KB Kookmin Bank, Hana Bank Followed by Woori Bank: "Limit Reduction if Not Used"

[Asia Economy Reporter Park Sun-mi] Amid pressure from financial authorities to manage household loans, commercial banks are reducing the limits on overdraft accounts with low utilization rates. In an environment where loans are being tightened across the board, financial consumers who opened overdraft accounts with the mindset of "just open it for now" are inevitably forced to take out loans to maintain their limits.

According to the banking sector on the 3rd, among the four major banks, KB Kookmin Bank, Hana Bank, and Woori Bank specify conditions for maintaining limits when extending the term of overdraft accounts. Starting from the 1st of this month, Woori Bank decided that if the higher value between the overdraft account limit utilization rate in the last three months or during the contract period is below 10%, the limit amount will be reduced by 10% when extending or renewing overdraft credit loan products. If the utilization rate is below 5%, the overdraft account limit will be reduced by 20%.

Since July last year, KB Kookmin Bank has specified in the special terms of its credit loan products that "if the average loan limit utilization rate for overdraft accounts in the three months prior to the maturity date is 10% or less, the loan limit contract amount will be reduced by 20% before extending the term." However, there is a condition that if the loan balance as of the extension date exceeds 50% of the contract amount, the extension can be made without reduction.

Hana Bank also announced screening criteria stating that customers using the Hana OneQ overdraft account, known as the "cup noodle loan," may face up to a 50% reduction in limit based on utilization performance during loan term extension screening, or a full reduction of the limit if the limit is unused during the loan period.

Customers Taking Out Temporary Loans to Maintain Limits

In reality, customers who have not used their overdraft account limits by the maturity date see their extension limit reduced by half compared to the limit they had a year ago when checking the loan extension limit. A customer who used Hana OneQ said, "There is a risk of having to immediately repay the loan amount reduced by the decreased limit," adding, "To maintain the existing limit, I have to temporarily take out loans up to the overdraft limit and then repay them a few days later."

These measures by banks are spreading further as financial authorities, concerned about excessive household debt growth, pressure the banking sector. However, as commercial banks reduce the limits on overdraft accounts with low utilization rates, a side effect is emerging where customers must temporarily take out unnecessary loans to maintain their limits.

One customer said, "There is strong demand to open overdraft accounts in preparation for sudden financial needs, but when informed that the limit will be reduced if the utilization rate is low at the time of extension, customers feel compelled to temporarily take out unnecessary loans to increase their limits," adding, "The guidance that there will be disadvantages if the loan limit is not utilized feels like an unfair loan inducement."

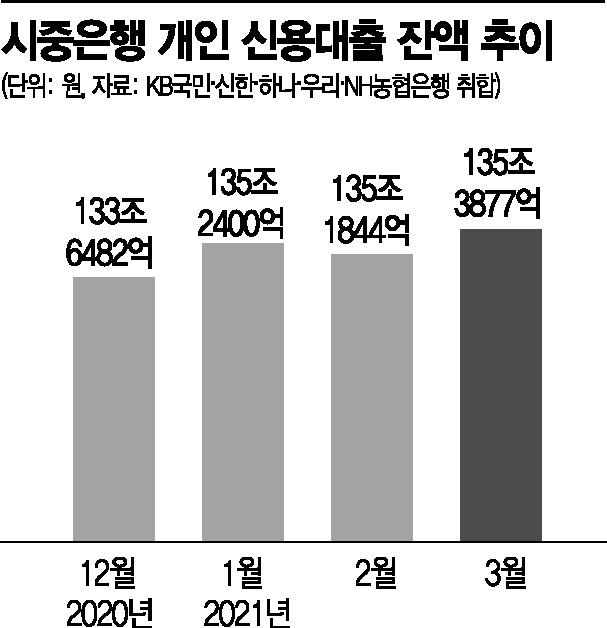

Recently, amid the enthusiasm for stock and real estate investment and the strengthening of household loan management by financial authorities, a perception has formed among financial consumers that overdraft accounts should be opened with the maximum limit possible when available. The number of new overdraft accounts opened daily at the five major banks currently exceeds 2,000. In particular, on the 10th of last month, the deadline for SK Bioscience's public offering subscription, the number of new overdraft accounts opened at the five major banks surpassed 2,500, about 10% higher than usual. The financial authorities plan to announce household debt management measures within this month, comprehensively considering trends in household loans for the first quarter.

A bank official explained, "While there is a movement to reduce overdraft account limits from the perspective of strengthening household loan management, banks incur costs because they have to set aside reserves for the amount customers use from their overdraft limits," adding, "We have no choice but to encourage customers who open overdraft limits but do not utilize them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.