Growing Interest in Fractional Trading at Fintech-Based Securities Firms

"Should Be Designated as an Innovative Financial Service Like Overseas Stocks"

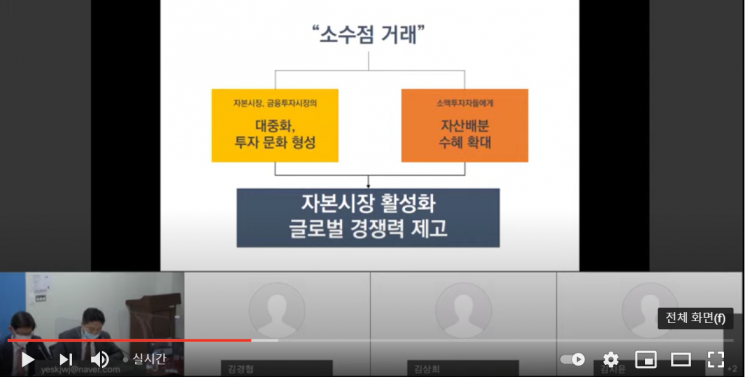

Fractional Trading Can Lower Investment Barriers in Capital Markets

Promotes Healthy Investment Culture Through Diversified Investment in Blue-Chip Stocks

[Asia Economy Reporter Minji Lee] Discussions are growing about fractional share trading, which allows investors to buy stocks in decimal amounts rather than whole shares.

According to the financial investment industry on the 4th, there is increasing demand for the urgent introduction of fractional share trading through innovative financial services. Fintech-based new securities firms such as Kakao Pay Securities and Toss Securities are showing growing interest in launching fractional share trading services. This is interpreted as a judgment that innovations like fractional share trading services are necessary to attract more investors amid heightened public interest in stocks, driven by phenomena such as the Donghak Ant and Seohak Ant investment booms.

In the case of Kakao Pay Securities, which generates 9.6 million fund investments per month through its "Coin Collection" service that allows users to invest leftover change into funds, the plan is to proactively apply fractional share trading services to its mobile trading service (MTS) scheduled for release in the second half of the year to secure customers.

Fractional share trading means trading stocks in smaller units such as 0.1 or 0.5 shares instead of one whole share. It is a familiar trading method for investors with experience in overseas stocks or Bitcoin investments. In 2019, the Financial Services Commission designated fractional share trading services for overseas stocks by Shinhan Financial Investment and Korea Investment & Securities as innovative financial services. If applied to domestic stocks, it would be positively received by investors as it increases accessibility to high-priced blue-chip stocks. For example, if an investor hesitated to buy NCSoft (closing price on the 3rd: 962,000 KRW) because they could only buy one share with the amount of money that could buy 11 shares of Samsung Electronics (84,000 KRW), fractional trading allows them to hold stocks by purchasing 0.1 shares (96,200 KRW) or 0.5 shares (481,000 KRW).

At the discussion titled "Choosing Top Stocks for the Price of a Cup of Coffee," hosted by Lee Kwang-jae, a member of the Democratic Party, at 10 a.m. that day, Ryu Young-jun, chairman of the Korea Fintech Industry Association and CEO of Kakao Pay, who delivered the keynote speech, emphasized, "Domestic stocks should also be designated as innovative financial services so that individuals can benefit from asset allocation through small investments." He argued for the necessity of fractional share trading services, stating, "From the perspective of asset allocation, individuals are at a disadvantage because they cannot invest large amounts to directly invest in blue-chip stocks," and "Investing in stocks priced close to one million KRW per share requires tens of millions of KRW, which inevitably lowers investment accessibility."

Fractional share trading is already active in overseas markets, centered on fintech companies and advisory firms. In the U.S., fintech companies like Motif Investing and Robinhood mainly provide fixed-amount trading and small portfolio services. In the U.K., fractional trading has been offered through discretionary advisory firms (PIs) since the second half of last year.

Lee Hyo-seop, director at the Korea Capital Market Institute, also said, "Now is the appropriate time to consider activating fractional share trading for domestic stocks," adding, "Before institutional improvements, it should be designated as an innovative financial service under the financial regulatory sandbox, and in the long term, supplemented by allowing internal order execution by securities firms or activating alternative trading systems (ATS)."

However, it is uncertain whether such discussions will quickly lead to the designation of innovative financial services by authorities. This is because there is a wide range of institutional aspects to review, including the Electronic Commerce Act, Commercial Act, and Capital Market Act. To introduce fractional share trading services, issues such as △sharing stock voting rights △fractional unit deposit systems △real-time trade execution △system stability must be resolved. For example, the Korea Securities Depository's system is currently configured to issue electronic securities only in whole shares (one share), making fractional trading processing impossible. Fractional shares must be aggregated into whole shares for trading, making it difficult to purchase stocks at market prices.

Byun Jae-ho, head of the Capital Market Division at the Financial Services Commission, said, "We are considering two approaches: applying the sandbox system used for overseas stocks domestically to provide services while completing institutional improvements, or the government accepting stable systems created by the market," adding, "We will ensure consumers can quickly access innovative services."

Existing securities firms (6 to 7 companies) are also expanding their interest in introducing fractional share trading services as brokerage commission fees account for an increasing proportion of their revenue. They see it as an opportunity to increase profitability, given the large number of young potential investors with high income and asset growth potential. According to Toss Securities, the number of domestic stock investors is only about 6 million. Accordingly, the Korea Financial Investment Association has formed a consultative body with some securities firms to deliver plans for activating fractional share trading services to financial authorities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.