seen in textiles and apparel (1.89%), food and beverages (1.16%), services (0.82%), and pharmaceuticals (0.67%). In the textiles and apparel sector, F&F rose 4.4%, while Hyungji Elite (3.7%), Taepyeongyang Mills (3.4%), and Vivian (2.1%) also increased. This is analyzed as reflecting expectations for improved earnings due to better consumer sentiment.

Among the top market capitalization stocks, Samsung Electronics traded at 83,700 KRW, down 1.18% from the previous day. SK Hynix (-0.35%), LG Chem (-0.62%), Samsung Biologics (-0.13%), and Hyundai Motor (-1.08%) also declined.

At the same time, the KOSDAQ index was at 988.38, up 0.65% (6.36 points) from the previous day. The KOSDAQ started the day at 983.40, up 0.14% (1.38 points) from the previous day, continuing its upward trend. By investor type, foreigners and institutions sold stocks worth 1 billion KRW and 24.3 billion KRW, respectively, while individual investors alone bought stocks worth 28 billion KRW.

By sector, construction (2.56%), non-metallic minerals (1.88%), pharmaceuticals (1.68%), and broadcasting services (1.43%) showed the highest gains. Among construction companies, Seohui Construction (10.7%), Dongshin Construction (6.6%), and Seohan (3.7%) had significant increases.

Among the top market capitalization stocks, Celltrion Pharm (0.42%), Seegene (0.60%), Pearl Abyss (2.10%), EcoPro BM (0.54%), and CJ ENM (1.78%) rose.

"Broaden Interest in Sectors with Earnings Improvement"

As the earnings season approaches in earnest, expectations for corporate earnings are rising in the stock market. For U.S. S&P 500 companies, first-quarter earnings estimates have been revised upward from a 15.8% increase at the end of last year to a 23.9% increase currently. This is because expectations for earnings improvement have increased in most sectors compared to the end of last year.

Domestic first-quarter net income estimates for KOSPI companies are expected to reach 31.5 trillion KRW, marking the third-largest scale following 2018 and 2017. Lee Jaeyoon, a researcher at SK Securities, said, "With earnings estimates revised upward in most sectors and confirmed strong external demand and clear export growth momentum, the domestic stock market remains attractive even in an earnings-driven market. Not only domestically but also as the global economic recovery strengthens, this is positive for the domestic economy and companies that are highly export-dependent."

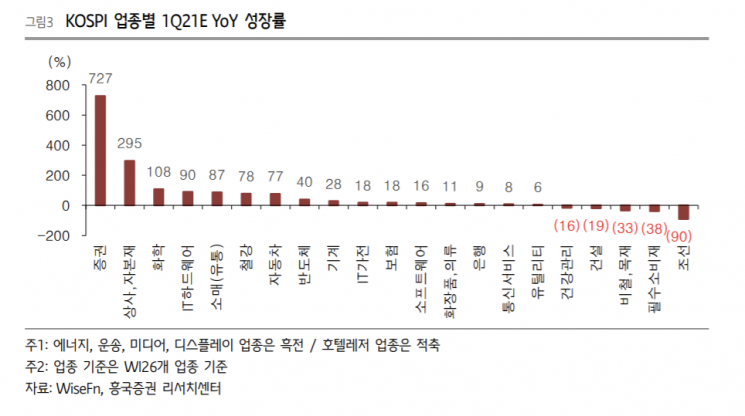

According to Heungkuk Securities, first-quarter earnings are expected to improve across most sectors compared to the previous year. Securities (726%), trading and capital goods (295%), chemicals (108%), IT hardware (89%), energy (turning profitable), transportation (turning profitable), media (turning profitable), and display (turning profitable) are expected to either turn profitable or show significant earnings improvements. Conversely, shipbuilding (-89%), essential consumer goods (-38%), and non-ferrous metals and wood (-33.4%) are expected to report poor earnings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.