Overseas Stock Market Settlement Amount Increases

New Revenue Sources Rapidly Emerging in Securities Industry

Expansion of New Customer Acquisition Events Including Investment Fund Support and Car Prizes

[Asia Economy Reporter Park Jihwan] The securities industry is intensifying efforts to expand services aimed at attracting overseas stock investment customers. This is interpreted as the scale of Seohak Gaemi, who directly invest in overseas stocks, is growing day by day, making the foreign currency securities settlement amount of domestic investors a new source of revenue for the industry.

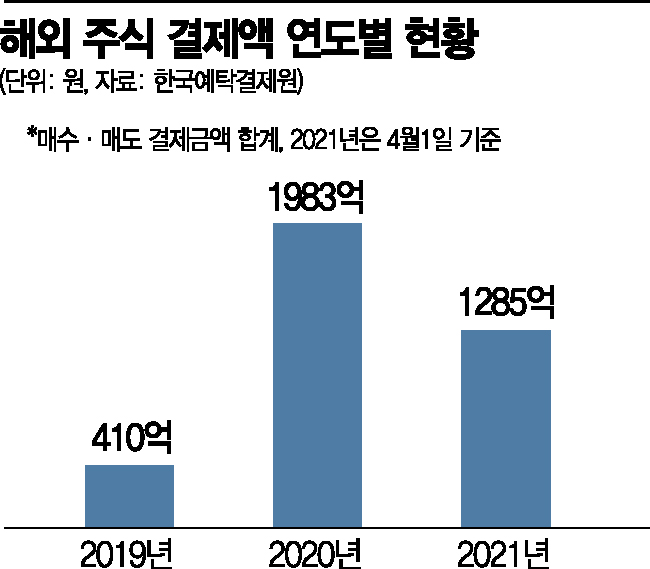

According to the Korea Securities Depository on the 2nd, the total amount of foreign stock purchase and sale settlements by domestic individual investors last year was $198.3 billion (about 224 trillion won), which is 4.84 times the $41 billion in 2019. Even this year, as of the 1st of this month, the foreign stock settlement amount reached $128.5 billion (about 145 trillion won), approaching 65% of last year's annual settlement amount.

As overseas market settlement amounts increased, Seohak Gaemi emerged as a major source of revenue for the securities industry last year. The securities industry earned a record high of 547.5 billion won in foreign securities custody fee income last year. This is an increase of 383.8 billion won (234.4%) compared to 163.7 billion won in 2019.

The competition among securities firms to attract Seohak Gaemi is becoming increasingly fierce. Previously, the expansion of services mainly focused on investors who were already investing in overseas stocks, such as free real-time stock quotes, commission reductions and preferential exchange rates, and extended trading hours before the regular market opening.

Recently, the trend has expanded to events aimed at acquiring new customers, such as investment fund support or car prize giveaways. Following Samsung Securities' initiative to attract customers by providing up to $100 in cash to Seohak Gaemi investors, Hyundai Motor Securities announced the day before yesterday that it will provide an investment support fund of $20 to the first 5,000 customers by June 30. Hyundai Motor Securities will also offer prizes such as the GV70 (2.5 Turbo) and Samsung Galaxy Tab S7 through a lottery for customers who trade overseas stocks.

With the capital gains tax filing deadline next month, tax filing agency services are also being offered. In the case of overseas stocks, a 22% tax is imposed on the amount exceeding 2.5 million won of the annual profit earned from overseas stock transactions. This differs from domestic stock investment, which has no tax on capital gains unless the investor meets the major shareholder criteria. Currently, Korea Investment & Securities, Kiwoom Securities, and Meritz Securities provide free tax filing services that include verification of transaction details from other company accounts as well as tax filing.

Unique events targeting overseas stock direct buyers are also attracting attention. At the end of last month, Kiwoom Securities and KB Securities displayed a 'Seohak Gaemi' support advertisement on the Nasdaq Tower in Times Square, New York, USA.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.