IMF World Economic Outlook Points to "Uneven Recovery Management"

High Vaccination Rates Boost Growth in US, UK... Brazil, Saudi Arabia Show Slower Recovery

[Sejong=Asia Economy Reporters Son Seon-hee and Lee Hyun-woo] The International Monetary Fund (IMF) released its World Economic Outlook (WEO) report in April with the subtitle "Managing Divergent Recoveries." This implies that achieving balanced recovery is a task the IMF aims to pursue, but it also reflects concerns that the pace of recovery in each country will be influenced by fiscal capacity and vaccine distribution status.

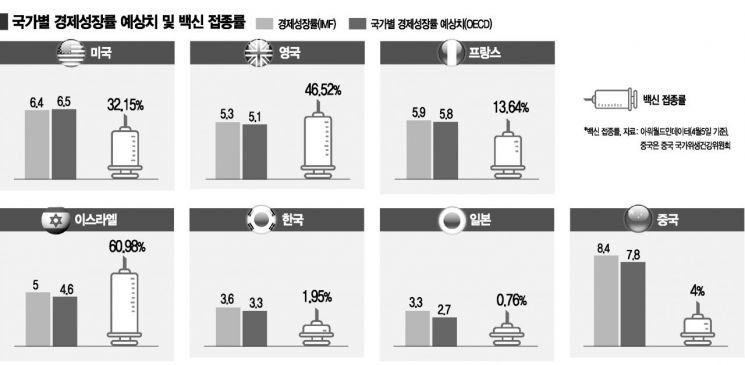

One notable point in the World Economic Outlook released by the IMF on the 6th (local time) is that the economic growth rates of advanced countries this year have been revised upward compared to the January forecast (4.3%). In terms of the magnitude of upward revisions, Canada showed an increase of 1.4 percentage points, the United States 1.3 percentage points, and Italy 1.2 percentage points.

These countries share the commonality that although they suffered relatively large damage from COVID-19 last year, they have since increased COVID-19 vaccine coverage and implemented strong economic stimulus measures through monetary expansion. The IMF stated, "Due to unprecedented policy responses, recovery is occurring faster than expected," and predicted, "The momentum for economic recovery will strengthen in the second half of the year due to additional fiscal expansion and vaccine distribution in advanced countries."

◆ Clear Economic Recovery Trend in the U.S. = The United States, where the vaccination rate has surpassed 30%, is receiving evaluations that the economic recovery trend is clearly emerging as employment figures last month greatly exceeded expectations. According to the U.S. Department of Labor's data on March 2, nonfarm payrolls increased by 916,000 compared to the previous month, which is more than 30% higher than the previously announced forecast of 650,000.

In the United Kingdom, where lockdown measures will be lifted from the 12th after about three months, a strong economic recovery is also expected. The UK, with a vaccination rate approaching 50%, will reopen non-essential shops, pubs, and restaurants starting on the 12th. The government is also considering allowing overseas travel from the 17th of next month. The IMF's growth forecast for the UK was revised upward to 5.3%, an increase of 0.8 percentage points from the previous forecast (4.5%). This is the fourth highest increase among advanced countries, following the U.S., Canada, and Italy.

In emerging and developing countries, recovery patterns varied by country. China is expected to grow by 8.4%, up 0.3 percentage points, and India is forecasted to grow by 12.5%, up 1.0 percentage point. However, the growth rates of other developing countries excluding these two are lower than those of advanced countries. Brazil's growth forecast was raised by 0.1 percentage points to 3.7%, Saudi Arabia's by 0.3 percentage points to 2.9%, and South Africa's by 0.3 percentage points to 3.1%. These countries have relatively weaker fiscal conditions and vaccine distribution.

Ultimately, it has become clear that the speed of economic recovery by country this year is determined by COVID-19 vaccine distribution and sufficient fiscal effects. Jeong Gyu-cheol, head of the Economic Outlook Office at the Korea Development Institute (KDI), said, "Vaccine supply is the most important factor for economic recovery," adding, "In this regard, growth rates may differ by country." He further predicted, "There will be differences between advanced countries that can boldly use fiscal policy and emerging countries that cannot in terms of policy response capacity."

◆ "South Korea Faces Recovery Burden Due to Slow Vaccine Supply" = Although the IMF significantly raised its growth forecast compared to January, it also warned about disparities in recovery speed by country, which is based on differences in vaccination rates and government policy support. Gita Gopinath, IMF Chief Economist, said, "Rapid policy support, including $16 trillion in fiscal support worldwide, prevented much worse outcomes," and added, "Without last year's policy coordination among countries, the economic shock from COVID-19 would have been three times worse."

The IMF revised South Korea's growth forecast upward to 3.6%. Although South Korea's COVID-19 vaccination rate is low at around 2%, the country's export boom, influenced by the economic recovery of advanced countries, contributed to the growth rate increase. However, domestic COVID-19 spread remains, and vaccination is still distant, making it difficult to avoid shocks to domestic demand, consumption, and employment. Jeong said, "It is positive that the medical system is well established, so COVID-19 has not spread as much as in other countries," but pointed out, "The relatively slow vaccine supply is a burden on economic recovery."

The government focused on exports rather than domestic demand revival in response to the IMF's upward revision of the global growth rate. Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, said at the Emergency Economic Central Countermeasures Headquarters meeting that day, "As a country highly dependent on external demand, South Korea will be one of the biggest beneficiaries of the recent strengthening global economic recovery," and added, "The IMF expects that the Biden administration's large-scale stimulus will have significant ripple effects on trading partners, so the strong recovery trend in the U.S. economy will further support the recovery of our exports and investments." As expectations for economic recovery grew, the won-dollar exchange rate showed a downward trend in the foreign exchange market that morning. This was analyzed as a result of improved investor sentiment toward risk assets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)