Volatility and Exchange Rate Rise Similar After External Shocks Like Epidemics

Clear Differences Too...Accumulated Inventory Demand and Increased Facility Investment

Contrasting National Policies..."Easing Stance Expected to Continue"

Pedestrians pass in front of the IFC Center cinema in New York City, USA, which reopened on the 5th (local time) after nearly a year of closure due to the COVID-19 pandemic. [Image source=Yonhap News]

Pedestrians pass in front of the IFC Center cinema in New York City, USA, which reopened on the 5th (local time) after nearly a year of closure due to the COVID-19 pandemic. [Image source=Yonhap News]

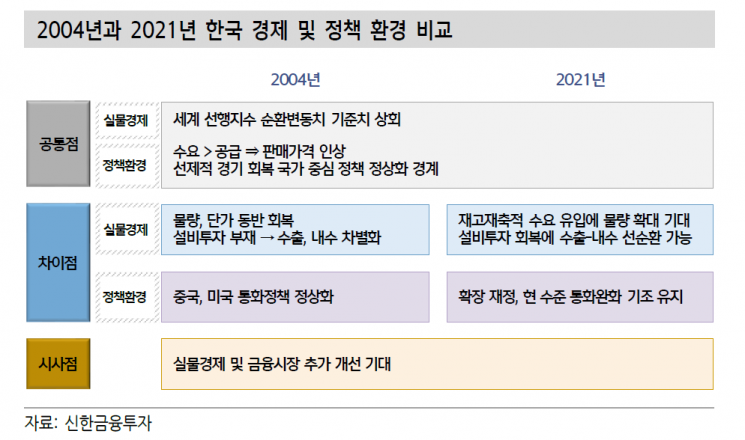

[Asia Economy Reporter Minwoo Lee] An analysis suggests that the domestic economy and financial markets are similar to those in the first half of 2004. This is against the backdrop of a phase where recovery and growth occur amid a favorable external environment and policy conditions, while various unit prices rise due to demand exceeding supply. However, unlike back then, this year investment is also expanding, forming a virtuous cycle between exports and domestic demand, leading to greater expectations than concerns.

On the 7th, Shinhan Financial Investment compared the current domestic real economy and financial markets to those in 2004. Since the beginning of the year, global inflation concerns have increased volatility due to rising market interest rates and early normalization of monetary policies. South Korea has shown a weaker performance compared to the U.S. financial market. Foreign investors have continued net selling in both stock and government bond futures markets cumulatively since the start of the year. Both stock prices and bond prices are relatively weaker compared to developed countries. The won-dollar exchange rate, which fell to the 1080 level in early December last year, has risen for two consecutive months to 1126 won.

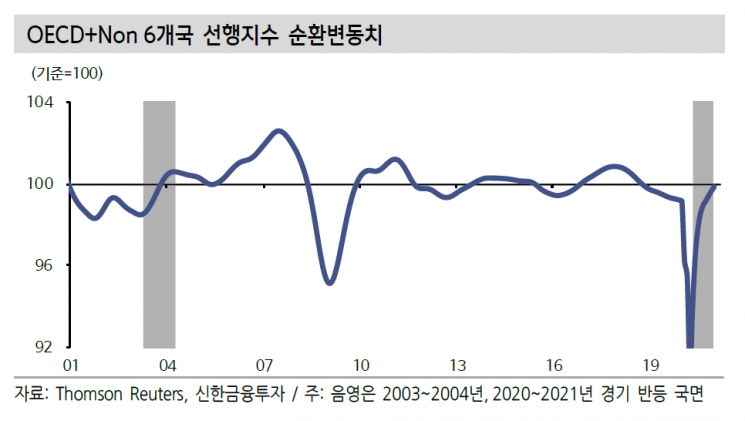

Leading Index Cyclical Components of the Organisation for Economic Co-operation and Development (OECD) and Six Emerging Countries (China, Brazil, India, Indonesia, South Africa, Russia)

Leading Index Cyclical Components of the Organisation for Economic Co-operation and Development (OECD) and Six Emerging Countries (China, Brazil, India, Indonesia, South Africa, Russia)

This situation is explained as being similar to the first half of 2004. At that time, the global economy, including South Korea, experienced several external shocks such as the early 2000 'dot-com bubble,' the September 11, 2001 terrorist attacks, and the 2003 SARS (Severe Acute Respiratory Syndrome) outbreak, after which demand recovery began in earnest. Despite a favorable economic trend, the financial market saw increased volatility. The KOSPI fell more than 20% over three months following the 'China Shock' on April 29, 2004. The 10-year government bond yield fluctuated around 5%, and the won-dollar exchange rate rose from the mid-1100s to the 1200 level. Ha Gun-hyung, an economist at Shinhan Financial Investment, explained, "In 2004, tightening began in major countries centered on China, causing the economic momentum to peak and slow down for about a year. This was due to the completion of front-loaded demand inflows during aggressive investment and inventory accumulation alongside tightening policies."

Room for Economic Recovery, Accommodative Policy Stance... "Different from 2004"

However, future developments are expected to differ. In 2004, tightening began in major countries centered on China, causing economic momentum to peak and slow down for about a year. This was due to the completion of front-loaded demand inflows during aggressive investment and inventory accumulation alongside tightening policies. In contrast, this year, unlike 2004, there remains potential for additional economic growth.

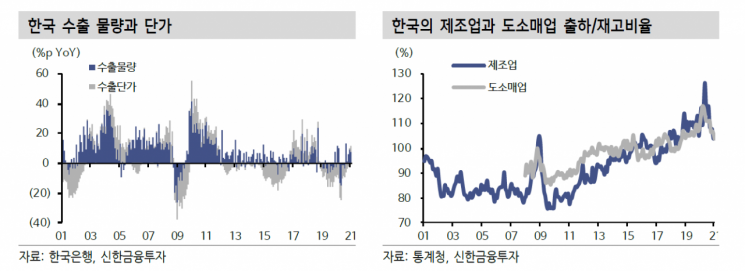

First, it is expected that volume improvements will accompany economic recovery based on rising unit prices. South Korea's exports have narrowed their year-on-year decline since the second half of last year and turned positive from November last year. However, this was largely due to unit price increases, with limited volume recovery. This contrasts with 2004, when both volume and unit prices improved. This year, there is demand for inventory rebuilding. The SARS outbreak ended early in the first half of 2003, leading to nearly a year of proactive inventory accumulation demand from the second half of that year. In contrast, due to the prolonged COVID-19 pandemic and remaining uncertainties, inventory rebuilding demand has not been observed. The domestic manufacturing and wholesale/retail shipment-to-inventory ratio has fallen to the level of late 2018. Except for China, which proactively ended the COVID-19 situation, most countries including the U.S. and Europe are keeping inventories to a minimum.

If the pandemic situation is resolved from the second quarter with widespread vaccine distribution in major countries, inventory rebuilding demand is expected to flow in for about a year. Economist Ha predicted, "If inventory rebuilding demand flows in, due to the 'bullwhip effect' (where consumer demand fluctuations amplify as they move upstream through the supply chain), countries with a high proportion of final goods production like the U.S. and China will see less inventory increase compared to countries like South Korea that produce intermediate goods."

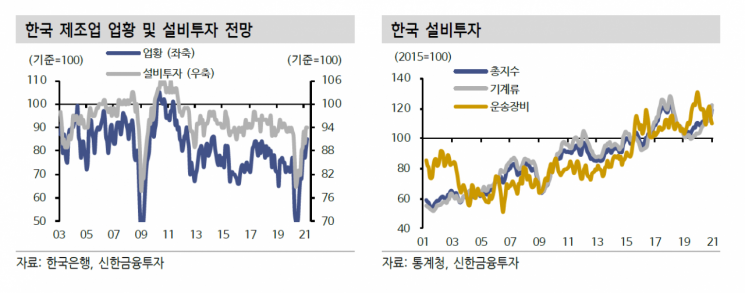

Another difference is the expansion trend in facility investment. Domestic companies' business outlook is at its highest level since the financial crisis, and facility investment forecasts have recovered to pre-COVID-19 levels. Regardless of the COVID-19 situation, facility investment had been gradually improving since early 2019, with recent increases accelerating. This is due to favorable investment trends in machinery, centered on semiconductors. Economist Ha explained, "If investment recovery accompanies this, unless external demand deteriorates sharply, a virtuous cycle between exports and domestic demand will form. Since inventory rebuilding demand is expected, the demand environment is positive, allowing for additional economic upswing due to investment expansion."

Policy Stance Also Different... "Definitive Fiscal Stance to Be Maintained"

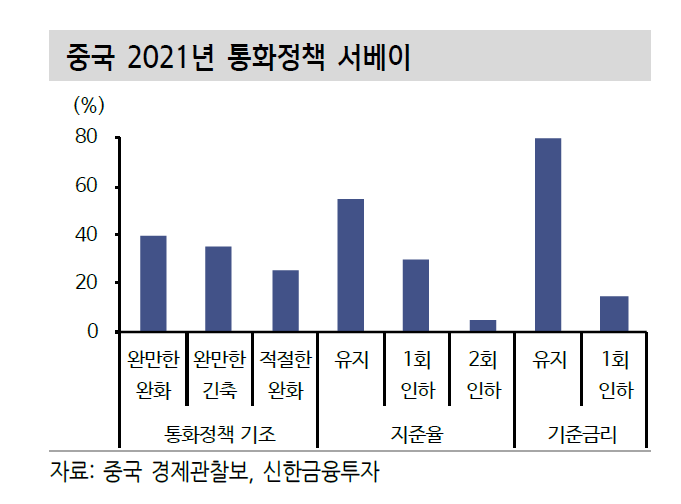

China recently aims to maintain a moderate and cautious monetary policy stance while being wary of economic overheating and asset price increases. At the end of January, when concerns about policy normalization arose due to liquidity withdrawal in the short-term money market, Yi Gang, Governor of the People's Bank of China, indicated that China's monetary policy would continue to support economic recovery. According to a survey of economic experts by China Economic Observer, the dominant view is to maintain an accommodative monetary policy stance and keep the reserve requirement ratio at the current level (55%). There is even openness to one or two rate cuts. The policy interest rate is expected to be maintained by 80% of respondents, with 15% expecting one cut.

Economist Ha said, "In other words, within China, the outlook is for strengthening monetary easing to support economic growth rather than tightening. The Two Sessions (National People's Congress and Chinese People's Political Consultative Conference) also reemphasized a moderate and cautious monetary policy stance and limited the possibility of tightening."

In the U.S., recent rapid increases in market interest rates have caused financial market volatility. However, this is due to the absence of additional monetary policy from the central bank rather than market expectations. The rate rise is not due to concerns about policy normalization. The Federal Reserve has repeatedly stated through various events and speeches that it will continue ultra-low interest rates and substantial asset purchases. Achieving employment and inflation targets, necessary for policy normalization, is estimated to take at least three years.

Economist Ha analyzed, "Unlike 2004, when policy normalization temporarily weakened external demand, the current risk of downward pressure on the real economy caused by policy is low. Rather, governments worldwide are expected to continue expansionary fiscal policies this year following last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)