High Loan Interest Rates Are a Burden for Small and Micro Enterprises

[Asia Economy Reporter Park Sun-mi] It has been revealed that the loan interest rates for small and medium-sized enterprises (SMEs) at IBK Industrial Bank of Korea, which was established to support SMEs, are still higher than those of commercial banks.

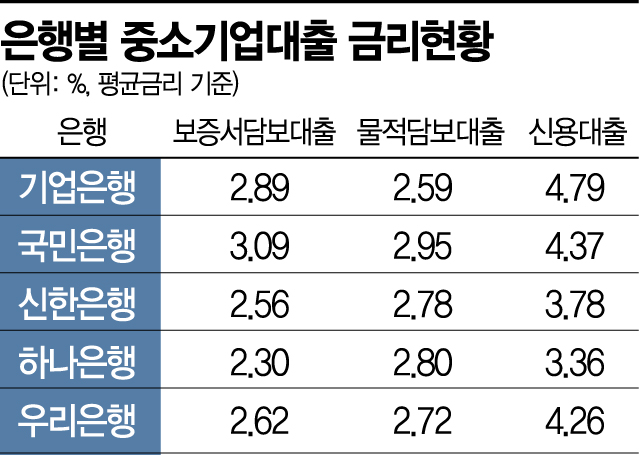

According to the SME loan interest rate disclosure by the Korea Federation of Banks on the 25th, the average loan interest rate at IBK for guarantee-backed loans secured by guarantee certificates from guarantee institutions such as the Korea Credit Guarantee Fund is 2.89%, which is higher than the rates of three commercial banks: Shinhan (2.56%), Hana (2.30%), and Woori (2.62%).

In particular, even when the guarantee ratio is 100%, meaning the bank has no collateral management burden, IBK’s interest rate is 2.38%, exceeding the levels of the four major banks: Kookmin (2.29%), Shinhan (1.62%), Hana (1.52%), and Woori (1.88%). For loans with a guarantee ratio below 80%, only IBK forms interest rates in the 4% range, which is higher than the 3.18?3.59% levels of the four major banks.

The situation is similar for unsecured loans to SMEs. IBK’s average unsecured loan interest rate is 4.79%, higher than the 3.36?4.37% range of the four major banks. Across credit rating brackets 1?3 (2.96%), 4 (3.83%), and 5 (5.46%), IBK’s loan interest rates exceed those of the four major banks. Even for the lowest credit rating bracket 7?10, IBK’s rate (6.72%) is higher than Kookmin Bank’s (6.21%).

However, for secured loans backed by real estate or other physical collateral, IBK’s average rate (2.59%) is lower than those of the four major commercial banks (2.72?2.95%).

The fact that IBK’s SME loan interest rates are higher than those of commercial banks has been pointed out repeatedly during national audits. In October last year, Assemblyman Bae Jin-kyo of the Justice Party criticized that it is problematic for IBK, which has a high proportion of loans to SMEs and self-employed individuals amid the difficult economic situation caused by COVID-19, to have higher loan interest rates than commercial banks. He urged the expansion of low-interest loans to ensure smooth funding support for SMEs and the self-employed.

High loan interest rates inevitably pose a burden on small SMEs that rely on financial institution loans as their funding source.

In this regard, an IBK official explained, "Even within the same credit rating bracket, IBK often lends to SMEs with lower creditworthiness than commercial banks, which may cause the average interest rate to appear somewhat higher." The official added, "Also, for customers with the lowest credit ratings, IBK limits the loan interest rate to a maximum of around 9%, whereas general commercial banks do not impose restrictions beyond 10%, so it should be considered that IBK is putting more effort into supporting vulnerable groups."

Some expect that since President Yoon Jong-won stated, "We will expand the proportion of SME loan supply in the first half of this year to support companies facing temporary liquidity difficulties," it will be inevitable to adjust interest rates to levels lower than those of commercial banks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)