Coupang Eats Growth Threatens Baemin... 110% Increase in Users Compared to November Last Year

Single-Order Delivery System Effective in Gangnam Area... Baemin and Yogiyo Also Launch Services

"Last year, orders from Baedal Minjok and Coupang Eats increased at similar levels, but this year, orders from Coupang Eats are increasing overwhelmingly." This is the story of a restaurant owner in Gangnam, Seoul. Although the number of users of the delivery application (app) Coupang Eats has been notably increasing since last year, Baedal Minjok (Baemin) was already far ahead, and Baemin's users were also increasing due to COVID-19, so it seemed difficult to narrow the gap. However, this year, the growth of Coupang Eats is said to be threatening Baemin, according to voices from the field.

Eventually, Baemin has begun preparing countermeasures to prevent further user loss to Coupang Eats. The competition between Kim Bong-jin, chairman of Woowa Brothers who led a unicorn (a privately held startup valued at over 1 trillion won) that successfully exited the global market, and Kim Beom-seok, chairman of Coupang, over the domestic delivery app market is expected to intensify further.

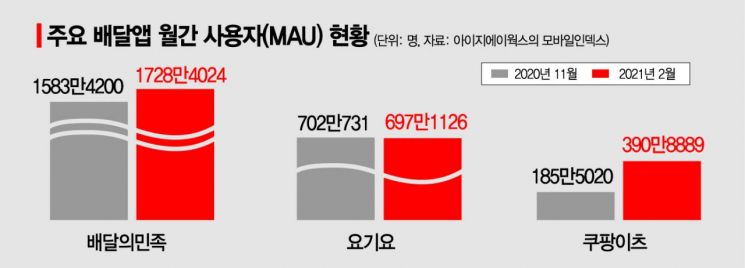

According to Mobile Index by data company IGAWorks on the 30th, the number of Coupang Eats users (MAU) based on Android and iPhone (iOS) smartphones last month increased by 110% compared to November last year. The number of users grew from 1,855,000 to 3,909,000 in February this year, with more than 2 million new users using Coupang Eats in just three months. Considering that the user growth rate of Coupang Eats was 70% from August to November last year, the growth rate has accelerated further. Compared to Baemin, Coupang Eats' growth is more remarkable. While Coupang Eats' users increased by 110%, Baemin's growth rate remained at 9%.

◆ Coupang-style Investment Taking Advantage of Baemin's Crisis = When Coupang Eats started its service in 2019, its users were only 1/50th of Baemin's. This gap narrowed to 1/8 by the end of last year and recently shrank to 1/4. During the past year, while Baemin struggled with pricing plan issues and investment was restrained due to the merger with Delivery Hero (DH), Coupang Eats' aggressive investment has been effective. In the first half of last year, Coupang Eats significantly raised delivery fees to secure delivery workers and started large-scale promotions lowering commissions for restaurant owners, thereby expanding its presence. Just as Coupang has continued large-scale investments regardless of deficits, Coupang Eats also took aggressive steps to increase market share.

At the center of this is the ‘single-order delivery’ system, which assigns one delivery worker per order. Unlike the existing ‘bundled delivery’ method that handles 3 to 4 orders at once, which requires fewer delivery workers but compromises delivery quality, this system requires securing sufficient delivery workers and large-scale capital investment to guarantee delivery workers' earnings. An industry insider said, "While Baemin and Yogiyo hesitated to make large-scale investments due to merger issues last year, Coupang Eats pushed forward with single-order delivery," adding, "The customer experience of receiving food 30 minutes faster at a similar price is difficult to match with the bundled delivery method."

◆ Nationwide Service Expansion Based on Gangnam's Three Districts = Baemin, the leader, is also actively responding to Coupang Eats' offensive. As single-order delivery spreads, the existing bundled delivery may be perceived as a relatively low-quality service. This is why Baemin has no choice but to enter the single-order delivery market, even at the cost of financial losses. In fact, Baemin began a pilot operation of the ‘Beonjjeok Delivery’ service, which performs only single-order delivery, targeting the Gangnam area from January. Yogiyo, which is threatened for the second place market share, also started single-order delivery competition through ‘Yogiyo Express.’ An industry insider said, "Platform services change rapidly with technology, and if they fail to provide utility to users, they are easily eliminated," and added, "It is expected that Baemin, having completed its merger, will significantly revamp its Baemin Riders service centered on single-order delivery through capital injection from DH."

Coupang Eats' single-order delivery has received great responses in Gangnam, Seocho, and Songpa districts of Seoul, and the industry sees that its market share in these areas has recently caught up to Baemin's within the last six months. The three Gangnam districts are the prime areas of the delivery app market, with the highest average order price and number of deliveries nationwide. A restaurant owner running a sushi restaurant in Seocho-gu said, "This year, Coupang Eats orders have increased significantly, and many restaurants in Gangnam are adjusting the number of advertising products exposed on Baemin." Based on such achievements in Gangnam, Coupang Eats is expanding its single-order delivery service network nationwide.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.