Surging Demand for Autonomous Driving... Last Year's Electronic Component Sales Increased by 34%

Two-Track Mobile and Electronic Cameras Since Startup... 132-Fold Growth

Focused R&D Capabilities... Prepared Changes in Line with Electric Vehicle Growth

On the 17th, the 'Ioniq 5' was unveiled at Hyundai Motor Company's Wonhyo-ro building in Yongsan-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 17th, the 'Ioniq 5' was unveiled at Hyundai Motor Company's Wonhyo-ro building in Yongsan-gu, Seoul. Photo by Jinhyung Kang aymsdream@

[Asia Economy Reporter Junhyung Lee] There is a company that is always mentioned when talking about automotive electronic equipment (electronic devices) cameras. MCNEX, a camera module manufacturer that holds the No. 1 domestic and No. 5 global market share in the automotive camera sector. The company's domestic market share reaches 80%. MCNEX cameras are used in 70-80% of vehicles produced by Hyundai and Kia, including all Genesis models except the G90. This year, the company secured a camera supply contract for Hyundai's dedicated electric vehicle E-GMP platform, and its cameras were installed in the Ioniq 5. Overseas companies such as Sweden's Volvo, France's Peugeot, and China's Geely are also customers.

Localization of Japan's Exclusive Parts... New Leap with Automotive Cameras

MCNEX was originally a strong player in the mobile phone camera market. It supplied smartphone camera modules to companies like Samsung Electronics, achieving sales exceeding 1 trillion KRW solely from mobile components. This component has been the primary contributor to the company's growth so far. Domestically, it holds the third highest market share after LG Innotek and Samsung Electro-Mechanics, both affiliated with large conglomerates. Globally, its market share ranks between 7th and 8th.

However, the industry views automotive cameras as the growth engine that will lead MCNEX in the future. The demand for autonomous driving technology has surged, accelerating the company's automotive parts performance. Autonomous vehicles use 1.5 to 2 times more camera modules than regular vehicles. Premium features found in some vehicles, such as infrared cameras necessary for nighttime driving, are included as standard equipment in autonomous vehicles.

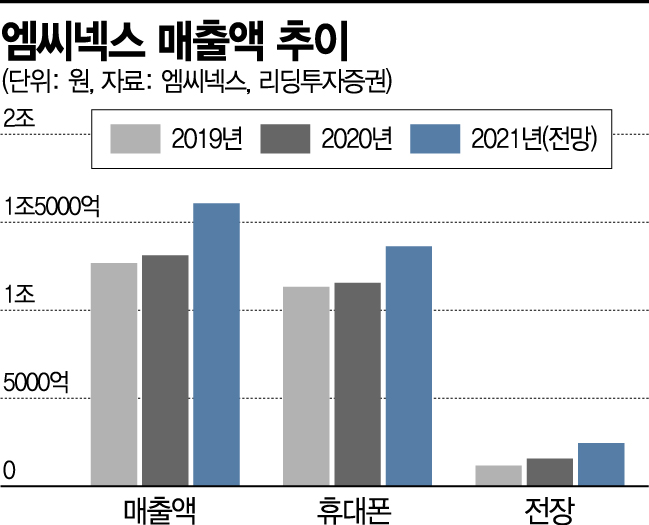

The smartphone market has matured, leading to intensified competition and stagnant market demand. According to Leading Investment Securities and others, MCNEX's mobile phone component sales increased by 2% last year compared to the previous year, while automotive component sales grew by 33.7%. The company's automotive division sales are expected to increase by 56.6% this year compared to last year.

MCNEX CEO Dongwook Min called this a "prepared change." CEO Min saw the potential of the camera module market 20 years ago when he was working at Hyundai Electronics Terminal Research Center, the predecessor of SK Hynix. He participated in the development of multimedia phones and commercialized video calls for the first time in the world in 2002. At that time, the mobile phone camera market was not large. Most mobile camera modules were Japanese-made. Japanese electronics companies such as Sharp, Kyocera, and Sony dominated the market.

36% Annual Growth... Automotive Parts Sales Also Rising

Founded in 2004, the company showed remarkable growth. Sales, which were 10.1 billion KRW in 2005, reached 1.3113 trillion KRW last year. CEO Min explained, "Arithmetically, the company has grown about 132 times since its founding," adding, "The average annual growth rate is about 36%."

From the company's inception, CEO Min developed both mobile and automotive cameras simultaneously. Automotive cameras were first used as rear cameras in Nissan's Infiniti vehicles in Japan in 2005. This indicates how low the awareness of automotive cameras was at the time. Although mass production of automotive cameras began in 2006, their sales proportion was not high.

Many years have passed, but the outlook was ultimately correct. The company's automotive division sales reached 156.4 billion KRW last year, a 73.6% increase compared to 90.1 billion KRW in 2015. This is due to the increased installation rate of automotive electronic parts. According to Samjong KPMG, the average installation rate of automotive electronic parts rose from 22% in 2000 to 50% last year. The automotive electronic parts market is rapidly growing as the biggest beneficiary of the autonomous driving era. Last year, the global automotive electronic parts market was worth 342.426 trillion KRW, a 27% increase from 269.83 trillion KRW in 2015. The domestic autonomous vehicle market's average annual growth rate reaches 40%.

The company has grown enough to consider listing on the KOSPI. However, CEO Min still spares no expense on research and development. The company spends about 45 to 55 billion KRW annually on R&D. Of the approximately 500 headquarters employees, about 330 are R&D personnel. CEO Min said, "Research and development is an activity essential for a company's survival," adding, "Even if there is no immediate marketability, we boldly invest in technologies that may be used in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.