Expected Revenue Over $2.5 Billion in Q1 This Year... Exceeding Market Forecast

Refining Margins Recover Amid Recent Oil Price Rebound Despite Texas Cold Wave Disaster Impact

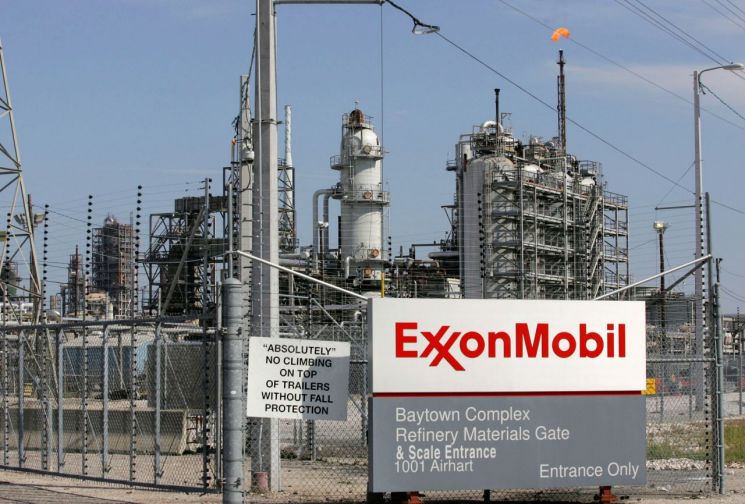

[Asia Economy Reporter Hyunwoo Lee] There is a forecast that the US major oil company ExxonMobil will return to profitability for the first time in five quarters, thanks to the recent rise in oil prices. ExxonMobil, which recorded losses for four consecutive quarters last year, is expected to improve its performance despite the refinery damage caused by the Texas cold wave in February. However, since the oil price trend remains unstable, it is uncertain whether the performance improvement will continue.

According to CNBC and major foreign media on the 31st (local time), ExxonMobil stated in the securities report submitted that day that first-quarter earnings are expected to rise, projecting at least $2 billion (approximately 2.26 trillion KRW) in performance improvement due to recent increases in oil and gas prices. This has raised expectations that the company will break away from losses sustained over four consecutive quarters last year and return to profitability.

The securities report detailed factors affecting the business environment, showing that the recent rise in oil prices sequentially increased oil and gas operating income from $1.6 billion to $2 billion over four quarters. The rise in natural gas prices added up to $700 million to operating profit. Additionally, improvements in refining margins and income from unsettled derivatives are expected to add $1 billion in revenue. The chemical business sector also saw an increase in profits of up to $600 million, indicating improved profitability across all business divisions.

However, the severe cold wave and power crisis in Texas in February negatively impacted refinery operations and other energy operations, causing shutdowns. The damage from the cold wave, including reduced production and sales volume, is estimated at about $400 million.

Overall, first-quarter earnings this year are expected to be around $2.5 billion. According to IBES data from global financial information provider Refinitiv, ExxonMobil’s first-quarter earnings are estimated at $2.55 billion, which is higher than the previous market forecast of $2.34 billion. However, concerns remain about whether the performance improvement trend can continue, as COVID-19 cases are rising again in Europe and the US, vaccine supply issues are worsening, and international oil prices are beginning to fluctuate depending on demand forecasts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.