Bank of Korea's Business Survey Index (BSI) Hits Highest in 10 Years Since July 2011

Economic Sentiment Index (ESI), Reflecting Consumer Sentiment, Highest Since May 2018

Total Industrial Production Turns to 2.1% Growth... Largest Increase in 8 Months

Business Indices ‘Rise Together’ Amid Positive Momentum

Q1 Growth Rate Expected Between 0.5% and 0.8%... Third Consecutive Quarter of Positive Growth

Revived Economic Sentiment: The Key is Whether It Will Establish Firm Growth

[Asia Economy Reporter Kim Eunbyeol, Sejong = Reporters Son Seonhee and Moon Chaeseok] The business sentiment perceived by companies surged to the highest level in 9 years and 8 months. Although the spread of COVID-19 continues, rapid vaccine rollout and the global economic recovery have raised expectations that the economy, led by export companies, will revive. The economic sentiment, calculated by reflecting both business and consumer sentiment, has also recovered to pre-COVID-19 levels. Last month, the increase in total industrial production was the largest in 8 months. Even considering only the economic indicators confirmed in January and February, the first quarter gross domestic product (GDP) growth rate is expected to be positive, marking the third consecutive quarter of positive growth. This means recovering the GDP lost due to the COVID-19 shock last year.

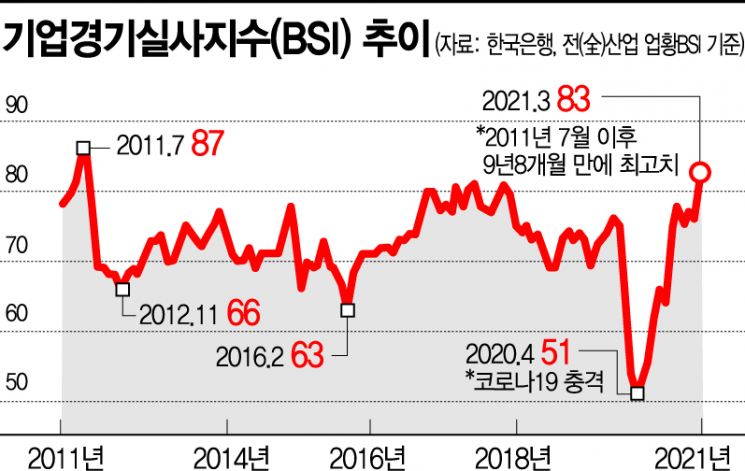

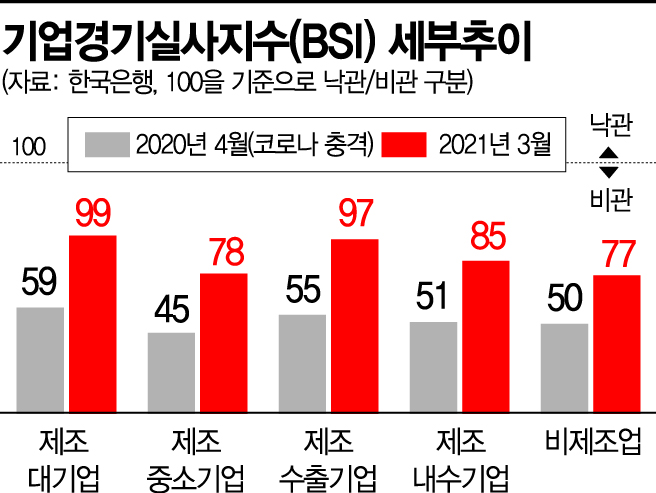

According to the 'March 2021 Business Survey Index (BSI) and Economic Sentiment Index (ESI)' released by the Bank of Korea on the 31st, the BSI for all industries this month was 83, up 7 points from the previous month, marking the highest since July 2011 (87). The manufacturing BSI was also the highest since July 2011, and the non-manufacturing BSI was the highest since December 2019 (78), before the COVID-19 outbreak. The BSI for the outlook of all industries next month also rose 6 points to 84, indicating that the improvement in business sentiment is expected to continue for the time being. The ESI, which reflects consumer sentiment as well, rose 4.7 points from the previous month to 101.3, the highest since May 2018 (101.9).

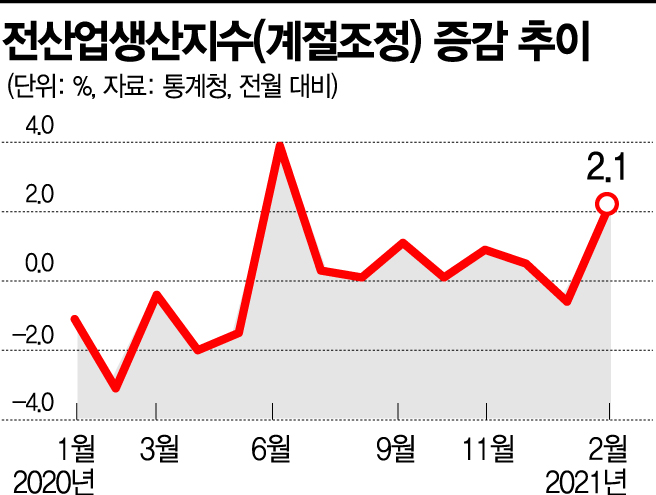

Economic recovery was also evident in industrial activity. Total industrial production, which had contracted by 0.6% in January, turned to a 2.1% increase last month as production in both manufacturing and services improved. In particular, manufacturing production rose 4.3% month-on-month, driven by semiconductors (7.2%) and chemical products (7.9%). The average operating rate of manufacturing also reached 77.4%, the highest in 6 years and 7 months.

Professor Kim Kyungsoo, Emeritus Professor at Sungkyunkwan University, evaluated, "The pattern of exports increasing first, followed by domestic demand improvement, is similar in other countries. It is positive that exports and industrial production are showing strong performance for now." However, he added, "There seem to be clear hurdles, such as a resurgence of COVID-19 spread or delays in vaccine rollout schedules," and said, "The government should pay attention to avoid becoming like Europe, where vaccination schedules were delayed." The sentiment indices that assess the economy have recovered to pre-COVID-19 levels, which could lead to increased investment and production, but for actual domestic demand recovery, faster vaccine rollout is necessary.

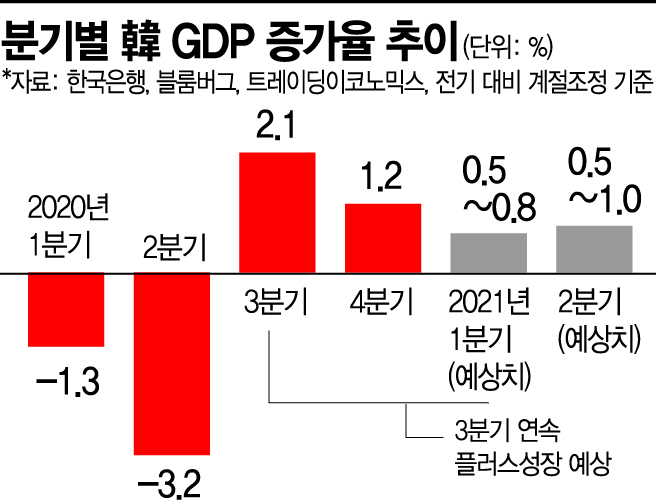

The economy is expected to grow positively in the first quarter. According to Bloomberg's survey of 42 investment banks (IBs), the first quarter growth rate is expected to be 0.8%. This marks the third consecutive quarter of positive growth, representing about 0.9% growth compared to the same period last year. Bloomberg's forecast for Korea's annual growth rate this year is 3.4%. Earlier, the International Monetary Fund (IMF) revised Korea's growth forecast upward from 3.1% to 3.6%.

Business Indices ‘Rise Together’ Amid Positive Momentum... Consumption Pauses

According to the industrial activity trends released by Statistics Korea on the same day, total industrial production rose 2.1% month-on-month, supported by export growth at the beginning of the year. The coincident composite index, which reflects current economic conditions, and the leading composite index, used for short-term forecasting, also rose by 0.3 percentage points and 0.2 percentage points respectively. Eo Unseon, Director of Economic Trend Statistics at Statistics Korea, analyzed, "Overall production showed considerable improvement, centered on manufacturing production," and added, "The economic recovery trend appeared stronger than the previous month."

Consumption and investment, however, showed signs of pause. Last month, the retail sales index fell 0.8% month-on-month, marking a decline for the first time in three months since November last year. The easing of social distancing measures due to COVID-19 led to a decrease in demand for food and beverages at home (-3.7%), which is believed to have contributed to the decline in consumption indicators. The facility investment index was 121.7, down 2.5% from the previous month. Imports of semiconductor manufacturing equipment fell 11.4% month-on-month, causing the machinery investment index to drop 6.2% month-on-month. Although consumption paused, experts believe that once the COVID-19 spread subsides and vaccine rollout accelerates, pent-up consumption could increase at any time.

Sentiment Already Back to Pre-COVID-19 Levels

The sentiment of economic agents has already returned to pre-COVID-19 levels. Business sentiment perceived by companies rose uniformly regardless of manufacturing or non-manufacturing sectors and company size. The manufacturing and non-manufacturing business survey indices (BSI) released by the Bank of Korea on the day also rose across the board. Kim Daejin, Team Leader of Corporate Statistics at the Bank of Korea's Economic Statistics Bureau, explained, "The manufacturing BSI rose 17 points in the primary metals sector due to rising steel product prices, and the chemical substances and products sector rose 12 points due to rising oil prices."

The BSI for the outlook of April business conditions rose 6 points to 84 for all industries. The Economic Sentiment Index (ESI), which reflects the Consumer Sentiment Index (CSI) in addition to the BSI, rose 4.7 points in one month to 101.3, the highest level since May 2018 (101.9).

Bloomberg Forecasts 0.8% Q1 Growth... Q2 Consumption Recovery is Key

With exports showing stronger-than-expected performance, the first quarter growth rate is expected to mark the third consecutive quarter of positive growth. According to Bloomberg's survey of 42 investment banks (IBs), the first quarter growth rate is expected to be 0.8%. This marks the third consecutive quarter of positive growth, representing about 0.9% growth compared to the same period last year. Bloomberg's forecast for Korea's annual growth rate this year is 3.4%. If the forecast holds, growth will have turned positive compared to the first quarter of last year, indicating a recovery from the COVID-19 shock.

The key question is whether the Korean economy can firmly establish a full-fledged recovery. It is important not only that corporate recovery is led by exports but also that employment and consumption revive to establish sustained growth. The semiconductor supply shortage could also act as a variable affecting production recovery. Statistics Korea remains cautious about whether the economy has hit bottom. A Statistics Korea official said, "It is cautious to explicitly say whether the bottom has been reached."

Hong Namki, Deputy Prime Minister and Minister of Economy and Finance, chaired the Emergency Economic Central Countermeasures Headquarters meeting at the Government Seoul Office on the day and said, "The second quarter is a decisive period (tipping point) to firmly establish our economy's full-fledged recovery," adding, "We will do our utmost to resolve the livelihood difficulties of self-employed people, small business owners, and vulnerable employment groups and to solidify the economic improvement trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.