27,000 Units Supplied Last Year with 360,000 Applicants

Apatels Instead of Apartments... Fewer Loan and Subscription Restrictions

Government Introduces 'Non-Residential Mortgage LTV Regulation'... Dark Clouds Ahead

Last year, the number of officetel applicants nationwide increased about fourfold compared to the previous year. This is attributed to the soaring apartment prices and the government's focus on regulating the housing market, which led demand to shift to officetels, which are subject to relatively fewer regulations.

On the 31st, Real Estate Info, a real estate market analysis firm, analyzed officetel sales information registered on the Korea Real Estate Board's subscription website and found that last year, 56 officetel complexes with 27,138 units were supplied nationwide, with a total of 363,982 applicants. Although the supply volume was smaller than in 2019, when 70 complexes with 33,635 units were supplied, the total number of applicants increased by a whopping 268,250, about 3.8 times.

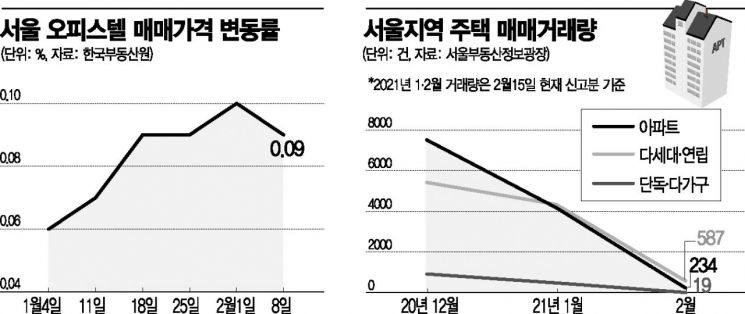

As apartment prices in Seoul and the metropolitan area rose sharply, a balloon effect caused demand to concentrate on residential officetels. They were popular among young generations who lacked cash and were desperate to own a home because they could avoid strict apartment loan regulations. In speculative overheated districts like Seoul, mortgage loans for apartments are limited to 40% of the house price, but for residential officetels, loans of up to 70% are possible.

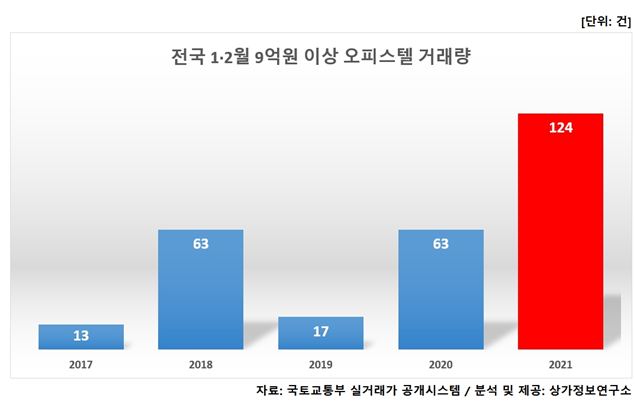

Officetel transaction volumes also increased. According to data from the Korea Real Estate Board, last year, the number of officetel transactions totaled 161,642, about 7.85% higher than in 2019 (149,878 transactions). Although the July real estate policy announced last year effectively abolished apartment rental businesses, officetels can still be registered as before. Various benefits favorable to investors remain, such as officetel pre-sale rights not being included in the calculation of acquisition tax and capital gains tax housing counts.

Prices have also shown an upward trend. According to the Korea Real Estate Board, as of February this year, officetel prices rose 21.8% compared to the same month last year. This increase was 11.8 percentage points higher than the apartment price increase rate (10%) during the same period.

However, with the government announcing land speculation prevention measures on the 29th, there is a growing possibility that the officetel market could be affected.

As part of the 'Real Estate Speculation Eradication and Recurrence Prevention Measures,' the government introduced measures to strengthen transparency in funding when acquiring land. The core is the introduction of loan-to-value (LTV) regulations on non-housing secured loans (non-housing collateral loans) across all financial sectors. The non-housing collateral loan targets include land, commercial buildings, agricultural machinery, fishing vessels, and officetels. Depending on the extent of loan restrictions on officetels, demand in the officetel market is inevitably affected. Detailed contents of the non-housing collateral loan LTV regulations will be included in the household debt management plan to be announced next month.

Meanwhile, new officetel supplies are scheduled nationwide.

In Seoul, Hyosung Heavy Industries will supply 285 units of the 'Harrington Tower Seocho' officetel (exclusive area 18?49㎡) in Seocho-dong, Seocho-gu, Seoul, in April. It is located within a 2?3 minute walk from Nam-Bu Terminal Station on Seoul Subway Line 3, a station area, and is in the business center of Gangnam, ensuring abundant rental demand. Especially, it is designed mainly as 2-room residential units preferred by 1?2 person households, attracting attention.

In the same month, Hyundai Engineering & Construction plans to launch 369 units of the 'Hillstate Jangan Central' officetel (exclusive area 38?78㎡) in Jangan-dong, Dongdaemun-gu, Seoul. The officetel is near well-developed road networks such as the Internal Circular Road and Dongbu Expressway, making it convenient for both private car and public transportation use.

In Incheon, POSCO Engineering & Construction will supply 225 units of the 'The Sharp Songdo Arkbay' officetel (exclusive area 84㎡) in Yeonsu-gu in April. It is a station-area complex close to International Business District Station on Incheon Subway Line 1, providing convenient access to Incheon downtown and the metropolitan area.

In Daegu, Hyundai Engineering & Construction's 'Hillstate Dalseong Park Station' officetel (exclusive area 84㎡) with 72 units is scheduled for subscription on April 5. This officetel is located in the Taepyeong-ro area, an emerging residential district in Daegu, adjacent to Dalseong Park Station on Daegu Subway Line 3, making it a station-area property.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.