PER of Telecom Stocks Compared to KOSPI at Virtually Historic Lows

High Dividend Yield Also a Strength Factor... Clear Upward Trend Curve

[Asia Economy Reporter Lee Seon-ae] As inflation concerns intensify in the domestic stock market, increasing volatility, the telecommunications sector is emerging as the optimal investment destination. Although stock investment strategies should vary depending on how one predicts the direction of inflation (rise or fall), the analysis suggests that telecommunications is the only sector that performs well regardless of which scenario occurs.

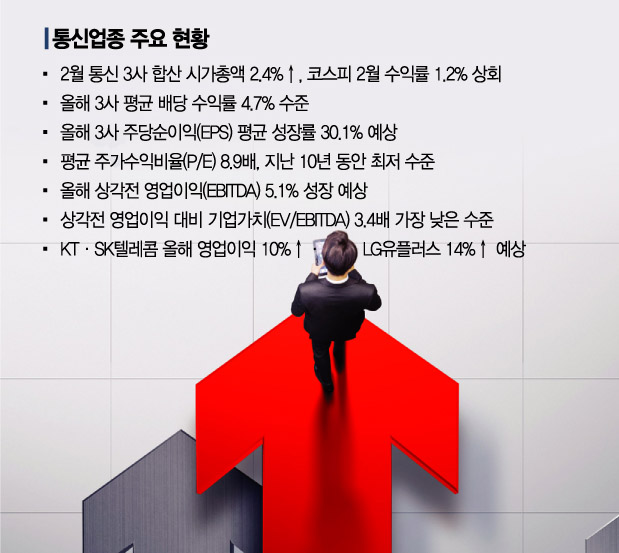

According to the Korea Exchange on the 9th, a clear rebound in telecom stocks has been observed this year. By February, the combined market capitalization of the three telecom companies (SK Telecom, KT, LG Uplus) increased by 2.4%, surpassing the KOSPI's 1.2% rise. Regarding this, Choi Gwan-soon, a researcher at SK Securities, explained, "Despite improved earnings, the heightened valuation appeal due to sluggish stock prices and the sector's emergence as an alternative amid increased index volatility have driven the rise in telecom stocks."

◆ Low-volatility + Dividend Stocks = Shin Eun-jung, a researcher at DB Financial Investment, analyzed, "It is important to note that the telecommunications sector possesses characteristics of both low-volatility (low variability) and dividend stocks." When prices rise, the stock market shakes due to the upward trend in market interest rates. In such situations, low-volatility stocks are the safest. When prices fall, growth stocks and dividend stocks generally gain attention. However, since the valuation of growth stocks has recently reached a considerable level, dividend stocks are more attractive. Researcher Shin emphasized, "The three telecom companies settled into a performance turnaround last year, and the expansion of dividends per share (DPS) is expected to continue this year. Although stock prices are significantly undervalued, considering dividends, valuation, and earnings growth potential, it is judged that there is sufficient value to increase weighting."

The average dividend yield of the three telecom companies was formed at the low 3-4% range, but applying this year's expected DPS, the average dividend yield is about 4.7%. The average earnings per share (EPS) growth rate of the three companies is estimated to rise from 27.7% last year to 30.1% this year, while the average price-to-earnings ratio (PER) is 8.9 times, the lowest level in the past 10 years.

Researcher Choi said, "As of the end of February, the 12-month forward PERs of SK Telecom, KT, and LG Uplus are 10.2 times, 8.3 times, and 7.5 times respectively, compared to the KOSPI's 13.3 times, indicating that the undervaluation phase of domestic telecom stocks continues." He added, "The PER of telecom stocks relative to the KOSPI has also fallen to 77%, 62%, and 56% for SK Telecom, KT, and LG Uplus respectively, which is practically a historic low."

Despite the expected 5.1% growth in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for the three telecom companies this year, the enterprise value to EBITDA ratio (EV/EBITDA) stands at 3.4 times, the lowest level. The outlook for operating profit is also bright. The securities industry expects LG Uplus, a strong player in wireless business, to increase operating profit by about 14% this year compared to the previous year. SK Telecom, which has started to show prominence in subsidiaries, and KT, with promising B2B and content subsidiaries, are expected to grow around 10%.

◆ 5G Subscriber Net Increase Boosts Earnings = The net increase in 5G subscribers is also a positive factor for telecom stocks. In January, the net increase in 5G subscribers reached 1,018,000, the highest number since 5G commercialization. The total number of 5G subscribers reached 12.87 million, raising the 5G proportion of total lines to 18.2%. KT had the highest 5G subscriber proportion at 22.5%, followed by SK Telecom and LG Uplus at 20.3% and 20.2%, respectively.

As of the end of January, SK Telecom secured 5.96 million 5G subscribers, and average revenue per user (ARPU) from mobile subscribers is expected. In the wired segment, subscriber growth centered on IPTV and high-speed internet continues. The possibility of transitioning to an intermediate holding company through spin-off is also high, which could highlight the value of new business sectors previously overshadowed by the telecom division.

KT's expected dividend yield this year is over 5%. With a high dividend yield securing downside support for the stock price, a rise in stock price due to improved earnings is also anticipated. With a higher 5G subscriber proportion than competitors and a solidified position as the number one operator in high-speed internet and IPTV in the wired segment, the earnings improvement trend is expected to continue.

LG Uplus has experienced stock price weakness starting from uncertainties related to Huawei equipment, which continues this year, but with the upcoming standalone (SA) 5G commercialization, dependence on Huawei equipment is expected to decrease. Accordingly, valuation normalization is anticipated this year. With the expansion of 5G subscribers and continued net increase in IPTV subscribers, operating profit margin is expected to rise to 6.7% this year and 6.9% next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.