SK Biopharm Eyes Success of 4 Consecutive Price Surges Beyond Triple Opening Gains

Expectations for Reevaluation of Valuations of Green Cross and Samsung Biologics

High Interest in IPO-Ready and Ongoing Companies Like HK Innoen

Ahn Jae-yong, CEO of SK Bioscience, is speaking at the ceremony celebrating the new listing of vaccine development and manufacturing company SK Bioscience on the KOSPI market, held on the 18th at the Korea Exchange in Yeouido, Seoul. Photo by Kim Hyun-min kimhyun81@

Ahn Jae-yong, CEO of SK Bioscience, is speaking at the ceremony celebrating the new listing of vaccine development and manufacturing company SK Bioscience on the KOSPI market, held on the 18th at the Korea Exchange in Yeouido, Seoul. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Lee Seon-ae] SK Bioscience, the largest IPO of the first half of this year, recorded a ‘ttasang’ (opening price at twice the public offering price followed by the upper limit price) on its first day of listing on the 18th. Investors are highly interested in whether it can succeed in a fourth consecutive upper limit price, surpassing SK Biopharm’s ‘ttasangsangsang’ recorded last year. It set a new record by attracting subscription deposits exceeding 63 trillion won, and with a high ratio of lock-up agreements, there is an expectation that the stock price’s upward trend will continue for some time.

◆Is ‘ttasangsangsang’ possible?

According to the Korea Exchange on the 18th, SK Bioscience’s opening price was set at 130,000 won, twice the public offering price, and immediately surged to the upper limit price of 169,000 won. Its current market capitalization is 12.9285 trillion won, ranking 29th in the KOSPI market capitalization. Considering that the over-the-counter price during SK Bioscience’s IPO process was around 200,000 won per share, experts believe that ‘ttasangsangsang’ (284,500 won) is quite possible. Moreover, among the shares allocated to institutions, 38,829,590 shares are locked under protective custody, 4,490,400 shares are employee stock ownership, and the parent company SK Chemicals holds 52,350,000 shares, totaling 67,602,490 shares that cannot be immediately released to the market, accounting for 88.37% of the total issued shares of 76,500,000. Only 11.63% of shares are available for circulation immediately after listing.

The securities industry gives high marks to SK Bioscience’s vaccine development capabilities. Jiha Kim, a researcher at Meritz Securities, forecasted, "With abundant momentum such as inclusion in the KOSPI 200 after listing and the announcement of Phase 1 results of its self-developed COVID-19 vaccine, we believe the stock price growth potential will remain high after listing." Earnings also support the stock price rise. Byunghwa Han, a researcher at Eugene Investment & Securities, predicted, "Contract manufacturing organization (CMO) sales for COVID-19 and domestic sales of Novavax are expected to newly generate about 625 billion won this year," and "Sales and operating profit this year are expected to surge by 316% and 940% respectively compared to the previous year." SK Bioscience recorded its highest-ever sales of 225.6 billion won and operating profit of 38.6 billion won last year.

◆Expectations for Revaluation of CMO Companies

With SK Bioscience’s listing, the value of domestic CMO companies is also likely to be re-evaluated. It is judged that SK Bioscience’s listing will raise investment sentiment toward CMO companies such as Samsung Biologics and Green Cross. Samsung Biologics has signed contracts to produce COVID-19 treatments with Eli Lilly and GSK, and Green Cross has also signed a contract with CEPI (Coalition for Epidemic Preparedness Innovations).

Shinyoung Securities expects that COVID-19 vaccine CMO will improve Green Cross’s performance this year and set a target price of 430,000 won. They estimated Green Cross’s CEPI vaccine CMO sales at 395.5 billion won and EBITDA (earnings before interest, taxes, depreciation, and amortization) at 83.1 billion won. Samsung Biologics’ stock price fell to the 700,000 won range in early February and has been sideways since, but securities firms still maintain a target price of 1,000,000 won due to expectations for CMO sales. Byung-guk Park, a researcher at NH Investment & Securities, explained, "Among domestic CMO companies, Samsung Biologics is the most promising," adding, "CMO’s operating rate directly affects corporate value, and Samsung Biologics shortened its production process, starting production of Eli Lilly’s antibody treatment just three months after technology transfer."

Mi-hwa Seo, a researcher at Yuanta Securities, said, "The surge in contracts for COVID-19 vaccine and treatment production is an unusual event, but it has caused shortages in existing pharmaceutical CMO facilities," and added, "Due to the growth of the pharmaceutical market and the increasing proportion of global major pharmaceutical companies and new biotechs using CMO, the CMO industry is expected to continue growing even after the COVID-19 situation."

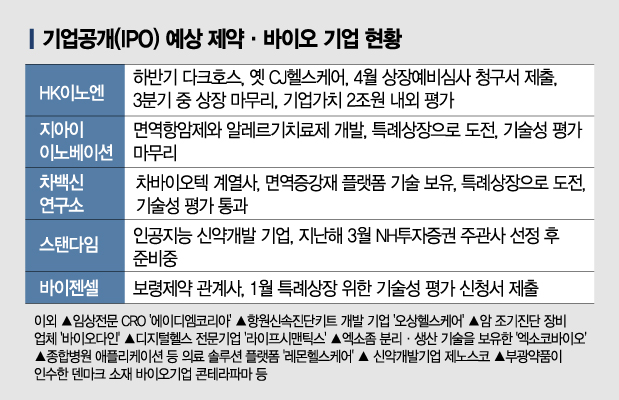

The successful stock market debuts of SK Biopharm and SK Bioscience have also raised interest in pharmaceutical and biotech companies preparing IPOs this year. GI Innovation, Cha Vaccine Institute, ExoCoBio, Osang Healthcare, Vigen Cell, and HK Innoen are expected to list within the year.

The most anticipated is HK Innoen, which is likely to list in the second half of the year. HK Innoen plans to submit a preliminary listing examination application to the Korea Exchange next month. The industry expects the listing to be completed by the third quarter at the latest. The market values HK Innoen at around 2 trillion won. Its sales are about 500 billion won, similar in scale to currently listed pharmaceutical companies such as Ildong Pharmaceutical, Dongkook Pharmaceutical, Boryung Pharmaceutical, JW Pharmaceutical, and Handok. Its flagship product is K-CAB, an anti-ulcer drug approaching annual prescription sales of 100 billion won.

GI Innovation is pursuing a special listing and has already completed technical evaluations, receiving A grades from all three evaluation agencies. The company is developing immuno-oncology and allergy treatments. Cha Vaccine Institute, an affiliate of Cha Biotech, is also knocking on the stock market door, having recently passed the technical evaluation for special listing. Standigm, an AI drug development company that selected NH Investment & Securities as its lead manager last March, is also rushing to list within the year. Vigen Cell, which submitted a technical evaluation application for special listing to the Korea Exchange in January, is expected to list within the third quarter.

Additionally, clinical trial CRO ‘ADM Korea,’ rapid antigen test kit developer ‘Osang Healthcare,’ early cancer diagnosis equipment company ‘Biodine,’ digital health specialist ‘Life Semantics,’ exosome separation and production technology holder ‘ExoCoBio,’ and comprehensive hospital application and medical solution platform ‘Lemon Healthcare’ are also preparing to enter the stock market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.