Time Reduction from Storage, Packaging, Shipping to Delivery with 'Fulfillment'

"Price is Meaningless" ... "Competition Will Focus on Services like Packaging and Exchanges"

[Asia Economy Reporter Jo In-kyung] "Mom, please make sure to pack my cutlery case starting tomorrow since I'll be eating school meals." Working mom Lee, who lives in Ahyeon-dong, Mapo-gu, Seoul, realized this while preparing her elementary school daughter for school on the 2nd. Hurriedly, she opened a smartphone application on the subway on her way to work and ordered a children's cutlery set priced at 9,200 won from Coupang. The phrase "Guaranteed delivery today" reassured her.

As soon as Lee completed the order, the cutlery case began a short journey. The product ordered at 8 a.m. arrived at Coupang Ilsan Camp at 11:54 a.m., and delivery started at 12:22 p.m. After traveling along Jayuro, it arrived at the entrance of Lee's apartment in Ahyeon-dong, Mapo-gu, at 6:32 p.m., arriving before Lee, who was hurrying home from work.

Top 3 Dawn Delivery Logistics Centers Double in Size

According to the distribution industry on the 8th, the logistics centers of the top three dawn delivery companies?Coupang, Market Kurly, and SSG.com?have more than doubled in size over the past three years. Coupang's logistics center expanded from 1.22 million square meters in 2018 to 2.32 million square meters currently. Having established logistics centers in most major cities nationwide, Coupang has a system capable of delivering to 70% of the Korean population.

During the same period, Market Kurly increased from 60,000 square meters to 150,000 square meters. On the 2nd, it opened the Gyeonggi Gimpo logistics center, covering 82,644 square meters. Market Kurly's average daily order processing volume was about 90,000 orders, but now it can deliver approximately 180,000 orders via dawn delivery.

SSG.com also nearly doubled its logistics center area from 60,000 square meters to 110,000 square meters. SSG.com not only uses Emart's PP Center (Pickup & Packing) but is also scouting new sites to expand its logistics centers.

The reason the distribution industry is continuously expanding logistics centers is that the e-commerce market depends not on the number of products but on delivery time. As the online distribution market rapidly grew due to COVID-19, next-day delivery services such as "Rocket Delivery" and "Dawn Delivery" emerged, as well as same-day delivery services like "Immediate Delivery" and "Immediate Pickup," which deliver within three hours.

E-commerce Grows 4x, Dawn Delivery 200x

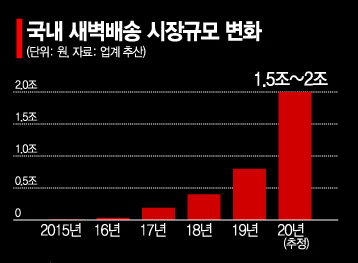

The domestic online shopping market has grown more than fourfold from 34 trillion won in 2015 to 161 trillion won last year. Among this, the dawn delivery market, centered on fresh food, is estimated to have grown nearly 200 times, from 10 billion won to about 2 trillion won during the same period.

This is largely due to the reduction in delivery time from a minimum of 3 days to 1 week down to same-day delivery. The core of fast delivery is "fulfillment," which comprehensively handles storage, packaging, shipping, and delivery of sellers' products. Previously, sellers would package products upon receiving orders, then couriers would pick them up, transport them to terminals, sort them, and finally deliver them to consumers.

Fulfillment eliminates the step where couriers pick up packages from sellers after receiving shipping labels by stocking inventory at hub terminals, thereby shortening delivery time. This is why products can arrive within half a day.

Surging Demand for ‘Fast Delivery’

This phenomenon has accelerated further during the COVID-19 era. Dawn delivery competition has evolved into "3-hour immediate delivery" and "instant delivery." Especially as price competition intensifies and products and prices become similar across companies, delivery time has become the main factor consumers consider when choosing e-commerce companies.

Consumer Park (35) said, "After a long period of price competition, the price difference for products costing 20,000 to 30,000 won is only a few hundred won between companies, making price competition almost meaningless. From a consumer's perspective, it feels more important to receive products quickly, safely, and at the desired time from a reliable company."

An industry insider said, "As companies offering dawn and same-day delivery services grow explosively, logistics centers have become the greatest competitive advantage in the distribution industry. Considering the planned logistics center investments, the era of same-day delivery services available throughout South Korea is not far off."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)