On the 24th, when the KOSPI index showed a flat trend in the early session, the KOSPI was displayed on the electronic board at the Hana Bank dealing room in Euljiro, Seoul. Photo by Moon Honam munonam@

On the 24th, when the KOSPI index showed a flat trend in the early session, the KOSPI was displayed on the electronic board at the Hana Bank dealing room in Euljiro, Seoul. Photo by Moon Honam munonam@

[Asia Economy Reporter Junho Hwang] On the 24th, the KOSPI fell below the 3000 mark due to net selling by foreigners. This was a result of weakened investor sentiment amid concerns over rising market interest rates. However, foreigners actively bought Samsung Electronics. Analysts interpret this as a shift from growth stocks sensitive to interest rates to value stock investments.

According to the Korea Exchange on the 25th, the KOSPI closed at 2994.98, down 2.45% from the previous day's closing price. It dropped to the 2000 level for the first time in 16 trading days (as of the 26th). This is the first close in the 2000 range this month. The investor sentiment index fell to 40%. A level below 25% is considered oversold. The KOSDAQ barely held the 900 level (906.31), with its sentiment index dropping to 30%.

Foreigners Bought Samsung Electronics

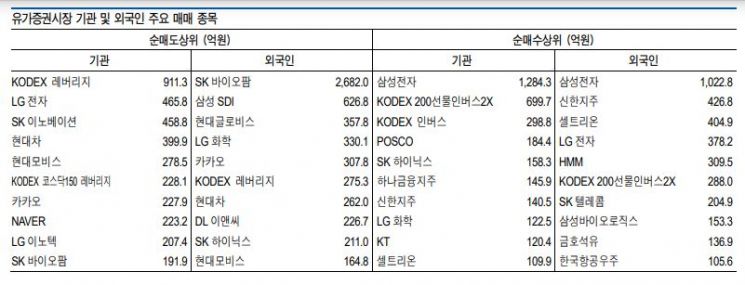

The main actors in net selling that day were foreigners. They sold 412 billion KRW in the KOSPI alone. Institutions also joined in, selling 133 billion KRW. The rise in market interest rates, with the US 10-year bond yield approaching 1.4%, weighed heavily on the stock market, increasing the proportion of net selling.

Despite this, foreigners concentrated their purchases on Samsung Electronics, with net buying of 102.2 billion KRW. Samsung Electronics ranked first among net purchased stocks that day. Institutions also bought 128.4 billion KRW, showing a similar trend to foreigners. Thanks to this, Samsung Electronics was able to close flat from the previous day.

This contrasts with the active selling of SK Biopharm, a representative growth stock. Foreigners net sold 268 billion KRW, causing SK Biopharm's stock price to drop by 17.2%. Although this can be interpreted as a result of SK Group's block deal share sale that day, it is also analyzed as a revaluation of growth stocks. Foreigners also sold 62.6 billion KRW of Samsung SDI, a leading secondary battery stock.

Now It's Value Stocks

On the 29th, the KOSPI index is displayed on the electronic board in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI started at 3,078.73, up 9.68 points (0.32%) from the previous trading day, showing an upward trend. Photo by Moon Honam munonam@

On the 29th, the KOSPI index is displayed on the electronic board in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI started at 3,078.73, up 9.68 points (0.32%) from the previous trading day, showing an upward trend. Photo by Moon Honam munonam@

In the market, there is an assessment that the time has come to choose value stocks over growth stocks. Growth stocks, which reflect future expectations in current value based on low interest rates, inevitably lower expectations when interest rates rise. On the other hand, value stocks, which do not face difficulties in raising funds due to interest rate hikes, see increased expectations for performance.

Seungjin Park, a researcher at Hana Financial Investment, explained, "In the early phase of rising market interest rates before policy rate hikes, value stocks recorded relatively better performance compared to growth stocks," adding, "It is necessary to build a portfolio focusing on stocks and sectors where performance improvement can be confirmed in the near future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.