Securities Firm Center Head Diagnosis

March KOSPI Expected at 2800-3200 Range

Interest Rate Hike Key Reason for Adjustment

March FOMC Outcome a Turning Point

[Asia Economy Reporter Song Hwajeong] The KOSPI regained the 3000-point level again on the morning of the 11th, buoyed by favorable winds from the U.S. However, the momentum that had been charging relentlessly toward the 3200 level has yet to recover. When will the market turn back to an upward trend? Heads of research centers at securities firms predict that the March U.S. Federal Open Market Committee (FOMC) meeting scheduled for the 17th will be a turning point for the market trend, advising investors to focus on cyclical stocks during this adjustment phase.

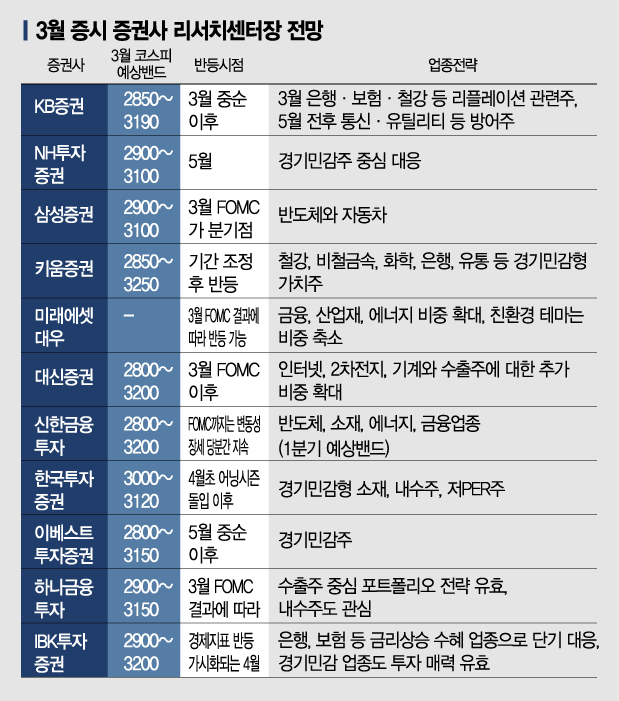

According to a survey conducted by Asia Economy Newspaper targeting heads of research centers at 11 securities firms, the KOSPI in March is expected to move mostly between 2800 and 3200 points.

The reason for the market adjustment was attributed to rising interest rates. Seo Cheolsu, Head of the Research Center at Mirae Asset Daewoo, stated, "The stock price adjustment centered on technology growth stocks is ongoing due to rising interest rates and inflation concerns. Technology growth stocks are more vulnerable to interest rate hikes the more they reflect future expected earnings. On the other hand, as seen by the Dow Jones Industrial Average reaching an all-time high, the concept of economic normalization is still driving stock price gains, so the core reason for the stock price adjustment can be seen as the rise in interest rates rather than concerns about the economy or corporate earnings." Previously, the liquidity-driven bull market background was overshadowed by fears that it might end due to rising interest rates, and valuation burdens intensified, leading to the adjustment.

Focus on FOMC Results

The timing of the rebound is expected to depend on the results of the U.S. Federal Open Market Committee (FOMC) meeting scheduled for the 16th-17th (local time). Oh Hyunseok, Head of the Research Center at Samsung Securities, explained, "The FOMC could be an important turning point as early as this meeting. If the FOMC calms market anxiety, the market will quickly stabilize. However, if the Federal Reserve (Fed) does not make any additional remarks beyond what has been discussed so far, the market might interpret it as the Fed passively allowing interest rates to rise, which could cause another shock."

Attention should also be paid to additional U.S. stimulus measures. Shin Dongjun, Head of the Research Center at KB Securities, said, "Typically, tightening issues are resolved through two events: authorities like the Fed confirming that they have no intention of tightening or introducing corresponding policies, and secondly, the economy and corporate earnings being confirmed as very robust, which gradually alleviates investors' fears about tightening. In this regard, attention should be paid to additional U.S. stimulus measures after mid-March."

Optimistic Outlook Expected Only in May

There are also forecasts that a rebound may only be possible in May. Yoon Jiho, Head of the Research Center at Ebest Investment & Securities, said, "The rebound timing will be after mid-May, when first-quarter earnings are confirmed and the positive effects of U.S. economic stimulus measures can be verified. The weakening of the U.S. dollar's strength, stabilization of commodity prices, and confirmation of improvements in domestic corporate earnings will be the triggers for the rebound."

Oh Taedong, Head of the Research Center at NH Investment & Securities, predicted, "The rebound is expected in May. The base effect on prices due to the spread of COVID-19 will peak in April-May, and inflation rates are expected to decline after June. In May, investors' concerns about inflationary pressures will likely decrease in anticipation of this."

During the adjustment phase, it is advised to focus on cyclical stocks. Additionally, attention should be given to domestic demand stocks, which have recently seen a revival in consumption. Kim Jisan, Head of the Research Center at Kiwoom Securities, said, "Rising interest rates increase the appeal of value stocks over growth stocks. A portfolio shift toward value stocks is necessary, and cyclical value stocks such as steel, non-ferrous metals, chemicals, banks, and retail are considered attractive segments."

Jung Yongtaek, Head of the Research Center at IBK Investment & Securities, analyzed, "During index adjustments caused by rising interest rates, short-term responses can be made through sectors benefiting from interest rate hikes (banks, insurance). For cyclical sectors such as construction, essential consumer goods, transportation, machinery, and retail, recent upward revisions in earnings expectations partly offset the risks of rising interest rates, maintaining their investment appeal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.