[Asia Economy Reporter Park Jihwan] Venture capital (VC) investment in fintech more than doubled in the second half of last year compared to the first half, and it is expected that the global VC investment in fintech will continue to be strong this year.

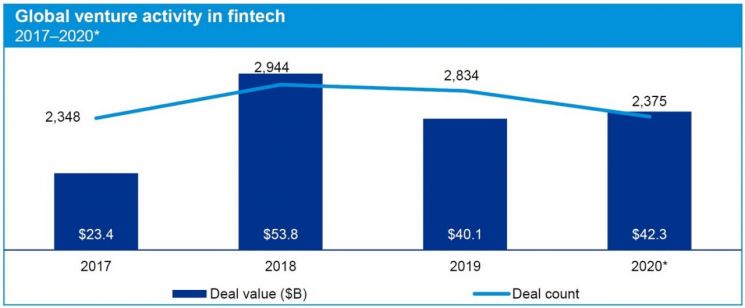

According to a report published on the 8th by KPMG, a global accounting and consulting firm, global fintech investment last year amounted to $105.3 billion, down about 37% from $168 billion the previous year, while VC investment in fintech companies totaled $42.3 billion, marking the second highest ever recorded.

In the second half of last year, following the U.S. stock trading platform Robinhood’s $1.3 billion VC funding, Sweden’s Klara ($650 million), the UK’s Revolut ($580 million), and the U.S.’s Chime ($530 million) also attracted large-scale VC investments.

Despite the COVID-19 pandemic, corporate fintech investment ($21 billion) remained strong. The report attributed this to increased consumer demand for electronic payment solutions and contactless banking services, as well as the growing need for digital transformation among companies, which heightened interest in later-stage companies.

M&A activity in the fintech industry in the second half of last year exceeded $50 billion, a significant increase compared to $10.9 billion in the first half. The acquisition of TD Ameritrade by Charles Schwab ($22 billion) and Intuit’s acquisition of Credit Karma ($7.1 billion) were among the top 10 M&A deals, nine of which took place in the U.S., driving a rebound in the M&A market.

In the latter half of last year, fintech unicorns emerged in the U.S. (Next Insurance, Chainalysis, Better.com, Porter), China (Waterdrop), Canada (Wealthsimple), India (Razorpay), the Netherlands (Mollie), and Brazil (Creditas). The first fintech unicorns also appeared in Saudi Arabia (STC Pay) and Uruguay (dLocal). The report analyzed that the emergence of diverse fintech unicorns worldwide indicates the rapid evolution of the global fintech ecosystem.

Fintech investment in the Asia-Pacific region fell to $11.6 billion, the lowest in six years since 2014. This was attributed to early-stage companies struggling to secure funding in emerging markets centered on Southeast Asia due to the impact of the COVID-19 pandemic.

The most notable fintech sector in the Asia-Pacific region is payments. Following large-scale investments in Indonesia’s Gojek ($3 billion) and Singapore’s Grab ($890 million) in the first half of last year, the U.S. company WEX acquired Australian B2B payment firm eNet for $777 million. Additionally, Australia’s digital bank Judo Bank and Korea’s remittance company Toss successfully raised $209 million and $147 million, respectively.

Among major fintech deals in the Asia-Pacific region last year, South Korea’s payment solution company KSNET’s $237 million buyout deal ranked eighth.

Jae-bak Cho, Fintech Leader at Samjong KPMG, explained, "Although global fintech investment slowed in 2020 due to the COVID-19 pandemic, the second half saw a clear rebound with more than double the scale of the first half, driven by active VC investment in asset management and digital banks such as Robinhood and Revolut."

He forecasted, "In 2021, as demand for convenient and simple financial services at customer touchpoints increases worldwide, embedded finance will be activated, and in addition to alliances and mergers in payment services, wealth tech, virtual assets as transaction intermediaries, cybersecurity, and regtech will attract attention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.