[Asia Economy Reporter Seulgina Jo] Online video service (OTT) Netflix, which has enjoyed considerable success in the global market with so-called K-content such as Kingdom and Sweet Home, announced an ambitious plan to invest a whopping $500 million (about 560 billion KRW) solely in Korean content production this year. Domestic OTT platforms like Wavve and TVING, feeling threatened by the aggressive investment moves of the global 'OTT giant' Netflix, are also actively securing original content, but industry insiders predict that the space for K-OTT will gradually shrink as their efforts are virtually like 'throwing eggs against a rock.'

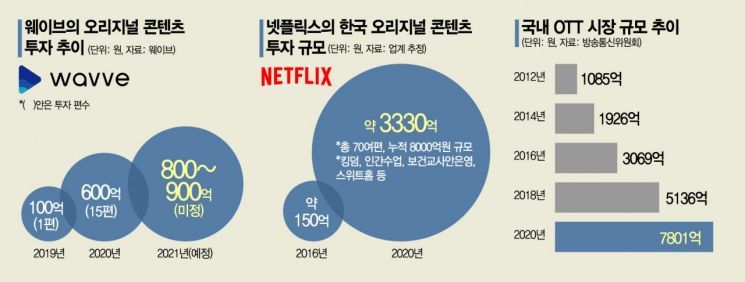

According to Netflix on the 6th, the scale of investment in Korean content this year is $500 million, with 13 original content productions planned. Considering that since entering the Korean market in 2016, Netflix has invested a total of $700 million over five years and produced about 80 pieces of content until last year, this is a significantly expanded scale. In its first year of entry in 2016, Netflix's investment in Korean content was only 15 billion KRW. This year, dramas such as "The Silent Sea," "D.P.," "Move to Heaven," "Hellbound," "Squid Game," "Kingdom: Ashin of the North," and reality variety show "Back Spirit" are scheduled to be released. Along with this, Netflix has also secured a stable content production base by long-term leasing studios located in Yeoncheon and Paju, Gyeonggi Province, early this year.

This move is interpreted as a reflection of Netflix's confidence that content produced in Korea can succeed in the global market. The hot popularity of K-content such as Kingdom and The School Nurse Files is considered one of Netflix's key growth drivers in the global market. Korea not only played a significant role in the increase of Netflix subscribers centered in Asia last year but also serves as a core production base for Netflix's 'original content strategy.' Domestically, despite massive traffic, Netflix has continuously faced controversy over 'free riding' by avoiding network usage fees, but it is widely acknowledged that Korea has greatly contributed to Netflix's rise as a streaming powerhouse with 200 million paid subscribers worldwide.

Ted Sarandos, Netflix's Chief Executive Officer (CEO), recently said in an online briefing via video message, "Please watch what the 'next' of Netflix and Korean content will be," and added, "We will invest in Korean storytellers regardless of genre or format." Earlier, in a letter to shareholders during the earnings announcement, Netflix emphasized its content investment strategy by stating, "Our strategy is simple: if we improve Netflix every day to provide better enjoyment to subscribers, we will be the first choice in streaming entertainment." It is also reported that Netflix considers the success of Korean content crucial to establishing a foothold in the high-growth-potential Asian region.

Domestic companies feeling the threat are also actively securing original content like Netflix. Wavve, based on terrestrial broadcasting content, plans to expand its original content investment to 90 billion KRW this year. The trend shows an increase from 10 billion KRW in its first year of launch to 60 billion KRW last year, and 80 to 90 billion KRW this year. Watcha, which completed a Series D investment worth 36 billion KRW, will start producing original content this year. TVING, a joint venture between CJ ENM and JTBC, also unveiled its first original content, "High School Mystery Club."

However, industry insiders lament that the scale of investment is at a level where competition itself is not feasible due to overwhelming differences in economies of scale and financial power. The amount Netflix announced it will invest this year is nearly half of the total annual direct program investment cost of all domestic terrestrial broadcasters (10.841 trillion KRW as of 2019).

There are also growing concerns that Netflix's strengthening of its original content strategy will deepen so-called Netflix dependency. Overseas OTT services including Netflix are dominating domestic platforms, and domestic producers may be reduced to subcontractors for K-content. As dependence on Netflix increases from content production to distribution, the bargaining power of domestic operators and producers is weakening.

Some suggest that domestic OTTs, which have not yet established as solid a position as Netflix, may engage in a chicken game by recklessly expanding original content investments. Original content production requires enormous funds during the production process but does not yield immediate profits. An industry insider said, "From the perspective of program providers (PPs), Netflix's investment in Korean content is welcome," but added, "The fact that domestic platforms could be dominated is a cause for concern."

The domination of domestic platforms by global ICT giants such as Google and Netflix, which have massive financial resources, has intensified since the spread of COVID-19. In the domestic online video distribution market, the combined share of Google YouTube, Netflix, and Facebook platforms reached 87.2% last year, up 23.6 percentage points from the previous year. The top three platforms are all overseas platforms. Meanwhile, the market shares of Naver TV and AfreecaTV, ranked fourth and fifth, declined to 4.8% and 2.6%, respectively. Additionally, Disney Plus (+), which holds vast content, is also set to enter the Korean market.

Inside and outside the industry, voices are growing louder for urgent policy support for domestic platforms and protective measures for the domestic ecosystem to prevent digital colonization and the outflow of digital content revenue overseas. Another industry insider emphasized, "It is practically difficult to fight Netflix alone," and stressed, "Since Korean content resonates overseas as well, an OTT content alliance looking toward overseas markets rather than just the domestic market is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.