Seok Jong-hoon FuturePlay Partner Interview

From Reporter-CEO-Entrepreneur-Government Official to Accelerator: A New Challenge

"The Core of the Second Venture Boom is 'Scale-up' to Turn Startups and Venture Companies into Unicorns"

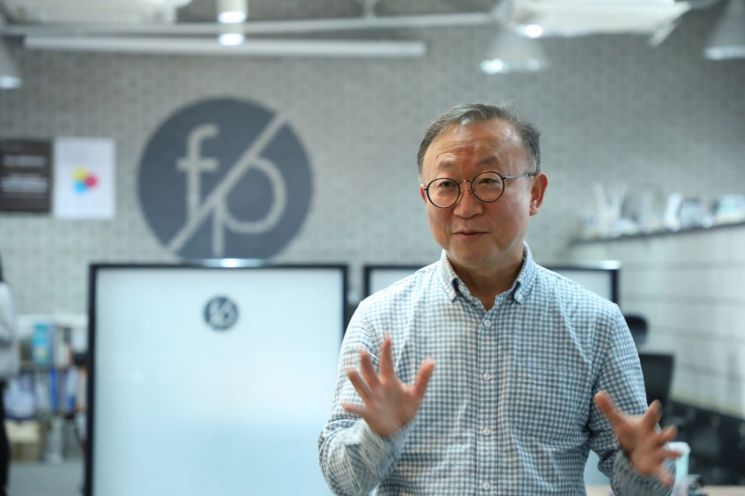

After completing over three years of public service as the Director of Startup and Venture Innovation at the Ministry of SMEs and Startups and as the Secretary for SMEs and Startups at the Blue House, Seok Jong-hoon, a partner at FuturePlay, returned to the venture industry. He defined the current era by saying, "While supporting and revitalizing startups was important before, now scaling up startups is more crucial, and the key is to grow these companies into unicorns." Photo by Yoon Jin-geun PD

After completing over three years of public service as the Director of Startup and Venture Innovation at the Ministry of SMEs and Startups and as the Secretary for SMEs and Startups at the Blue House, Seok Jong-hoon, a partner at FuturePlay, returned to the venture industry. He defined the current era by saying, "While supporting and revitalizing startups was important before, now scaling up startups is more crucial, and the key is to grow these companies into unicorns." Photo by Yoon Jin-geun PD

[Asia Economy Reporter Kim Heeyoon] “Learning to ride a bicycle through books and videos makes it difficult to master physically. Similarly, startup programs must be properly guided by accelerators so that founders can truly experience the ecosystem.”

After transitioning from a reporter to a professional manager and venture entrepreneur, and completing over three years of public service, Seok Jonghoon, a partner at FuturePlay, emphasized the importance of accelerators when asked about his return to the startup ecosystem. He said, “While considering how I could contribute to revitalizing the startup ecosystem in the private sector, I joined after receiving an offer from CEO Ryu Junghui. Now, amid the second venture boom, the role of accelerators in supporting the growth of 1- to 3-year-old companies behind the scenes is increasingly demanded.”

Last year, the growth of the startup and venture industry was remarkable. The number of companies valued at over 100 billion KRW, which was only 51 in 2015, grew more than sixfold to 320 last year. Coupang was listed on the U.S. stock market, soaring to a market capitalization of 100 trillion KRW. Additionally, last year, the total sales of venture companies reached 193 trillion KRW, ranking second in the business world after Samsung Group. During this period, Partner Seok, who supported the startup ecosystem through policies spanning the Ministry of SMEs and Startups and the Blue House, said, “Coupang’s direct listing in the U.S. was a groundbreaking event that broke stereotypes by recognizing the growth potential of Korean ventures,” adding, “As founders’ capabilities and companies’ item competitiveness improve, it proves that the venture ecosystem has gained global competitiveness.”

In fact, the second venture boom is supported by various government startup support programs, accelerators, and venture capital (VC) investments. The Korea Fund of Funds, led by the Ministry of SMEs and Startups, created a 900 billion KRW venture fund following a 500 billion KRW investment in February. The Korea Technology Finance Corporation also increased guarantee limits for prospective unicorns, and the Financial Services Commission expanded growth finance funds to promote venture ‘scale-up.’ Nevertheless, Partner Seok points out that these efforts are still insufficient.

Coupang is running a billboard advertisement in Times Square, Manhattan, New York, on March 11 to commemorate its listing on the New York Stock Exchange. Photo by Yonhap News

Coupang is running a billboard advertisement in Times Square, Manhattan, New York, on March 11 to commemorate its listing on the New York Stock Exchange. Photo by Yonhap News

Beyond Startup Support, Now Is a Crucial Time for Venture ‘Scale-Up’

He stated, “Venture investments should be more active in the private sector than by the government,” and asked, “After the first venture boom in the late 1990s, the venture industry experienced a downturn, but wasn’t it the investments by accelerators and VCs who discovered and nurtured first-generation ventures like Lee Hae-jin and Kim Taek-jin that firmly supported the startup ecosystem?” He continued, “Helping startups enter global markets through collaboration between domestic conglomerates and ventures can also be a unique strength of our industrial ecosystem. Until now, supporting and activating startups was important, but now scaling up startups and growing them into unicorns is the core of this era.”

Partner Seok, who implants the agile decision-making DNA of the private sector into the public domain and then reflects on public equity in the private sector, plans to focus on discovering early-stage companies going forward. He emphasized, “Unicorn companies were once 1- to 3-year-old companies at a crossroads of growth ten years ago. While it is generally thought that startups grow rapidly through VC roles, mature companies beyond a certain stage need multifaceted support not only in investment but also in growth direction and corporate spirit.” Furthermore, he stated, “I want to expand the support area beyond Korea to global startups, broaden the scope of accelerator business, and share concerns and roles to make the venture ecosystem dynamic and efficient.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)