[Asia Economy Reporter Lee Seon-ae] It has been analyzed that the most important variable affecting the domestic stock market will no longer be the ‘U.S. interest rate’ but the ‘U.S. infrastructure investment policy.’ However, while the approximately $900 billion stimulus package initially drew attention mainly for its ‘positive effects,’ the upcoming infrastructure investment policy is expected to face sharp debates over both ‘positive’ and ‘negative effects’ from the early stages of policy implementation, suggesting that a cautious strategy is necessary.

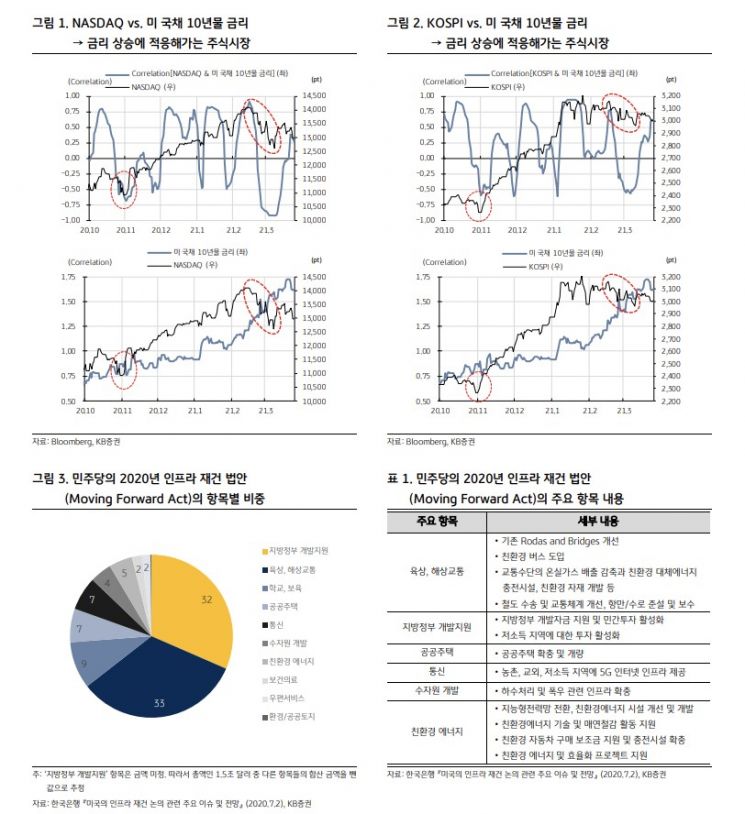

According to KB Securities on the 27th, the pattern of ‘interest rate hikes → stock price shocks’ that lasted for more than a month is gradually changing. The inverse correlation, where stock prices fell as interest rates rose, intensified in February and March, but this trend has recently reversed. In other words, it is judged that the stock market has entered the final stage of adapting to the higher interest rate levels. Therefore, it is now time to broaden attention elsewhere, with the core focus on U.S. infrastructure investment policy.

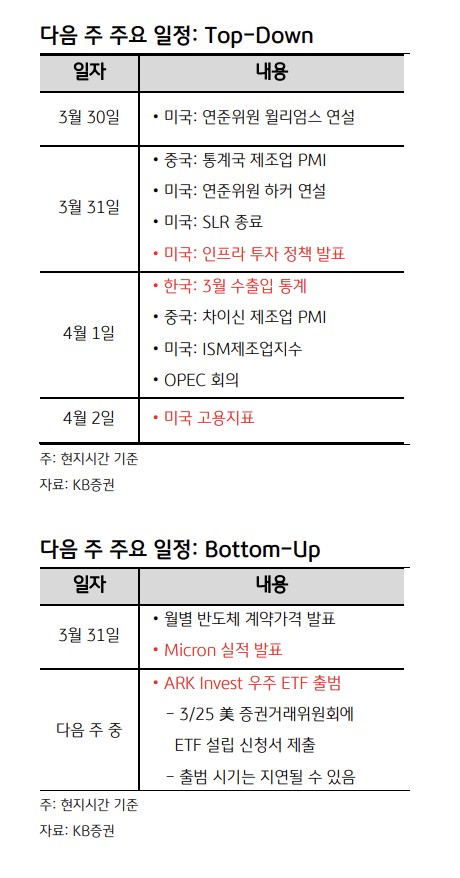

KB Securities pointed out infrastructure investments in roads, bridges, eco-friendly infrastructure, and 5G infrastructure improvements as notable references from the ‘beneficiary’ perspective in the stock market. From the funding perspective, unlike the stimulus packages passed since the outbreak of COVID-19, the financial market’s view on this stimulus package is quite different. Having recently experienced ‘interest rate hikes,’ the market is more concerned about the ‘method of funding’ rather than the ‘effects’ of infrastructure investment. This concern has been further amplified by U.S. Treasury Secretary Janet Yellen’s mention of a ‘tax increase’ plan. Researcher Hainhwan Ha of KB Securities emphasized, “If the method of funding is ‘tax increases (such as corporate tax),’ the stock market cannot help but become tense once again.”

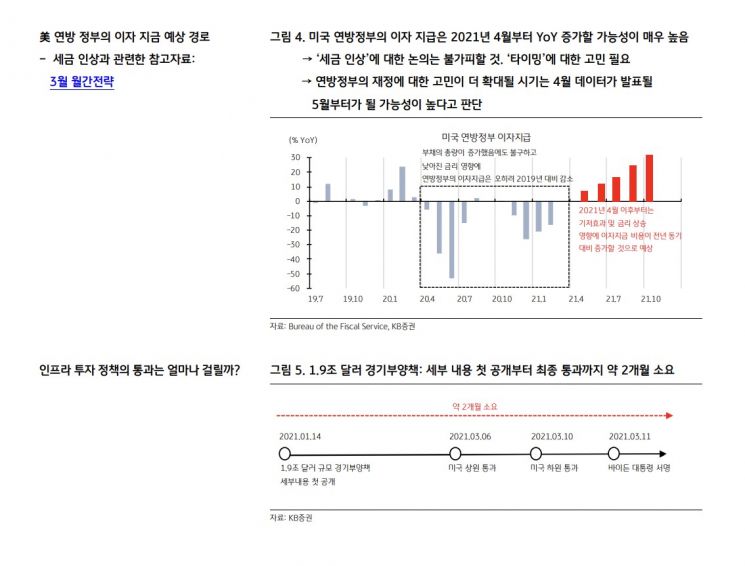

It took two months for the $1.9 trillion stimulus package to be passed. The two-month duration was due to Republican opposition to the fiscal deficit expansion caused by the additional ‘large-scale’ stimulus package. Therefore, if it took two months for the $1.9 trillion stimulus package to pass, it is necessary to recognize that it is highly likely that the $3 trillion infrastructure investment policy will take even longer to pass, according to researcher Ha’s advice.

He said, “President Biden is expected to announce policies centered on ‘investment,’” adding, “While the three areas worth noting from the investment perspective (traditional infrastructure, eco-friendly, and 5G) should be viewed positively, doubts about congressional approval may arise, so expectations should be lowered rather than being overly optimistic about the ‘$3 trillion’ figure.”

Once expectations are lowered, it is advised to also consider the next issue of funding. Especially since Republicans are likely to strongly oppose funding through tax increases, conflicts between Republicans and Democrats over the ‘method of funding’ are expected. Researcher Ha stated, “The ‘conflict’ delays the timing when the tax increase issue impacts the stock market,” emphasizing, “The risk of a stock market correction due to the ‘tax increase’ issue is expected to occur not at the policy announcement next week but rather when the details of the tax increase method become clearer (likely 1 to 3 months later).”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.