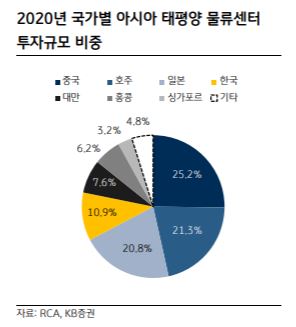

[Asia Economy Reporter Ji Yeon-jin] As COVID-19 vaccination expands in major countries worldwide, expectations are growing for the recovery of office demand, which had shrunk due to the pandemic. Last year, logistics centers, which attracted the greatest interest from investors in domestic and international markets, are expected to continue drawing investment funds this year as well.

According to KB Securities on the 28th, although office leasing demand in major overseas cities decreased last year due to COVID-19, demand for about 76,000 pyeong (approximately 251,000 square meters) in Seoul continued. Steady investment demand has led to record-high prices per pyeong. The capitalization rate (Cap Rate) has fallen from the previous 4% range to the 3% range. The capitalization rate is a discount rate applied to convert future estimated profits into present value; the lower it is, the higher the valuation of unlisted companies, while a higher capitalization rate lowers corporate value.

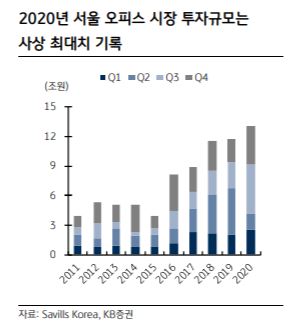

Kim Mi-sook, an analyst at KB Securities, said, "The price per pyeong of the recently transacted O2 Tower in Yeouido (formerly HP Building) is 24.7 million KRW, which is expected to set a new record for the Yeouido area upon deal closure," adding, "The scale of Seoul office transactions in 2020 exceeded 13 trillion KRW, marking an all-time high, and steady investment and price increases per pyeong are expected this year as well."

However, it is pointed out that with the domestic and overseas alternative investment guidelines for securities companies and non-life insurance companies set to be implemented from March and the second half of the year respectively, commercial real estate investment may become more cautious in the future.

Although the pace of vaccination in major Asia-Pacific countries is slower compared to the US and Europe, market recovery is expected after vaccine distribution. This optimism is reflected in the market, with commercial real estate investment demand in the Asia-Pacific region recovering, centered on logistics centers. Some financial firms are reorganizing their spaces, such as Citigroup’s sale of its Asia-Pacific retail banking business and Standard Chartered Hong Kong’s decision to use shared offices for its 6,000 employees,

but office demand recovery in major cities is anticipated due to increased demand from tech companies.

In the US, COVID-19 cases are decreasing due to vaccination. Although office demand in major cities like Manhattan and San Francisco declined last year, recovery is expected from the second half of this year. The scale of commercial real estate investment in the US last year was about 441 trillion KRW, and investment demand is expected to increase.

Inland Empire, a logistics hub in California, hosts nine Amazon fulfillment centers. The vacancy rate for logistics centers in Q4 last year was 3.1%, and the annual rent growth rate was 8.8%. Investors are analyzing that they are seeking investment opportunities in offices in major cities where demand recovery is expected, logistics centers in major and mid-sized cities showing strong demand, and residential assets.

Amid concerns over the spread of the UK variant and delays in vaccination schedules, which are expected to slow Europe’s economic recovery, the UK?where vaccination is progressing fastest?is making efforts to restore the market, such as announcing a four-step roadmap to end lockdowns. Although prime office demand in major cities like London, Paris, and Berlin decreased compared to the previous year, rents have maintained pre-COVID-19 levels. European commercial real estate investment volume fell 27% year-on-year last year, but the value and capitalization rate levels of key assets such as offices and logistics centers have been maintained. Analyst Kim forecasts, "Selective investment in prime assets in core areas is expected, and the value of prime assets is likely to remain stable without adjustment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.