Overlap in Support Measures Between Ministries and Local Governments

Concerns Over Blind Money Exploitation

Rental Business Boom Unrelated to Startup Promotion

Urgent Need for Simplified Channels and Strengthened Management... Shift from Funding to Technical Support Needed

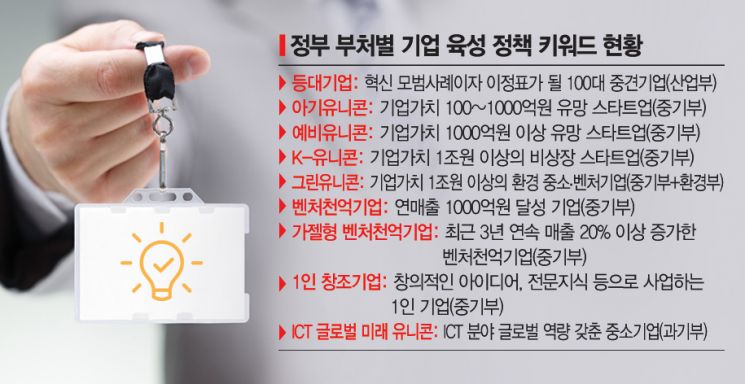

[Asia Economy Reporters Haeyoung Kwon (Sejong), Bokyung Kim] As government ministries competitively introduce corporate fostering measures, cases where existing policies are merely "rehashed" or "patched together" are not uncommon. As a result, clear and effective "moves" that address the "itchy spots" are rarely seen. Experts point to the competitive rollout of populist policies by government ministries and local governments as the cause. They emphasize the need to simplify the dispersed support channels by ministry and strengthen the efficient execution of financial support.

◆Government releasing rehashed, patched-together fostering measures=According to related ministries on the 25th, the "Lighthouse Project" announced by the Ministry of Trade, Industry and Energy (MOTIE) the day before overlaps significantly with previously announced policies. The project aims to discover private investments worth over 1 trillion won to support entry into new industries such as future cars, displays, and bio-health, which overlaps with the 20 trillion won-scale policy-type New Deal Fund established by the Ministry of Economy and Finance last year. The "Export Pioneer Business Club" targeting 300 domestic-focused, early-stage mid-sized companies with global capabilities, and the establishment of the "Mid-sized Enterprise Digital Innovation Center" to accelerate digital transformation of mid-sized companies, are also rehashed versions of policies MOTIE announced in March (Digital Innovation Center for Mid-sized Companies) and August (Digital-based Industrial Innovation Growth Strategy) last year. Although the project includes tax support and expansion of innovative products recognized in public procurement, there is little difference from existing policies.

Not only MOTIE but also other ministries such as the Ministry of SMEs and Startups (MSS) and the Ministry of Science and ICT have released support measures that are similar in content, differing only in the scale of target companies. Due to this situation, some in the mid-sized and small business sectors are concerned that financial support is being distributed like "free money." According to the office of Assemblyman Kyumin Lee of the Democratic Party, in the case of Company A, it received policy funds every year from 2016 to 2020, resulting in a total of seven policy funds from various ministries over five years.

◆Among startups last year, 3 out of 10 were in leasing... growth of mid-sized companies slowed=Government support measures lacking "selection and concentration" ultimately make it difficult to achieve results in the corporate field. According to financial information firm FnGuide, as of the third quarter of last year, 349 listed mid-sized companies recorded sales of 203.6219 trillion won and operating profit of 11.344 trillion won, both down from the same period the previous year (204.6743 trillion won and 12.1281 trillion won). While COVID-19 had an impact, both external and internal growth of mid-sized companies have slowed.

An awkward situation has arisen where a "startup boom" is occurring in sectors unrelated to government startup fostering policies. According to startup company trends announced by MSS the day before, real estate businesses accounted for 438,000 newly established startups last year, representing 29.5% of the total. This was followed by wholesale and retail trade (390,000, 26.3%) and accommodation and food services (167,000, 11.2%). MSS stated that despite the COVID-19 crisis, startups increased by 15.5% compared to the previous year, but excluding real estate, the startup growth rate was only 4.1%. By industry, the number of manufacturing startups, which have driven the Korean economy, has been decreasing annually. From about 57,300 in 2018 to 52,300 in 2019, and 49,900 last year, the 50,000 mark has been broken.

◆Need to strengthen pre- and post-support management system... shift support from funds to technology=While many companies receive overlapping policy funds due to the proliferation of policies by each ministry, there are also complaints from the corporate field that companies truly in need are not receiving policy funds. MSS has been running the "100 Specialized Small Giants in Materials, Parts, and Equipment" project from 2019 to last year to foster specialized SMEs in the materials, parts, and equipment sector, but 1,834 companies applied and 1,407 were rejected. An official from the Korea Federation of SMEs said, "Because the number of support targets is small, benefits do not reach smaller companies that desperately need support," and added, "It is necessary to expand the selection scope and scale of small giants to strengthen competitiveness through diversification of materials, parts, and equipment items."

Experts point out the need to reduce the more than 100 mid-sized and small business policies and simplify support channels to increase efficient resource allocation. A national research institute official said, "In Germany, a strong country of small giants, applied technology specialized institutions like the Fraunhofer Institute have regional headquarters supporting SMEs with various practical technologies and product development such as machinery, parts, and materials," and advised, "Korea should also shift the focus from financial support to technological support for mid-sized and small companies, while strengthening pre- and post-management for beneficiary companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.