MetLife Net Profit Up 35%

ABL Life Successfully Returns to Profit

[Asia Economy Reporter Oh Hyung-gil] Foreign life insurance companies, which were rumored to be sold one after another last year, recorded strong performance despite the impact of COVID-19.

The results are noteworthy as they were achieved amid pessimistic business forecasts that the companies would withdraw from the Korean market due to prolonged low interest rates and a stagnant domestic insurance market.

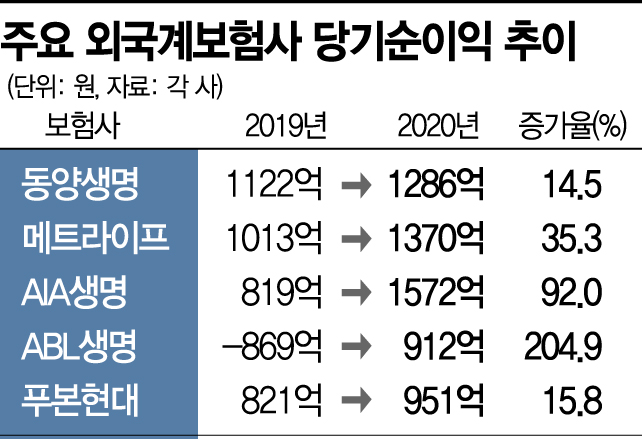

According to the insurance industry on the 9th, the US-based MetLife announced that its net profit last year was 137 billion KRW, a 35.3% increase from 101.3 billion KRW the previous year. Total assets increased by 8.3%, from 21.6218 trillion KRW to 23.4247 trillion KRW.

A MetLife official explained, "Premium income increased and business expense reduction effects appeared," adding, "As the rate of interest decline slowed, there was also an effect of reduced reserve fund contributions."

MetLife, which entered the Korean market in 1989, has been embroiled in sale rumors in recent years. It has grown steadily by introducing variable insurance products to the domestic market, but as Orange Life and Prudential Life were sold to Shinhan Financial Group and KB Financial Group, respectively, MetLife has been mentioned as a likely next candidate for sale.

Dongyang Life and ABL Life, which were not free from sale rumors amid the crisis of their Chinese major shareholder Anbang Insurance Group, also improved their performance last year.

ABL Life recorded a net profit of 91.2 billion KRW on a consolidated basis last year, successfully turning a profit. It explained that corporate tax income was generated due to the recognition of deferred tax assets related to the adequacy evaluation of reserve funds.

Dongyang Life also achieved a net profit of 128.6 billion KRW, up 14.5% from the previous year. Sales reached 6.949 trillion KRW, up 11.1%, and operating profit surged 61.0% to 177.6 billion KRW. It is analyzed that the effect of adjusting the main product group from savings insurance to protection insurance is appearing.

Hong Kong-based AIA Life also achieved a net profit of 157.2 billion KRW, soaring 92.0% compared to the previous year. An AIA Life official said, "Stock-related gains increased due to the stock market boom, and although cancellations increased after COVID-19, the reversal of reserve funds increased significantly, improving net profit."

In November last year, Peter Jung, CEO of AIA Life, directly dismissed sale rumors, saying, "We operate in 18 markets across Asia, and we have never left any market so far." AIA Life is attempting differentiation by focusing on healthcare business that offers premium discounts to encourage healthy lifestyle habits.

Taiwan-based Fubon Hyundai Life also recorded a net profit of 95.1 billion KRW, up 15.8% from the previous year, achieving its highest performance. Fubon Hyundai successfully raised capital worth 600 billion KRW in January, including a paid-in capital increase by its major shareholder, Taiwan's Fubon Life.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.