Review Underway to Lower Loan Brokerage Fees to the 2% Range

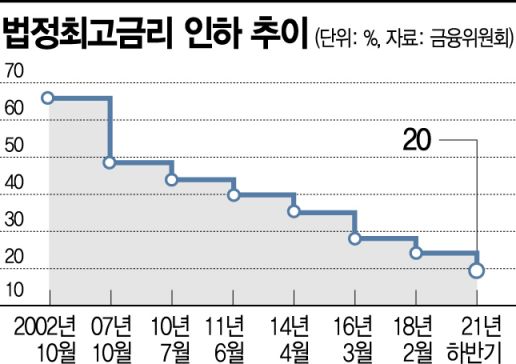

[Asia Economy, reporter Lee Kwangho] With the statutory maximum interest rate set to be lowered to 20.0% per annum in July, authorities have decided not to apply this new cap retroactively to existing loans. Instead, financial regulators plan to encourage refinancing of high-interest loans through policy-based financial products for low-income individuals. There are also ongoing discussions to reduce the current loan brokerage fee, which stands at around 4%, to the 2% range.

According to financial authorities and industry sources on March 10, the Financial Services Commission (FSC) plans to announce supplementary measures in May to enhance financial inclusion in response to the maximum interest rate reduction.

An FSC official stated, "We are comprehensively reviewing various measures to minimize the impact of the maximum interest rate reduction on the financial market."

The FSC has decided not to retroactively apply the new 20.0% maximum interest rate to existing loans from specialized credit finance companies and private lenders once the new cap takes effect. Instead, the authorities will encourage voluntary rate reductions by private sector lenders. Since current loan agreements do not require retroactive application, forcing it could be seen as excessive government intervention.

In fact, when the maximum interest rate was lowered from 27.9% to 24.0% per annum in 2018, card companies, capital firms, and savings banks applied the new cap retroactively to existing loans at the request of financial authorities, which sparked controversy. However, in the same year, savings banks revised their basic lending agreement terms to ensure that for any loan contracts signed thereafter, the statutory maximum interest rate would be retroactively applied whenever it was lowered. As a result, borrowers from savings banks may be eligible for retroactive application, raising potential concerns about fairness.

To address this issue, the FSC plans to promote refinancing through the four major policy-based financial products for low-income individuals: Microfinance (Miso Geumyoong), Sunshine Loan (Haetsalron), New Hope Loan (Saehimang Holssi), and Switch Dream Loan (Bakkwo Dreamron). The aim is to have borrowers take out low-interest policy loans to repay their previous loans or overdue balances. To facilitate this, the supply of such products will be expanded by more than 270 billion KRW annually, and support for debt restructuring and credit recovery for vulnerable and delinquent borrowers will also be strengthened.

Additionally, the brokerage fee charged when introducing borrowers to private lenders will be lowered. The current enforcement decree of the Act on Registration of Credit Business limits this fee to 4% or less, but it is expected to be reduced to around 2%. An FSC official explained, "The specific level has not yet been finalized."

To address concerns that lowering the maximum legal interest rate could make it harder for low-income individuals to access funds, a "Private Lender Premier League" will be introduced, which will ease funding regulations for private lenders. The Private Lender Premier League will grant various benefits-including relaxed funding, business regulations, and sanctions-to large private lenders with assets of at least 10 billion KRW that have not been subject to disciplinary action by the Financial Supervisory Service or other authorities. Currently, private lenders secure funds at rates of 5-6% from secondary financial institutions such as savings banks and capital firms, but if they are allowed to borrow from primary financial institutions (banks), their funding costs could be reduced.

Amendments to the Act on Registration of Credit Business are also being pursued to address concerns about moral hazard among private lenders and to strengthen penalties for illegal private lending businesses. Those operating without registration as private lenders or brokers, or charging interest rates above the legal cap, will face fines of up to 100 million KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)