Advance Notice of Legislation on House Price Increase

Household Debt Management Measures to Be Announced Soon

[Asia Economy Reporter Kiho Sung] As the government raises the small lease deposit to protect tenants, it is expected to become more difficult to obtain mortgage loans. Increasing the small lease deposit inevitably reduces the loan limit under the bank's loan calculation method. With banks tightening mortgage loans and jeonse loans under the financial authorities' orders, combined with the household debt management measures to be announced later this month, the loan limits for actual homebuyers are expected to drop significantly.

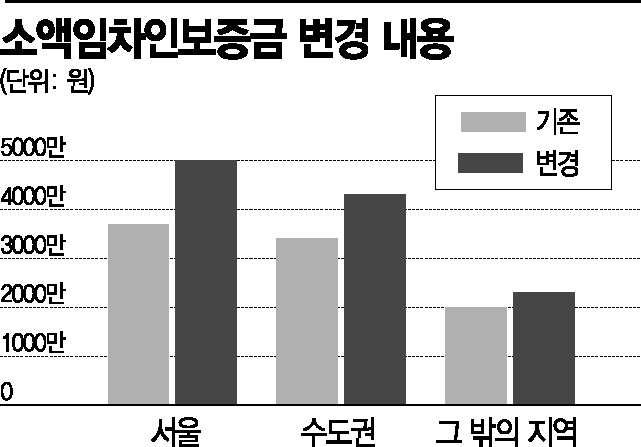

According to the financial sector on the 6th, the Ministry of Justice and the Ministry of Land, Infrastructure and Transport proposed and announced for public comment an amendment to the Enforcement Decree of the Housing Lease Protection Act last month to raise the small lease deposit. This bill is expected to be promulgated as early as this month. The small lease deposit refers to the deposit that tenants can be repaid preferentially if there is a problem with the rented house. This is intended to strengthen tenant protection further amid the recent overall rise in real estate prices.

According to the amendment, currently, tenants with deposits of 110 million KRW or less in Seoul can receive a maximum repayment amount of 37 million KRW, but tenants with deposits up to 150 million KRW will be able to receive a maximum of 50 million KRW, which is 35%, as a preferential repayment. In the metropolitan area, the overconcentration control zone, and Sejong Special Self-Governing City, the amount will be raised from the existing 34 million KRW to 43 million KRW, and in other metropolitan cities and regions, it will increase from 20 million KRW to 23 million KRW.

However, from the perspective of those who own or purchase houses, the collateral value will decline due to the enforcement of the amendment. Currently, banks that receive mortgage loan applications calculate the loan limit by subtracting the small lease deposit from the loan-to-value ratio (LTV) limit, regardless of whether the house is actually rented, in preparation for the case where the house is auctioned due to failure to repay the loan. For example, if a person owning a 300 million KRW house in Seoul receives a loan at an LTV of 50%, they can borrow up to 150 million KRW, but after the enforcement decree is implemented and the increased repayment amount of 50 million KRW is deducted, only 100 million KRW can actually be borrowed.

The problem lies in the fact that the mortgage loan limits for actual homebuyers may be significantly reduced. Commercial banks have already tightened household loans following the financial authorities' guidelines, simultaneously reducing the limits or raising interest rates on mortgage loans and jeonse loans. Shinhan Bank reduced preferential interest rates on mortgage and jeonse loans by 0.2 percentage points last month. Woori Bank cut the preferential interest rate on jeonse loans by 0.2 percentage points, and NH Nonghyup Bank lowered the preferential interest rate on mortgage loans by 0.3 percentage points. In addition, the Financial Services Commission plans to announce strengthened household debt management measures later this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)