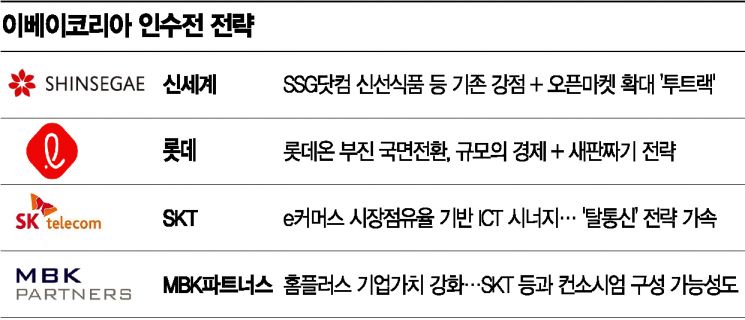

[Asia Economy Reporters Yuri Kim and Seulgina Jo] In the bidding war to acquire eBay Korea, attention is focused not only on major retail conglomerates such as Lotte and Shinsegae but also on large ICT companies like SK Telecom and private equity firms like MBK Partners, as they unveil their blueprints. Each company’s strategy is to leverage eBay Korea’s biggest strength?a transaction volume worth 20 trillion KRW?to expand market share and seek synergies with their existing businesses.

◆Shinsegae’s ‘Two-Track’ and Lotte’s Focus on ‘Reshaping the Board’

In the eBay Korea acquisition battle, Shinsegae Group, led by Emart, is expected to pursue a ‘two-track strategy’ that capitalizes on SSG.com’s existing strengths in fresh food while expanding volume through the open market. To become a ‘game changer’ in the rapidly changing commerce market, they believe it is necessary to break down the boundaries between online and offline and, if needed, collaborate with competitors. They have already joined hands with Naver through a 250 billion KRW equity swap. They are concretizing a vision where consumers ‘play at Starfield, earn points on Naver, shop at Emart via Naver Shopping, or get luxury goods recommendations at Shinsegae Department Store.’ Acquiring eBay Korea would instantly expand their e-commerce transaction volume to 24 trillion KRW. Ultimately, the strategy also includes attracting consumers familiar with Shinsegae products both online and offline from the ‘allied platform’ to Shinsegae’s own platform.

Lotte, through acquiring eBay Korea, has the opportunity to shake up the e-commerce market undergoing a tectonic shift and turn the tide. Given the sluggish performance of the group’s integrated mall Lotte On, the industry views Lotte’s participation in the preliminary bidding and due diligence process as essential to ‘growing their scale.’ Despite no significant achievements one year after Lotte On’s launch, Lotte has repeatedly appeared as a leading candidate whenever rumors of e-commerce company sales arise.

◆SKT’s ‘Beyond Telecom’ and MBK’s Enhancement of Homeplus’s Corporate Value

SK Telecom’s participation in the preliminary bidding is a move to boost the competitiveness of its subsidiary 11st and to leap forward as a platform leader. At the end of last year, SK Telecom CEO Park Jung-ho successfully established a super-collaboration with the world’s largest e-commerce company, Amazon, and is now planning to expand ‘platform collaboration’ with Amazon centered on 11st. The expectation is that 11st, which would grow to a ‘Big 3’ scale domestically through acquiring eBay Korea, will gradually adopt Amazon’s business model.

11st, which holds about a 6% share of the e-commerce market, has been repeatedly subject to sale rumors. However, CEO Park, who has advocated ‘beyond telecom,’ has drawn a line on the possibility of selling 11st, focusing instead on growth in commerce, AI, and the potential for platform expansion linked to ICT competitiveness. It is expected that 11st, with its expanded market share, will play a key role in SK Telecom’s future AI-based platform strategy.

MBK Partners, the major shareholder of Homeplus, is considering acquiring eBay Korea as a card to enhance Homeplus’s corporate value. Homeplus has been investing efforts to strengthen its online presence, raising online sales to nearly 20%, but it is still challenging to gain an advantage in the fierce e-commerce survival competition. The market also sees a possibility of MBK Partners partnering with SK Telecom in the eBay Korea acquisition. In this case, the synergy effect between e-commerce and large-scale supermarkets is expected to be greater.

◇Kakao’s Final Withdrawal=Meanwhile, Kakao, one of the prominent potential bidders, ultimately did not participate in the preliminary bidding yesterday. Industry insiders cite reasons for Kakao’s withdrawal including the difficulty in generating synergy between Kakao’s SNS-based relational commerce and eBay’s price-competition-based open market platform, as well as the limited expected benefits compared to the asking price (5 trillion KRW).

Each company plans to conduct detailed due diligence on eBay Korea’s management indicators and other factors to assess the feasibility of expected benefits and will make a final decision on whether to continue in the bidding. The acquisition price for eBay Korea is expected to be set around 4 trillion KRW, lower than the seller’s initial asking price of 5 trillion KRW. A retail industry insider said, “The acquisition cost is still a heavy burden, so most participating companies will have serious considerations before the final bidding.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.