Extended for an Additional 6 Months Until September This Year... Legal Interpretation Maintained

Various Long-Term and Installment Repayment Methods Selectable Depending on Next Week's Situation

Close Monitoring Conducted... Continued Promotion of Financial Company Soundness Management

[Asia Economy Reporter Kwangho Lee] Financial authorities will extend the loan maturity extension and interest repayment deferral measures for small and medium-sized enterprises (SMEs) and small business owners by an additional six months until September this year. Even after the financial support program ends, a "soft landing plan" has been prepared to reduce the borrower's burden by allowing principal and interest to be repaid over a long period. In reality, this is a "6 months + α" support that not only extends the loan maturity until the end of September but also provides time for repayment.

The Financial Services Commission announced on the 2nd that it has prepared such a "maturity extension and repayment deferral measure extension and soft landing plan for deferred repayment loans" through discussions with the Financial Supervisory Service, financial associations, and policy financial institutions.

Kwon Daeyoung, Director of the Financial Industry Bureau at the Financial Services Commission, explained, "Considering comprehensively the impact of COVID-19 on the real economy and the opinions of the industrial and financial sectors, we decided to extend the previous measures by six months until September. We also specified the 'soft landing plan for deferred repayment loans' to prevent the borrower's repayment burden from concentrating all at once after the deferral period ends."

As of the end of January, the total loan maturity extensions across all financial sectors amounted to 121 trillion won (371,000 cases), principal repayment deferrals were 900 billion won (57,000 cases), and interest repayment deferrals were 163.7 billion won (13,000 cases).

Under this measure, SMEs and small business owners who applied for maturity extension and repayment deferral can reapply if the maturity or deferral period ends within the extension period. For example, a borrower whose loan matured at the end of November last year and received an extension until the end of May can reapply in May to extend it at least until November.

The existing legal interpretations regarding asset soundness and classification standards for loans with maturity extension and repayment deferral will remain unchanged.

Policy financial institutions such as the Korea Development Bank, Export-Import Bank of Korea, Industrial Bank of Korea, Korea Credit Guarantee Fund, and Korea Technology Finance Corporation will also provide maturity extension and interest repayment deferral upon application for loans and guarantees maturing in September for SMEs and small business owners.

Additionally, 14 commercial and regional banks will extend the maturity of the small business interest subsidy loan program by one year.

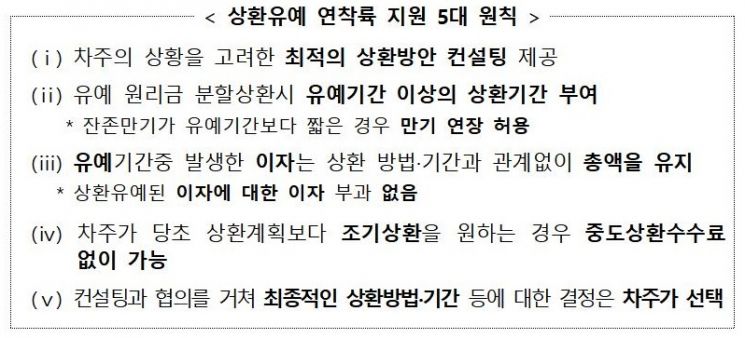

The Financial Services Commission will apply the "Five Principles of Soft Landing Support" to allow borrowers to choose from various long-term and installment repayment methods, considering their individual circumstances.

The five principles are: ▲Providing optimal repayment plan consulting considering the borrower's situation ▲Granting a repayment period longer than the deferral period when repaying deferred principal and interest in installments ▲Maintaining the total amount of interest accrued during the deferral period regardless of repayment method or period ▲Allowing early repayment without prepayment penalties if the borrower wishes to repay earlier than originally planned ▲Allowing the borrower to decide the final repayment method and period after consulting and negotiation.

In other words, to prevent the burden of principal and interest repayment from concentrating at once, optimal repayment plan consulting will be provided, and based on the consultation, the borrower can choose the final repayment method and period.

Director Kwon stated, "We plan to closely monitor and promptly respond to inquiries and field difficulties arising during the implementation of the maturity extension, repayment deferral application, and soft landing plan through dedicated desks within the Financial Supervisory Service's 'COVID-19 Financial Support Special Consultation Center' and sector-specific support centers."

He added, "We reaffirmed that financial companies will not be penalized for active measures regarding maturity extension, repayment deferral, and soft landing plans for SMEs and small business owners affected by COVID-19, unless there is intentional or gross negligence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.