Hyundai Motor Securities, Yuanta, and Others

Evaluated for Balanced Profitability and Risk Management

[Asia Economy Reporter Park Ji-hwan] The credit rating upgrade relay among domestic small and medium-sized securities firms continues.

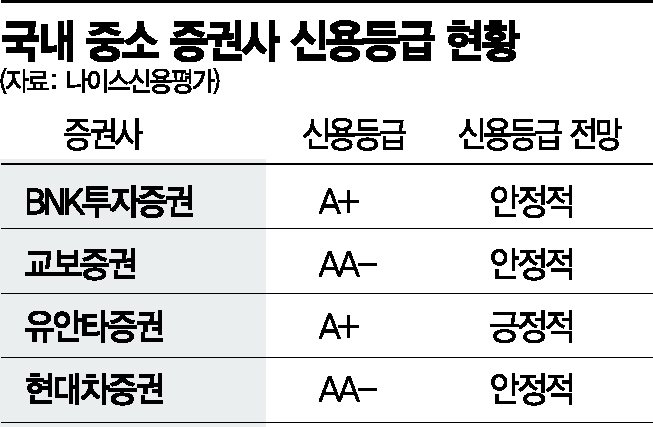

According to the financial investment industry on the 18th, on the 16th, NICE Credit Rating upgraded Hyundai Motor Securities' credit rating from ‘A+/Positive’ to ‘AA-/Stable’. NICE Credit Rating stated, "Despite increased volatility in the financial market, we reflected the stable maintenance of improved profit-generating capacity, risk management policies related to contingent liabilities and derivative-linked securities, and the improvement of capital buffer through retained earnings and capital increase."

Earlier, last month, NICE Credit Rating upgraded Yuanta Securities' long-term credit rating outlook from ‘Stable’ to ‘Positive’. In the case of BNK Investment & Securities, the short-term credit rating was upgraded from A2+ to A1. Korea Credit Rating also raised IBK Investment & Securities' credit rating outlook from Stable to Positive.

The credit rating industry evaluated that recently, small and medium-sized securities firms are achieving a balance between profitability and risk management as their business foundations strengthen. The business foundation is judged by capital size and market position, among which capital size represents the securities firm's operational capability. Also, regulatory indicators from financial authorities, such as the net capital ratio, are regulated based on equity capital. As of the end of the third quarter last year, the average capital growth rate of small and medium-sized firms compared to the end of 2017 was 53%, higher than the large firms' average of 35%. In particular, BNK Investment & Securities (319%), IBK Investment & Securities (59%), Kyobo Securities (51%), and Hyundai Motor Securities (36%) showed higher growth rates compared to large firms.

Profitability has also improved. Representative indicators for evaluating securities firms' profitability are ‘Operating Net Income Coverage’ and ‘Return on Equity (ROE)’. Operating Net Income Coverage is calculated as operating net income relative to selling and administrative expenses. It has a high correlation with the securities firm's profit-generating ability and debt repayment capacity. Kyobo Securities (153%), Hyundai Motor Securities (164%), and IBK Investment & Securities (160%) have recent 5-year average operating net income coverage significantly exceeding 140%. The credit rating industry considers profitability excellent if it exceeds 140%. The ROE, which indicates how effectively a securities firm utilizes its capital, shows that the recent 3-year average ROE of small and medium-sized firms is 9.5%, surpassing the large firms' 8.9%.

Lastly, regarding risk management, Lee Jae-woo, a researcher at Korea Credit Rating, explained, "The risk exposure ratio, which indicates the level of preemptive risk underwriting relative to equity capital, is below 200% for most small and medium-sized firms as of the end of the third quarter last year." During this period, the risk exposure ratio relative to equity capital for large firms reached 277%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.