MTS Completely Redesigned for Mobile... 640,000 Pre-registrations Flood In

Stock Investment Made Easy for Everyone... Targeting Beginner Investors

Will It Become the Next Kiwoom Securities? Startup DBA Actively Expands

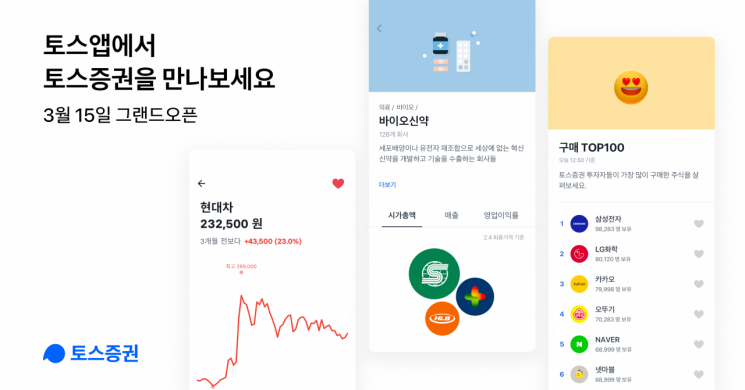

[Asia Economy Reporter Minwoo Lee] Toss Securities' Mobile Trading System (MTS) officially launched on the 15th. It plans to actively target investors who are new to stock investment by simplifying and reorganizing terms and items for easy and convenient use.

After a one-month pilot operation for pre-registered customers starting from the 15th of last month, it has entered full-scale operations. During the pre-registration period, 640,000 people signed up. Currently, there are 280,000 registered members, of which 130,000 have completed account opening.

Toss Securities, a newly established securities firm appearing for the first time in 12 years, is a 100% subsidiary of Viva Republica, the operator of the simple remittance service "Toss." Unlike most domestic securities firms that started with HTS and expanded to MTS, Toss Securities focused on mobile from the beginning and does not have any offline branches. This has drawn attention in the industry as to whether it will replicate the success of Kiwoom Securities, which dramatically increased its user base by focusing on online rather than offline in the past.

Toss Securities emphasized that it did not merely shift customer contact points to mobile devices. All functions have been refined to be mobile-friendly and simple. Buying and selling were renamed to "Sagi" (Buy) and "Palki" (Sell), and stock searches were made intuitive, such as typing "Saewookkang" to bring up Nongshim. They also introduced a new stock classification system called Toss Investment Category Standard (TICS). They directly analyzed about 2,200 listed companies domestically and reorganized categories quarterly based on a 10% revenue threshold to make it easy to understand how companies earn money. For example, instead of simply classifying by smartphone-related industries, it is detailed into smartphone cameras, smartphone batteries, etc., according to sales performance.

The strategy is interpreted as positioning itself as the first stock investment gateway for the mobile-savvy 2030 generation. Furthermore, given the heated enthusiasm for stock investment, the plan is to onboard all 18 million Toss app users onto Toss Securities. Among the 18 million Toss app users, about 10 million are from the 2030 generation, but other generations also account for 8 million.

In particular, leveraging its startup DNA, Toss Securities aims to quickly adapt, change, and establish itself in the market. About 25% of the total 90 employees are former Toss staff, reflecting fast decision-making and a horizontal, free organizational culture. Lee Seung-geon, CEO of Viva Republica, personally responds to hundreds of inquiries on an internet public community, explaining the company's philosophy, future plans, hiring numbers, and types, which is quite different from traditional securities firms. A Toss Securities official said, "The DNA of Toss, which started as a fintech (finance + technology) startup, has permeated Toss Securities as well," adding, "We will provide differentiated services that customers want and can easily use."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.