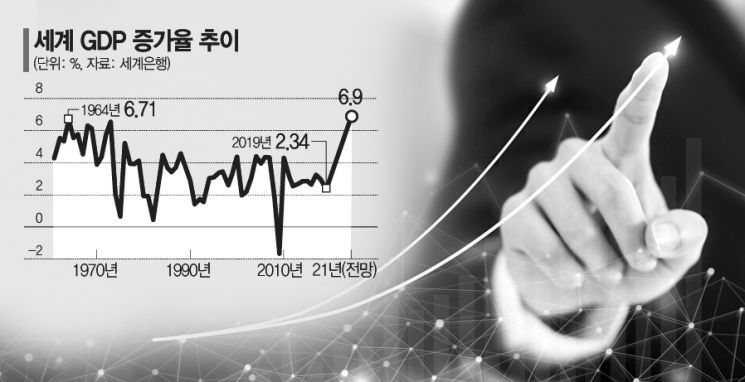

Global Economic Growth Forecast at 6.9%... US and China Rise in Q1, Germany and France Expected to Decline

Vaccine and Fiscal Policy Differences Anticipated to Cause Imbalance... South Korea's Vaccination Rate Stalls at 1.85%

[Asia Economy Reporter Byunghee Park] This year, the global economic growth rate is expected to reach its highest level in half a century. This is thanks to the rapid economic growth of the United States and China, as well as the effects of large-scale stimulus measures. However, countries with slow vaccine rollouts and failed quarantine measures are unlikely to share in this growth. Severe imbalances between countries are emerging as the biggest challenge for the global economy this year.

On the 4th (local time), Bloomberg Economics forecasted that the global economic growth rate will reach 6.9% this year. If this forecast proves accurate, it will be the highest record since the World Bank (WB) began compiling data in 1960. The highest growth rate so far was 6.71% in 1964.

This forecast was released ahead of the spring meetings of the International Monetary Fund (IMF) and the WB, which will be held from the 5th. The IMF is scheduled to release its revised World Economic Outlook on the 6th, and it is expected to raise its previous forecast of 5.5%.

◆ Vaccine Distribution and Fiscal Policies Likely to Determine Growth Rates = The reason for the high expected global economic growth this year is the sharp recovery of the U.S. economy. The U.S. central bank, the Federal Reserve (Fed), projects that the U.S. economy will grow by 6.5% this year. If this materializes, it will be the highest growth rate since 1984. China, as usual, is expected to record high growth rates. The Chinese government has set a target of over 6%, but major global financial institutions expect China's economic growth rate to reach the 8% range this year.

On the other hand, major European economies such as Germany, France, the United Kingdom, and Italy are expected to remain in negative growth territory. The economic growth rates of major emerging countries such as Brazil, Russia, and India are also expected to be much lower compared to China.

Bloomberg diagnosed that the reason for these imbalances is differences in vaccine distribution and fiscal policies among countries. The U.S. vaccination rate has reached 25%, while the European Union (EU) has not yet reached 10%. Mexico, Brazil, and Russia are below 6%.

The Wall Street Journal (WSJ) reported, "Thanks to the growth of the U.S. and China, the global economy is recovering faster than economists' forecasts," but also noted, "New lockdown measures in Europe and middle- and low-income countries threaten growth."

South Korea's situation is also challenging. According to the COVID-19 Vaccination Response Promotion Team, South Korea's vaccination rate was only 1.85% as of the 4th. The sluggish vaccine rollout is pointed out as a potential obstacle to economic recovery at any time.

Heo Jin-wook, a research fellow at the Korea Development Institute (KDI), emphasized, "As COVID-19 control has fallen short of initial expectations, downside risks to the economy are emerging," adding, "To accelerate the current recovery trends in services, clothing, and other semi-durable goods consumption, resolving the quarantine situation is essential."

Joo Won, head of economic research at Hyundai Research Institute, said, "If social distancing is strengthened again, psychological contraction is likely to lead to actual consumption contraction," and observed, "Although recently even face-to-face industries have turned positive compared to last year, showing an overall recovery mood, there is a risk of falling into a double dip recession."

◆ Growth Imbalances May Spur Capital Outflows from Emerging Markets = The uneven growth is expected to be a major theme at this week's IMF and WB spring meetings. Kristalina Georgieva, IMF Managing Director, pointed out, "Overall economic outlook is improving, but country-specific outlooks are dangerously divergent," adding, "Vaccinations are not happening everywhere globally, unemployment is too high, and poverty rates are rising sharply." Georgieva said, "The most worrying aspect of the COVID-19 crisis in February was the widening gap between rich and poor countries."

The strengthening of the dollar due to expectations of U.S. economic recovery is a significant burden for emerging markets. Capital is flowing out of emerging markets and into the U.S.

According to the Institute of International Finance (IIF), $5.16 billion flowed out of emerging markets in March. This is the first capital outflow from emerging markets since October last year. When capital flows out, emerging market currencies weaken, increasing inflationary pressures. Indeed, Turkey, Brazil, and Russia have successively raised their benchmark interest rates this month. However, raising benchmark interest rates can tighten financial markets, becoming another economic burden.

Maurice Obstfeld, former IMF Chief Economist, pointed out that U.S. President Joe Biden's stimulus package is a "double-edged sword" because it induces U.S. interest rate increases. He predicted that rising U.S. interest rates will tighten global financial markets and further increase the fiscal burden on governments whose deficits have grown due to the pandemic.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)