Simulation of This Year's Property Tax + Comprehensive Real Estate Tax

Marapu Single Homeowners Face Holding Tax Over 5 Million Won

High-End Homes in Gangnam Area Near 30 Million Won

Multi-Homeowners, Ultra-High-End Properties Jump to Billions

Holding Tax Burden... Even Single Homeowners Face Tax Pressure

[Asia Economy Reporter Moon Jiwon] As the government raises the average official price of apartment complexes by 19%, apartment holding taxes are set to increase to ‘tax bomb’ levels again this year, following last year. While the tax burden is expected to be particularly heavy for multi-homeowners and owners of ultra-high-priced homes, single-homeowners in areas where housing prices rose significantly last year are also expected to receive substantially higher holding tax bills this year.

Property Tax Jumps if Official Price Exceeds 600 Million KRW

Apartment holding taxes are expected to vary in burden compared to the previous year based on the official price threshold of 600 million KRW. This corresponds to approximately 800 to 900 million KRW in market price. Single-homeowners with an official price below 600 million KRW will benefit from a special reduction of 0.05 percentage points in property tax rates starting this year, so even if the official price rises, the property tax burden decreases. According to the Ministry of Land, Infrastructure and Transport’s holding tax simulation, a person owning an apartment with an official price of 460 million KRW last year will see their property tax decrease by 8.2%, from 1,017,000 KRW to 934,000 KRW, even if the official price rises to 600 million KRW this year.

On the other hand, if the official price exceeds 600 million KRW, the holding tax burden increases significantly. For example, an apartment with an official price of 530 million KRW last year will see its official price rise to 700 million KRW this year, causing property tax to increase by 30%, from 1,234,000 KRW to 1,604,000 KRW. Especially for apartments with an official price of 900 million KRW or more, which are subject to comprehensive real estate tax for single-homeowners, the increase is even greater. Assuming no long-term holding or senior citizen deductions, a person owning an apartment with an official price of 960 million KRW last year paid a combined property and comprehensive real estate tax of 3,023,000 KRW, but this year will pay 4,325,000 KRW, a 43.1% increase.

Multi-homeowners and Ultra-high-priced Homes Face ‘Tax Bomb’

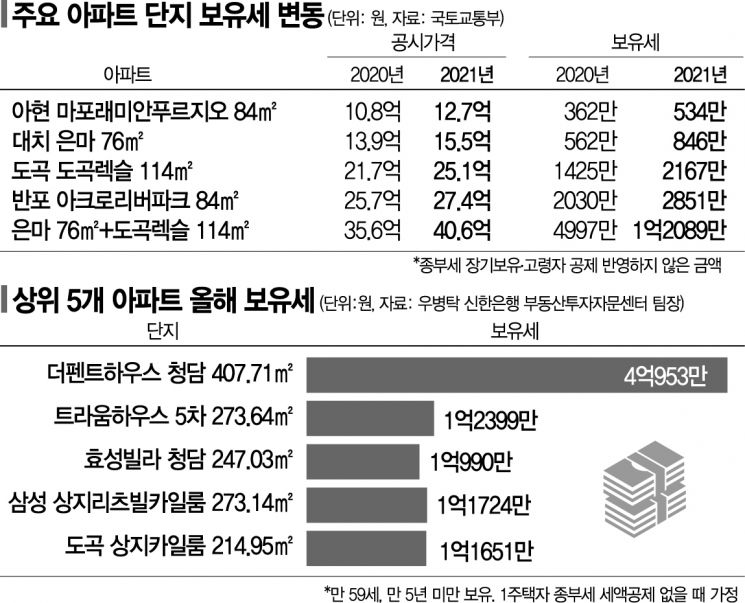

Multi-homeowners and owners of high-priced homes are expected to face particularly heavy holding tax burdens again this year, following last year. An owner of Mapo Raemian Prugio (84㎡, exclusive area) in Mapo-gu, Seoul, paid 3.62 million KRW in holding tax last year but must pay about 5.336 million KRW this year. The comprehensive real estate tax increased nearly threefold from 520,000 KRW to 1.42 million KRW in one year, which had a significant impact. This amount does not include long-term holding or senior citizen deductions.

The representative reconstruction project in Gangnam, Eunma Apartment 76㎡ in Gangnam-gu, is also expected to see holding tax rise from 5.616 million KRW to 8.456 million KRW, an increase of nearly 3 million KRW. Since apartments cannot generate profit without selling, owners express dissatisfaction over the heavy holding tax burden. A person owning an apartment worth about 1.3 billion KRW criticized, "Holding tax increased by 40% in one year," adding, "The government raises housing prices, but the burden falls on the people."

Holding two or more homes causes holding taxes to surge even more. A person owning two homes, Gwanak Prugio 84㎡ in Gwanak-gu and Eunma Apartment 76㎡ in Gangnam-gu, will see their holding tax rise from 16.28 million KRW to 39.91 million KRW this year, more than doubling. A person owning Eunma Apartment and Dogok Rexle 114㎡ in Gangnam-gu will face holding taxes reaching 120.89 million KRW this year.

In particular, ultra-high-priced apartments in Gangnam, Seoul, have holding taxes approaching the prices of average apartments in other regions. According to a holding tax simulation by Woo Byungtak, team leader of Shinhan Bank’s Real Estate Investment Advisory Center, the holding tax for The Penthouse Cheongdam 407.71㎡, the most expensive apartment in Korea, is a staggering 409.53 million KRW this year. The top 10 apartments, including Hannam The Hill and Hyosung Villa Cheongdam, are all expected to have holding taxes well over 10 million KRW.

Single-homeowners Also Face Considerable Burden

The issue is that not only owners of high-priced homes but also single-homeowners in Seoul have seen their holding tax burdens increase. Complaints about excessive property tax burdens have emerged among apartment owners in northern and outer areas of Seoul, where housing prices rose sharply last year due to the ‘balloon effect.’ In fact, in Seoul, the official price increase rates in areas like Nowon-gu (34.66%) and Dobong-gu (26.19%) were significantly higher than in the four Gangnam districts.

In Sejong, where housing prices surged last year due to the ‘administrative capital relocation’ issue, the number of apartments with property tax increases hitting the cap (130%) is expected to rise. The first village 3rd complex (102㎡) in Sejong saw its official price rise from 410 million KRW last year to 720 million KRW, an increase of 310 million KRW in one year, causing property tax to increase from 590,000 KRW to 770,000 KRW. An industry insider explained, "As the official price realization rate continues to rise, the tax burden on the middle class will inevitably increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.