Bank of Korea Financial Stability Report

12 Trillion Won Credit Provision and Forced Selling Possible if Stock Prices Fall 30%

[Asia Economy Reporter Kim Eunbyeol] Since the global shock of COVID-19 in March last year, stock prices surged sharply, leading to a 'rebalancing (money move)' of household financial assets as funds shifted from deposits to stocks. The Bank of Korea noted that while this shift from deposits to stocks creates favorable conditions for companies to raise capital and has positive effects, increased stock price volatility raises the risk of losses for households and could extend risks to financial institutions.

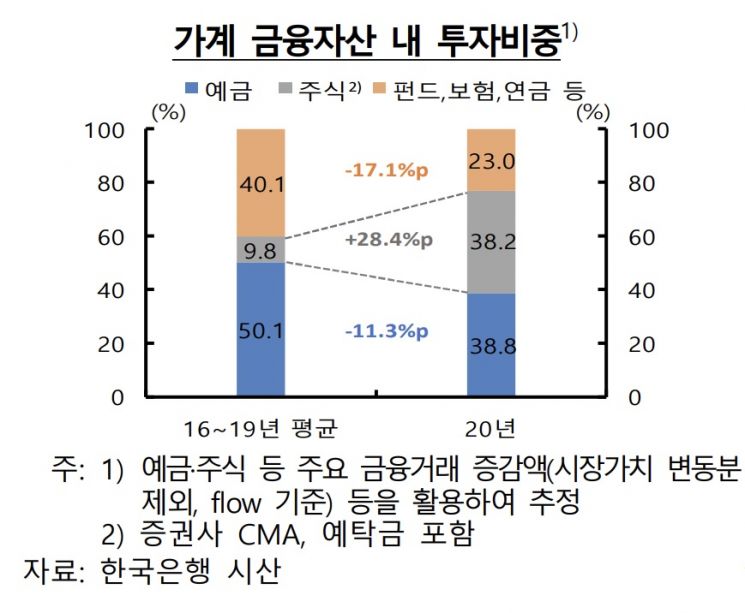

According to an analysis by the Financial Stability Department of the Bank of Korea on the 27th, the proportion of stocks in financial asset investments last year surged by 28.4 percentage points from 9.8% to 38.2%, while the share of deposits, funds, insurance, and pensions decreased by more than 10 percentage points. The share of deposits in household financial assets averaged 50.1% from 2016 to 2019, exceeding half, but dropped significantly to 38.8% last year. The share of funds, insurance, and pensions also declined from 40.1% to 23.0% during the same period.

The Bank of Korea analyzed, "This is due to the decline in deposit interest rates, which strengthened individuals' profit-seeking tendencies, combined with a learning effect based on past experiences where stock prices rose sharply within a relatively short period after crises."

Unlike the past money move (2007-2008), when inflows into indirect investment funds were prominent, direct investment by individuals also expanded. From March to December last year, the number of stock trading activity accounts increased by 18.6%, and securities firms' CMA and customer deposits linked to direct stock investment rose by 63.4%. This contrasts with sluggish inflows into indirect investment products such as equity funds (-15.2% from March to mid-December 2020), bond funds (-11.0%), derivative-linked securities (-16.2%), and variable insurance and retirement pensions (net premium inflow down 26.2% year-on-year, based on life insurance).

This is interpreted as a result of declining trust in indirect investment products, improved convenience due to the activation of mobile trading, and enhanced information accessibility through social networking services (SNS), which improved conditions for direct investment.

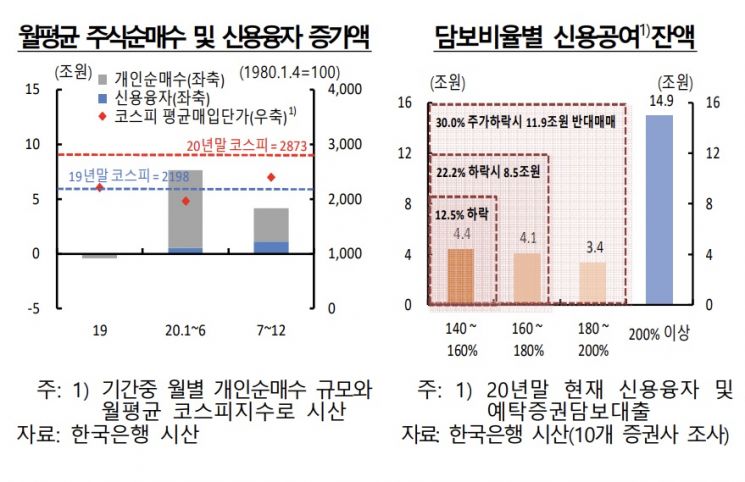

Additionally, leverage investment expanded significantly, with a sharp increase in individuals' securities firm margin loans. Leverage investment refers to an investment strategy that borrows capital (debt) to purchase assets to increase returns from asset investments. The balance of margin loans increased by 85.3% (8.8 trillion KRW) from March to December 2020, and the ratio of margin loan balance to market capitalization reached an all-time high. Since March, when net stock purchases began in earnest, bank credit loans have also increased sharply, suggesting that if investments using bank loans are considered, the scale of household leverage investment is likely to grow further.

The Bank of Korea assessed that the increase in debt-financed investments poses significant potential risks. A Bank of Korea official pointed out, "Following trades, concentrated investment in certain stocks, and leveraged investments may increase households' risk of losses, and investments through securities firm loans can lead to forced sales of collateral stocks (margin calls) during stock price declines, which may amplify stock price volatility."

They also warned that if the acceleration of financial asset rebalancing and consumption recovery reduce fund inflows, some financial institutions may face increased funding pressures. For banks, deposits are expanding mainly in short-term deposits, which could cause asset-liability maturity mismatches due to the shortening of deposit structures. Furthermore, if liquidity regulations such as the Liquidity Coverage Ratio (LCR) and loan-to-deposit ratio normalize, competition to attract deposits may increase funding costs, the Bank of Korea explained.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)