Asset Allocation: Banks Decline, Financial Investment, Insurance, and Specialized Credit Finance Companies Rise

[Asia Economy Reporter Park Sun-mi] The total assets of domestic financial holding companies increased by 12% last year, approaching 300 trillion won.

According to the "2020 Financial Holding Companies' Business Performance" announced by the Financial Supervisory Service on the 6th, the consolidated total assets of 10 financial holding companies including KB, Shinhan, NongHyup, Hana, Woori, BNK, DGB, JB, KDB, and Meritz recorded 2,946.3 trillion won last year, an increase of 31.77 trillion won compared to 2,628.6 trillion won at the end of the previous year. The total asset growth rate was 12.1%.

Over the past three years, the proportion of consolidated total assets of financial holding companies relative to the total assets of domestic financial companies (banks, insurance, financial investment, credit finance, savings banks, mutual finance, financial holding companies (separate)) has gradually increased from 38.9% at the end of 2018 to 45.8% at the end of 2019, and 46.3% at the end of 2020.

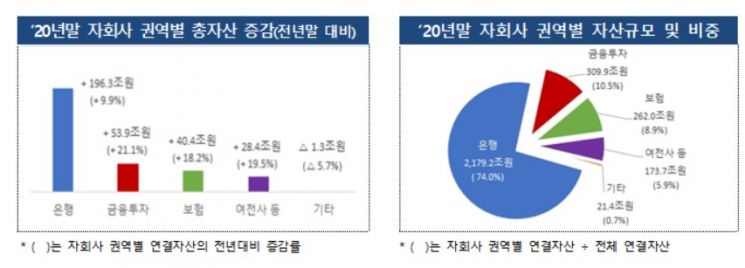

By subsidiary sector, banks accounted for the highest asset proportion at 74.0%, but this was down 1.47 percentage points from 75.4% at the end of the previous year. Financial investment rose to 10.5% (9.7% at the end of the previous year, +0.78 percentage points), insurance to 8.9% (8.4% at the end of the previous year, +0.46 percentage points), and credit finance, etc., to 5.9% (5.5% at the end of the previous year, +0.37 percentage points).

Last year, the consolidated net income of financial holding companies was 15.1184 trillion won, a decrease of 115.4 billion won (-0.8%) compared to 15.2338 trillion won the previous year. By subsidiary sector, banks decreased by 1.202 trillion won (-10.4%) due to expanded provisions for loan losses and costs related to private equity funds; financial investment increased by 232.5 billion won (+7.6%) due to increased commission income from a booming stock market; insurance increased by 355.5 billion won (+35.4%); and credit finance, etc., increased by 456.9 billion won (+23.2%).

By subsidiary sector, banks had the highest profit share at 57.1%, down 7.18 percentage points from 64.3% the previous year. In contrast, financial investment rose to 18.3% (17.2% the previous year, +1.15 percentage points), credit finance, etc., to 13.5% (11.0% the previous year, +2.44 percentage points), and insurance to 7.5% (5.6% the previous year, +1.92 percentage points).

Meanwhile, as of the end of last year, the total capital, core capital, and common equity tier 1 capital ratios of bank holding companies subject to Basel III standards were recorded at 14.63%, 13.19%, and 11.93%, respectively. Due to the introduction of the final Basel III framework, risk-weighted assets decreased by 0.7%, while total capital (+7.3%) and common equity tier 1 capital (+6.8%) increased, resulting in an increase in total capital ratio (+1.09 percentage points) and common equity tier 1 capital ratio (+0.83 percentage points) compared to the end of the previous year.

Asset soundness showed that the non-performing loan ratio of financial holding companies was 0.58% at the end of last year, the same level as 0.58% at the end of the previous year. The loan loss provision coverage ratio (total loan loss provisions/non-performing loans) increased by 8.14 percentage points from 123.29% at the end of the previous year to 131.43%, due to increased provisions in preparation for uncertainties such as COVID-19.

A Financial Supervisory Service official stated, "We will continue to ensure stable management of the financial system by inspecting financial holding companies' management strategies, asset soundness, and capital adequacy. In preparation for the end of COVID-19 policy support, we will encourage the establishment of self-response measures such as strengthening pre-monitoring of vulnerable borrowers, and also guide financial holding groups to enhance financial consumer protection and risk management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.