[Asia Economy Reporter Ji Yeon-jin] There is a forecast that the large-scale infrastructure investment in the United States will also act as a positive factor for the domestic stock market. Despite persistent inflation, rising interest rates, and tax risk that have recently pressured the stock market behind the large-scale money supply in the U.S., expectations for policies have raised corporate profit forecasts, which can alleviate the burden of rising interest rates.

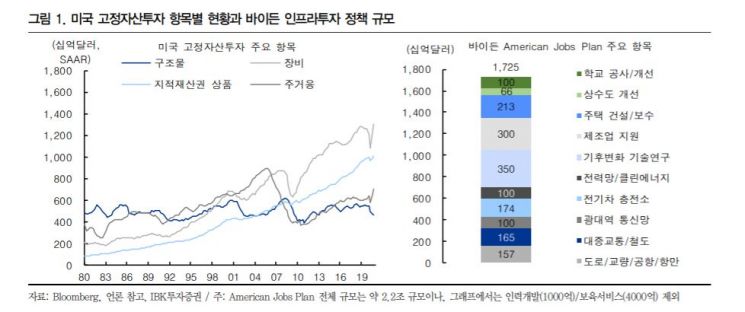

According to the securities industry on the 4th, the $2.2 trillion infrastructure investment policy (American Jobs Plan) recently announced by U.S. President Joe Biden

far exceeds the $2 trillion initially expected by the market. This corresponds to part of the Build Back Plan, a recovery bill announced in mid-January, and considering the remaining policy (American Family Plan), it is estimated to reach up to $4 trillion. This amount is comparable to last year's U.S. private fixed asset investment of $3.5 trillion.

In particular, the market is most focused on the high proportion of new technology-related sectors. Traditional infrastructure such as transportation and water supply improvements accounts for about 17% of this policy, while new technology-related infrastructure investments such as broadband networks and electric vehicle charging stations account for nearly 50%.

Such infrastructure investment is led by government-driven projects, so the fiscal multiplier is high and the economic stimulus effect is significant. Since the economy has already begun to recover based on the base effect, easing of the COVID-19 situation, and other stimulus measures without the infrastructure investment policy, the implementation of the infrastructure investment policy is expected to strengthen the economic recovery trend and investment cycle.

This also means that domestic economy and corporate profit benefits can be expected according to the U.S. investment cycle. Both Korean exports, which show a high correlation with core durable goods orders that precede the U.S. facility investment cycle, are showing a rapid recovery trend. In terms of corporate profits, representative beneficiary sectors such as steel and machinery are showing signs of recovery linked to the U.S. investment flow. Especially since Biden's infrastructure investment includes various new technology sectors beyond traditional fields, a broader range of industries can be expected to benefit.

So-eun Ahn, a researcher at IBK Investment & Securities, pointed out, "The main negative factor of infrastructure investment, rising interest rates, is a natural flow in the economic recovery phase supported by large-scale stimulus measures," adding, "However, from the perspective of the yield gap, if corporate profit forecasts are raised, the burden of rising interest rates can be offset to some extent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.