Decrease in Traffic Volume Due to COVID-19

Possibility of Fare Increase Again from April↑

[Asia Economy Reporter Ki Ha-young] Last month, the loss ratio of automobile insurance for non-life insurance companies dropped to the high 70% range. This is a reflection of the decrease in automobile usage due to the impact of COVID-19. However, the loss ratio is expected to rise again starting this month as the peak outing season begins.

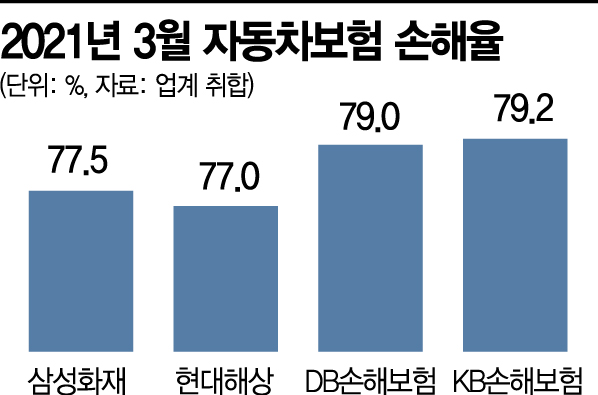

According to the non-life insurance industry on the 8th, the automobile insurance loss ratios for March of Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance ranged from 77.0% to 79.2%. These four companies hold an 84.7% market share in automobile insurance. By company, Samsung Fire & Marine Insurance recorded 77.5%, Hyundai Marine & Fire Insurance 77.0%, DB Insurance 79.0%, and KB Insurance 79.2%.

Accordingly, the automobile insurance loss ratio for the first quarter also decreased to between 80.1% and 81.1%. Compared to 84.4% to 85.6% in the first quarter of last year, this is an improvement of about 4 percentage points.

The loss ratio refers to the ratio of insurance claims paid to customers relative to the premiums received from customers. The industry considers an appropriate loss ratio to be below 78-80%. With the first quarter loss ratio approaching this range, non-life insurers are expected to have reduced deficits in automobile insurance.

Among small and medium-sized insurers, Meritz Fire & Marine Insurance had the best loss ratio last month at 76.0%, the lowest among 11 non-life insurance companies. On the other hand, MG Insurance, which raised automobile insurance premiums this year, still had a high loss ratio of 91.2%. For the first quarter, Meritz Fire & Marine Insurance had the lowest loss ratio at 77.5%, while MG Insurance had the highest at 95.0%.

The overall improvement in loss ratios is attributed to the decrease in automobile usage due to the COVID-19 impact, which kept automobile accident rates low. Last year as well, the accident rate decreased due to COVID-19, improving automobile insurance loss ratios. The annual automobile insurance loss ratio of 12 non-life insurance companies, including Carrot Insurance, was 85.7%, and the operating loss from automobile insurance was 379.9 billion KRW, reducing the loss by 1.2646 trillion KRW compared to 1.6445 trillion KRW in 2019.

The industry expects the loss ratio to rise again as the peak outing season begins. Typically, the loss ratio is low in March due to seasonal factors, but with warmer weather, automobile traffic is increasing.

Meanwhile, with the improvement in loss ratios, it seems difficult for large non-life insurers to raise automobile insurance premiums for the time being. Recently, small and medium-sized insurers with high loss ratios have raised premiums. MG Insurance and Lotte Insurance increased personal automobile insurance premiums by 2.0% and 2.1%, respectively, and Carrot Insurance and AXA Insurance (for commercial use) are preparing to raise premiums. However, with the recent submission of a request to the Ministry of Land, Infrastructure and Transport by the automobile maintenance industry demanding an 8.2% increase in maintenance fees, there is a possibility of premium increases in the second half of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.