Survey of 53 Complete Vehicle Partners

36% Say "Parts Production Halved"

Concerns Over Continuation for at Least 3 Quarters

Calls for Eased Financial Support Criteria

The semiconductor shortage has lasted longer than expected, causing losses. Even last night, we stayed up all night trying to secure quantities available on the black market in the US and Europe, but the amount secured is insufficient. Government or external support measures are urgently needed." (A representative from Company A, a domestic supplier of vehicle sensors to automakers)

Due to the global shortage of automotive semiconductors, domestic auto parts companies are facing significant difficulties. Some are experiencing such severe business deterioration that they have to borrow money to keep their factories running. As the semiconductor crisis is expected to continue through the second half of the year, urgent government support is being called for.

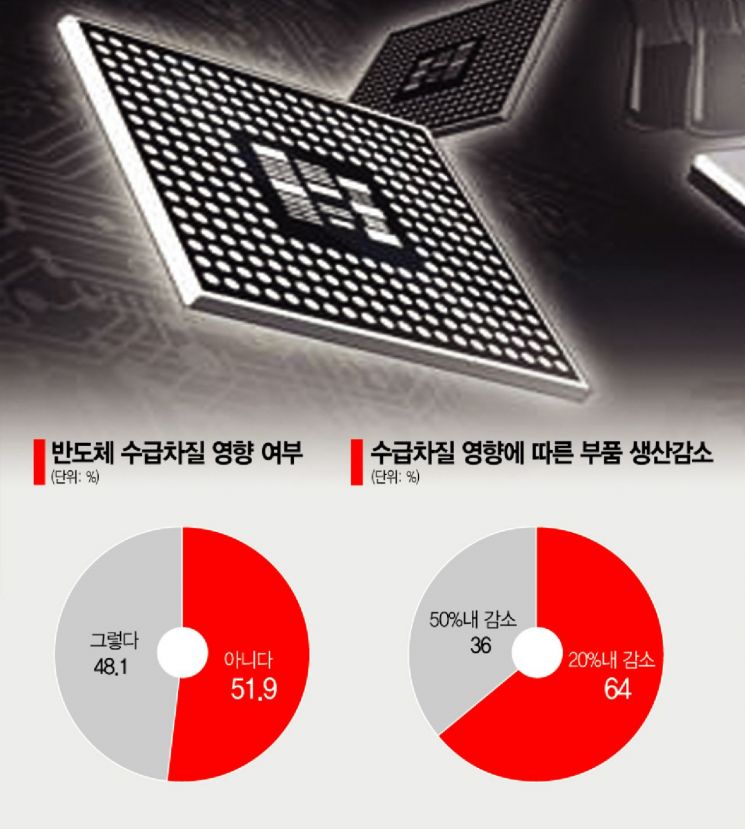

◇ "Production disruptions due to semiconductor supply shortage" = According to a survey conducted on the 6th by the Korea Automobile Industry Association (KAIA) targeting 53 first- to third-tier suppliers of domestic automakers, 48.1% of respondents reported negative impacts due to disruptions in the supply of automotive semiconductors.

These companies are experiencing actual production declines as the supply of automotive semiconductors is not smooth. Among the companies reporting supply disruptions, 36% said parts production decreased by up to 50%, while 64% reported a reduction of up to 20%.

The automotive semiconductor crisis began at the end of last year in the US and Europe and has recently significantly affected South Korea as well. Automotive semiconductor manufacturers switched their production lines to IT device semiconductors after the COVID-19 outbreak reduced automobile demand last year. However, as the spread of COVID-19 slowed and consumption rapidly recovered, automotive sales increased recently, causing semiconductor supply to fall short of demand. Natural disasters such as the Texas cold wave in the US and earthquakes and fires in Japan, which halted semiconductor factory operations, also accelerated the supply shortage.

◇ Half of auto parts companies face worsening financial difficulties = Auto parts companies are adjusting parts production through inventory management, but if the shortage of automotive semiconductors prolongs, they will be in such a difficult situation that they must borrow money to keep factories running.

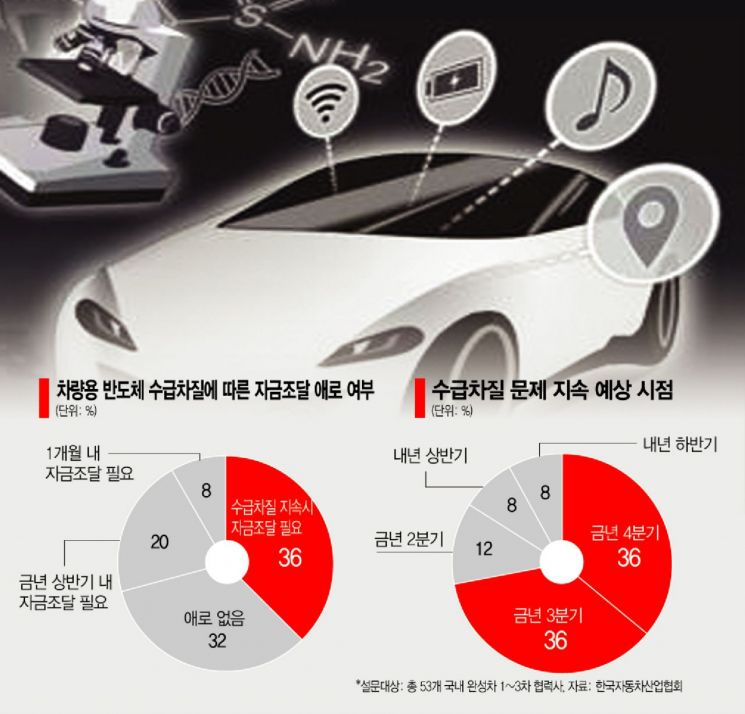

Regarding financial difficulties caused by the semiconductor supply disruption, 8% of companies responded that they are in an urgent situation requiring financing within one month. Including these, 28% of companies need to secure funds within the first half of the year. Additionally, 36% said they would need financing if the supply shortage continues long-term.

They argued that the government should step in to support companies facing financial difficulties. Among respondents, 39% demanded an expansion of government financial support, and another 39% requested relaxation of financial support criteria.

A representative from Company B, which supplies advanced driver assistance systems (ADAS) and sensors?components that require many automotive semiconductors?to automakers, expressed frustration: "We hold daily video conferences with automotive semiconductor companies such as Infineon, NXP, and Renesas to secure automotive semiconductors, but they only say the shortage will continue until the end of this year."

◇ Concerns over continuation through the second half of the year = The automotive semiconductor supply shortage is expected to last at least until the third quarter of this year. Market research firm IHS Markit announced on the 31st of last month that global automobile production would be disrupted by about 1.3 million units in the first quarter alone.

Domestic suppliers shared a similar view. 72% of respondents expected the supply shortage to continue through the second half of this year. AlixPartners forecasted that the global automotive industry's revenue loss this year would reach $60.6 billion (approximately 68.78 trillion KRW).

The damage to global automakers is becoming increasingly severe. Volkswagen, the world's largest automaker, has been continuously reducing production since December last year, cutting 100,000 units in the first quarter alone across China, North America, and Europe. Ford reduced production by 10-20% in the first quarter, and Toyota adjusted production volumes at plants in China, the US, and Japan.

Domestic automakers are also suffering losses. Hyundai Motor temporarily suspended operations at its Ulsan Plant 1 starting the 7th and is discussing a shutdown at its Asan Plant. Kia is also temporarily halting operations at its Georgia plant in the US. Korea GM is operating its Bupyeong Plant 2 at 50% capacity.

As the semiconductor crisis worsens, companies’ willingness to localize parts production is strengthening. Among surveyed parts companies, 72% said they would replace imported parts with domestic ones if performance is adequate. They explained that discovering domestic companies and supporting commercialization are necessary for localization.

Jung Manki, chairman of KAIA, said, "According to the survey, about half of the suppliers are struggling due to disruptions in automotive semiconductor supply. While expanding cooperation with the Taiwanese government to overcome semiconductor supply difficulties, the government and financial sector need to implement proactive and extraordinary financial measures for companies facing liquidity challenges."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.