TSMC Plans to Triple US Expansion Investment Amount

Expanding Semiconductor Supply Chain in the US...Aligned with Biden Administration Policy

Samsung Electronics Reviewing Four US Expansion Candidate Sites

Concerns Over Delay in Investment Timing Amid Semiconductor Supercycle Response

Company logo at the headquarters of TSMC, the world's largest semiconductor foundry, located in Hsinchu, Taiwan. [Image source=Yonhap News]

Company logo at the headquarters of TSMC, the world's largest semiconductor foundry, located in Hsinchu, Taiwan. [Image source=Yonhap News]

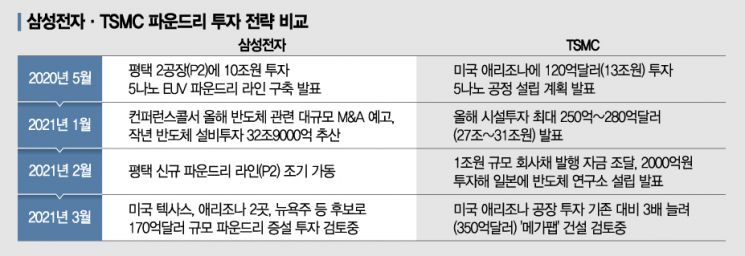

[Asia Economy Reporter Woo Su-yeon] As Taiwan's TSMC considers tripling its investment in its Arizona plant in the United States, the competition for preemptive investment among global foundry competitors is intensifying. TSMC, the industry leader, is actively promoting expanded investment in the U.S. by strengthening intergovernmental cooperation, while Samsung Electronics, currently without a head, is struggling to speed up the final decision on potential expansion sites in the U.S.

According to local media such as UDN on the 5th, TSMC is recently reviewing a plan to increase its investment in the Arizona plant by about three times compared to the previously announced amount, aiming to build six "megafabs" (large-scale semiconductor factories). In May last year, TSMC announced plans to invest $12 billion (approximately 13 trillion KRW) to complete a 5nm process line in Arizona by 2024.

However, with U.S. President Joe Biden recently signing an executive order reviewing the semiconductor supply chain and emphasizing strengthening the domestic semiconductor supply chain, TSMC's investment trend has shifted toward expansion. TSMC is considering an investment scale of up to $35 billion (approximately 40 trillion KRW), tripling the original $12 billion, and plans to hire about 1,000 local engineers. The state of Arizona is also offering active incentive policies, including investing $205 million (approximately 232 billion KRW) in operating funds for the city of Phoenix to supply water necessary for semiconductor production.

Samsung Electronics, planning to expand its foundry plant in the U.S. with an investment of $17 billion (approximately 19 trillion KRW), is also reviewing two candidate sites in Arizona. Although expansion of the existing Austin plant in Texas was considered a likely option, recent record cold waves in the U.S. caused power outages in Texas, prompting additional reviews not only on the stability against natural disasters but also on various incentives.

As the semiconductor supply shortage intensifies recently, global industrial attention is focused on Korea and Taiwan. On the 4th, Bloomberg News re-highlighted Korea and Taiwan, which hold strong power in the global semiconductor industry, comparing the world's dependence on these countries to the Organization of the Petroleum Exporting Countries (OPEC).

The Taiwanese government is pursuing a policy to actively fill the gap left by China due to the U.S.-China trade dispute through cooperation with TSMC, the world's top foundry company. The recent decision to invest in the Arizona plant and expand local engineer hiring aligns with the policy direction of the Biden administration in the U.S., which promotes domestic manufacturing revival and employment expansion.

On the other hand, in Korea, there are criticisms that unified policies between the government and Samsung Electronics to capitalize on the global semiconductor market boom are lacking. Although the government announced a 133 trillion KRW system semiconductor investment support policy in February, it is focused on nurturing domestic manufacturing and is considered difficult to use as a policy to prepare for short-term global market cycles.

Moreover, concerns have been raised that Samsung Electronics' investment decisions may not be made in a timely manner amid the absence of a head. An industry insider said, "If there are four candidate sites, it means that internal opinions are divided even more," adding, "It will take considerable time just for the internal system procedures of discussion and verification to unify the decision."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.