[Asia Economy Reporter Lee Seon-ae] Interest rates continue to rise. Although rising interest rates are currently hindering stock prices, as the economy recovers, interest rates remain a variable that must eventually be overcome. Investors need to find stocks that can withstand rising interest rates until sensitivity to interest rates decreases. Stocks that can endure rising interest rates

are those whose earnings outlook improves faster this year than next year, according to investment advice.

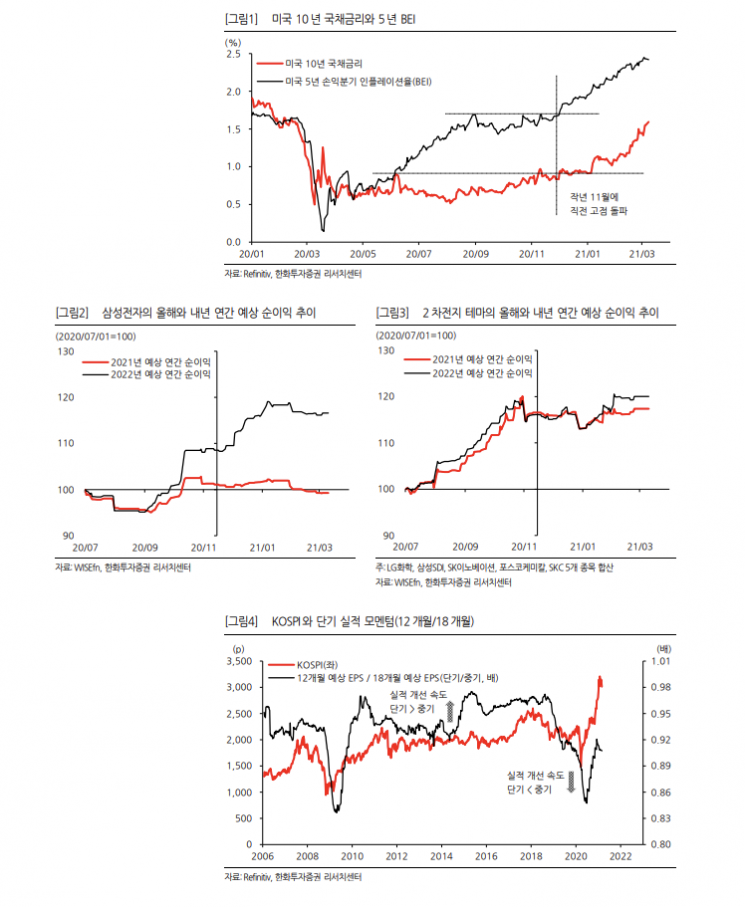

On the 13th, according to Hanwha Investment & Securities, as the U.S. 10-year Treasury yield fluctuated around 1.5%, the expected net profit trend for Samsung Electronics, the leading stock in the domestic market, began to stagnate this year. Meanwhile, the expected net profit for next year continued its upward trend. Companies in the secondary battery theme, which led the growth stock rally, have also seen their earnings forecasts stall since November last year (based on the top 5 market capitalization stocks in the TIGER KRX Secondary Battery K-New Deal ETF). On the positive side, this can be seen as entering an earnings market where this year's results are better than last year's, and next year's growth surpasses this year’s. However, it can also be interpreted as the improvement in earnings being pushed back to next year.

If interest rates remain a key market topic, investors should keep in mind the possibility of increased volatility in next year's earnings, which are higher than this year's. It is only the first quarter. Next year is still far away. Cases where this year's earnings do not catch up to next year's can be gauged by comparing the 12-month expected EPS (earnings per share) with the 18-month expected EPS. A decline in the ratio of 12-month (short-term) expected EPS to 18-month (mid-term) expected EPS means that the pace of short-term earnings improvement is not keeping up with the mid-term.

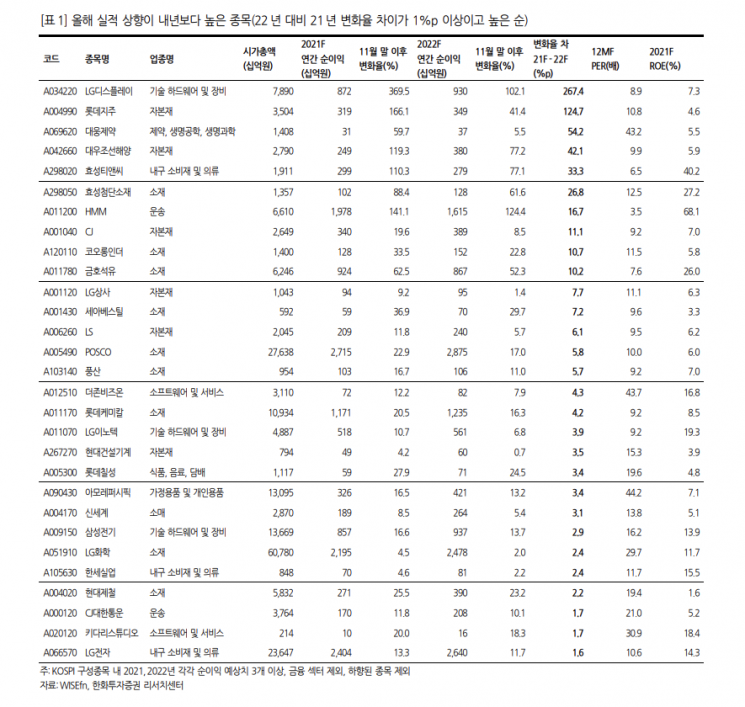

Empirically, when short-term earnings momentum lags behind the mid-term, stock indices have often stalled. Earnings need to improve now, not next year. Hyunguk Ahn, a researcher at Hanwha Investment & Securities, said, "Stocks that can withstand rising interest rates are those whose earnings outlook has improved faster this year than next year, despite the sharp rise in interest rates since the end of November last year." He added, "Stocks that meet this criterion include LG Display, CJ, Poongsan, Hyundai Construction Equipment, Lotte Chilsung, Shinsegae, and Hansae Yes24."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.