Constitutional Challenge Lawyers for Comprehensive Real Estate Tax File Tax Appeal

190 Plaintiffs Who Received Last Year's Tax Notice Participate in Lawsuit

Complaints Over June Tax Imposition Date and Capital Gains Tax Strengthening

Cheongwadae Petitioner: "Interpretations of Capital Gains Tax Differ Even After Visiting 10 Places"

[Asia Economy Reporter Moon Jiwon] Mr. A, who owns an 84㎡ apartment (exclusive area) in Banpo Xi, Banpo-dong, Seocho-gu, Seoul, paid about 3.5 million KRW in comprehensive real estate tax (종합부동산세) last year. This amount is nearly double compared to the previous year (1.9 million KRW). Considering the rise in the official apartment price, it is expected that his 종부세 this year will exceed 7 million KRW by a large margin. Mr. A said, "I am afraid to receive the tax bill every year due to the rapidly increasing taxes."

With the upcoming 종부세 imposition date in June and the strengthening of capital gains tax surcharges, taxpayers' resistance to taxation is also intensifying. This dissatisfaction stems from the fact that income has not changed much, but the tax burden has sharply increased.

According to the industry on the 23rd, a legal team composed of former Legislative Office Chief Lee Seok-yeon and former Blue House Legal Secretary Kang Hoon submitted tax appeal petitions twice?on the 10th and the day before?claiming that the government's 종부세 imposition was incorrect. The legal team plans to proceed with administrative litigation, constitutional law review requests, and constitutional complaints if no decision is made within 90 days after the tax appeal.

About 190 people who received last year's 종부세 payment notices participated in this lawsuit process. A legal team official said, "Although the time was short, more than 190 people bore the costs to proceed with the lawsuit," adding, "Since procedures like constitutional complaints take a long time, we plan to continue the lawsuit next year for the 종부세 imposed this year as well."

Complaints about the sharply increased tax burden this year are flooding both online and offline. Mr. B, who owns two houses in Seoul, said, "It feels like paying expensive rent to the state even though I own my home," adding, "The holding tax burden is heavy, but if I sell and move to a jeonse (long-term deposit lease), I probably won't be able to buy an apartment of the same level again, so I'm holding on."

There are even cases considering divorce due to the 종부세 burden. Mr. C, who owns a house worth about 1.5 billion KRW, said, "I have a long-term plan to increase my assets, so if I buy another house worth about 1.5 billion KRW, I am considering transferring the two houses to my wife and me under separate names and filing for divorce on paper." In this case, the 1 household 1 house deduction amount increases, which could significantly reduce the 종부세 burden.

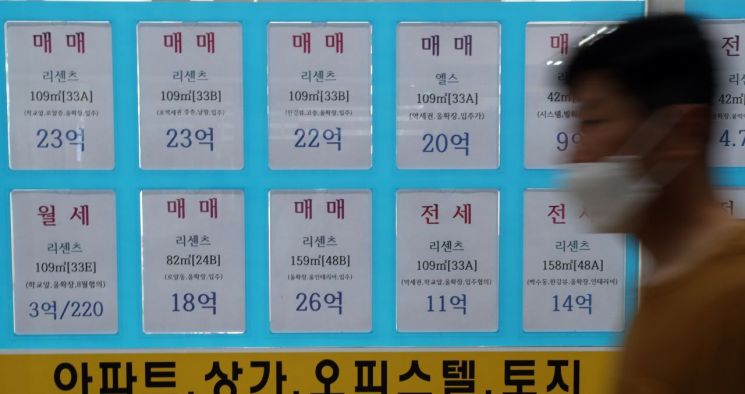

Real estate agency in the commercial area of an apartment complex in Jamsil, Songpa-gu, Seoul (Photo by Yonhap News)

Real estate agency in the commercial area of an apartment complex in Jamsil, Songpa-gu, Seoul (Photo by Yonhap News)

Among homeowners, dissatisfaction with capital gains tax is also growing. Capital gains tax is levied on the price difference when disposing of a house, and the top tax rate increased from 42% to 45% starting this year. From June, the capital gains tax surcharge rate for multi-homeowners selling houses in regulated areas will also increase by 10 percentage points.

While capital gains tax is necessary to limit the huge price gains caused by the rapid rise in apartment prices, the sharp increase is criticized for preventing the appearance of listings in the market. In particular, recent changes in real estate tax regulations and the complexity of calculation methods raise concerns that they hinder the rightful exercise of property rights by the public.

Mr. D, who posted a petition on the Blue House website on the 19th, said, "I am trying to sell the house I currently live in, but even after visiting about ten places including the National Tax Service written inquiry, tax office, and private tax accountants, everyone gives different interpretations," appealing, "Please create a department within the Real Estate Supervision Agency that can calculate capital gains tax."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.