Goyang and Namyangju in Gyeonggi, Incheon, etc.

Small to medium-sized properties built in the outskirts of the metropolitan area

Jeonse-sale price gap of 50 million KRW

After the government's Lease 2 Act enforcement

Rapid rise in Jeonse prices in Seoul and metropolitan area

Domino effect causing increases even in the outskirts

[Asia Economy Reporter Ryu Tae-min] The number of apartments in the Seoul metropolitan area where the gap between sale prices and jeonse (long-term lease) prices has narrowed is increasing. These are mainly complexes built in the mid to late 1990s, which are relatively affordable. It is analyzed that this is the result of tenants, burdened by soaring jeonse and monthly rent prices, seeking relatively affordable jeonse listings with good access to Seoul.

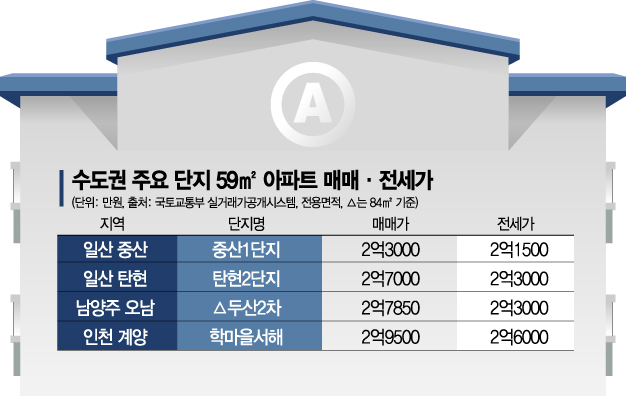

According to the industry on the 12th, the number of small to medium-sized apartments in the outskirts of the metropolitan area such as Goyang and Namyangju in Gyeonggi Province and Incheon, where the difference between jeonse and sale prices is less than 50 million KRW, is increasing.

In Goyang City, jeonse demand has recently been concentrated in the northern areas of Jungsan and Tanhyeon-dong, which are outside the Seoul Subway Line 3. According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, a 59㎡ (exclusive area) unit in Jungsan 1st Complex Doosan Apartments was sold for 230 million KRW last month. Considering that the jeonse transaction for the same area was 215 million KRW in January, the gap between sale and jeonse prices is only 15 million KRW.

Similarly, in Tanhyeon-dong, the Tanhyeon 2nd Complex Samik 59㎡ unit had sale and jeonse prices of 270 million KRW and 230 million KRW respectively in January, showing a difference of only 40 million KRW. Currently, the jeonse asking price for the same size unit in this complex has risen to 250 million KRW.

In Namyangju, the Onam District Doosan 2nd Complex 84㎡ unit was sold for 278.5 million KRW in January. The jeonse price for this complex last month was 230 million KRW, making the price gap 48.5 million KRW. Onam District is gaining attention from buyers due to improved transportation convenience from the extension of Line 4, the Jinjeop Line.

In Incheon, the Hakmaeul Seohae 59㎡ unit in Gyeyang-gu stands out. The sale price in January was 295 million KRW, while the jeonse price last month was 260 million KRW. This means that adding only 35 million KRW to the jeonse price would allow for purchase.

The narrowing gap between sale and jeonse prices in these areas appears to be due to the sharp rise in jeonse prices in key areas of Seoul and the metropolitan area following the government's implementation of the Lease Protection Act (Imdaecha 2 Law). Tenants unable to afford the suddenly soaring jeonse prices have been pushed to the outskirts, causing a domino effect of rising jeonse prices.

Some also analyze that increased moves to fulfill residency requirements in anticipation of the 3rd New Town developments such as Changneung, Wangsuk, and Gyeyang have also influenced this trend.

Kwon Il, head of the research team at Real Estate Info, said, "These complexes are relatively affordable compared to apartments in major Seoul areas and have well-established residential environments, leading to a significant increase in actual residence demand recently. With growing concerns over setbacks in supply measures such as the 3rd New Town, demand for these areas is expected to continue rising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.