[Asia Economy reporters Seulgina Jo, Nahum Kang, Eunmo Koo] Will Google's sly behavior, which has earned trillions of won annually in the Korean market while avoiding tax obligations, finally come to an end? The United States has proposed a new tax system requiring multinational corporations to pay taxes to countries based on their revenue generated in each country, drawing attention in the ICT industry toward global platform giants such as Google, Apple, and Amazon. Google's tax avoidance issue has been a recurring topic in annual government audits and is regarded as the starting point of unfair treatment between domestic and foreign companies.

◆Earning Trillions in the Korean Market but Paying 'Peanuts' in Taxes

According to industry sources on the 9th, Google is considered a prime example of a multinational corporation engaging in tax avoidance. Despite demonstrating comprehensive influence from the video market led by YouTube to the application market and cloud services, the scale of Google's revenue and tax payments has remained shrouded in secrecy since the establishment of Google Korea in 2006.

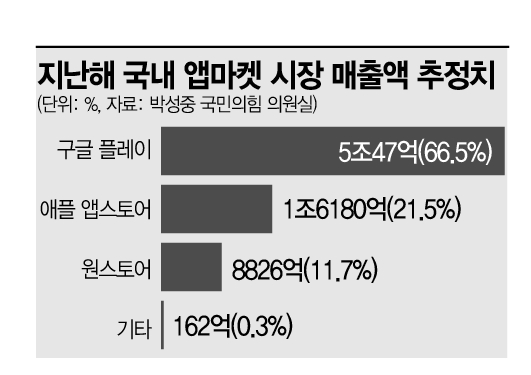

The industry estimates Google's domestic revenue to be at least 5 to 6 trillion won. The estimated revenue of Google Play, the app market with a domestic market share of 70%, was around 5.7 trillion won in 2019 (Mobile Industry Association). Considering the advertising revenue generated by YouTube, the scale is even larger. This far exceeds the revenue of Naver, a leading domestic platform competitor, which was 5.3041 trillion won.

However, the amount of taxes paid is incomparable. Many ICT multinational corporations, including Google, argue that because their servers are located overseas in places like Singapore, they are not subject to Korean corporate tax.

Google does pay some taxes domestically. A significant portion of the VAT collected by the Ministry of Economy and Finance from foreign businesses comes from Google and Apple. Google Korea also pays corporate tax on online advertising revenue from contracts.

Several years ago, Lee Tae-hee, Dean of the Graduate School of Global Startup Venture at Kookmin University, estimated Google Korea's 2017 revenue at approximately 4.92 trillion won based on Google's Asia-Pacific regional sales. The estimated tax paid by Google Korea that year was about 20 billion won, far less than the 400 billion won corporate tax imposed on Naver.

Dean Lee pointed out the tax avoidance issue, stating, "Digital goods are not physically produced, so the actual location of servers is not that important. Nevertheless, taxes are paid only where the servers are located." He added, "All global platform operators without a fixed place of business, similar to Google, fall under (tax avoidance)."

This logic was first used by Apple and later expanded to Google and others. While not illegal, criticism of tax avoidance is inevitable. Facebook's earlier decision to recognize advertising revenue in each country's branch office instead of consolidating it in its Irish entity was also a response to such controversies.

On the other hand, Google Korea stated, "Google complies with tax laws and pays all applicable taxes in every country worldwide, including Korea, where it provides services." After the National Tax Service imposed a 500 billion won corporate tax on Google Korea last year, the company paid it but subsequently filed an objection with the Tax Tribunal. At that time, the National Tax Service reportedly based its taxation on the fact that despite servers being overseas, the business is substantially conducted in the country.

◆Google as a 'Cherry Picker,' Controversies Over an Uneven Playing Field and Unfair Treatment

Tax avoidance by multinational platform giants also exacerbates unfair treatment between domestic and foreign companies, hindering fair competition. By saving massive taxes owed and reinvesting them in technology and services, the gap widens further. This is why platform giants, which should serve as global role models, are criticized as 'cherry pickers' who reap benefits on a tilted playing field.

Earlier, Yoon Young-chan, a member of the Democratic Party of Korea, criticized, "The growing global resentment toward Google is because it avoids taxes through loopholes without establishing necessary business establishments for operations." Kim Young-sik of the People Power Party said, "Google was fined 500 million euros for tax avoidance in France and paid an additional 610 billion won to settle all disputes. Unlike France, Google is opposing corporate tax reassessments in Korea," criticizing the company.

The international tax proposal presented by the U.S. the day before centers on requiring multinational corporations to pay taxes to countries based on their revenue generated in each country. It is also interpreted as an alternative to the digital tax, which has often led to disputes. A Ministry of Economy and Finance official explained, "Negotiations will begin in earnest for the new tax system," adding, "Instead of raising corporate tax rates, the idea is to set a kind of minimum tax threshold targeting multinational corporations like Google that install servers in low-tax countries to avoid taxes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)