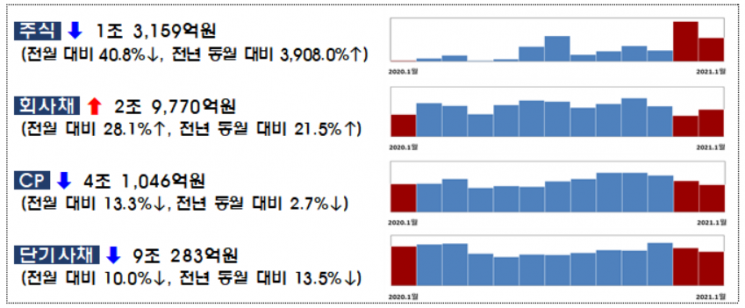

[Asia Economy Reporter Park Jihwan] The scale of domestic companies' fundraising through the stock and corporate bond markets in January increased by 12% compared to the previous month.

According to the direct financing performance of companies in January 2021 announced by the Financial Supervisory Service on the 23rd, the issuance amount of stocks and corporate bonds by domestic companies in January was 15.4723 trillion KRW, up 12% from the previous month.

Stock issuance was 16 cases, totaling 1.9118 trillion KRW, down 40.8% from 34 cases and 3.2277 trillion KRW in the previous month. Initial Public Offerings (IPO) were 10 cases, 5 fewer than in January, and the amount decreased by 11.1% to 289.6 billion KRW. Paid-in capital increases were 6 cases, 1.6222 trillion KRW, down 13 cases and 44.1% compared to the previous month.

The decrease in stock issuance volume compared to the previous month is explained by seasonal factors and a base effect due to the concentration of large-scale paid-in capital increases in the previous month. In particular, paid-in capital increases significantly decreased in both the number of cases and amount due to a sharp reduction in large-scale paid-in capital increases by affiliates of large corporations compared to the previous month. In December last year, there were many large-scale IPOs such as Doosan Heavy Industries & Construction (1.2125 trillion KRW), Korea Securities Finance (612 billion KRW), and Doosan Fuel Cell (336 billion KRW), but in January this year, POSCO Chemical (1.2735 trillion KRW) accounted for the majority of the issuance scale.

The issuance amount of corporate bonds was 13.5605 trillion KRW, up 28.1% from the previous month. It is analyzed that the demand for issuance increased due to the low interest rate effect, and issuance expanded mainly in high-quality general corporate bonds as institutional investors resumed fund execution.

The issuance amount of general corporate bonds increased by 330.9% to 4.52 trillion KRW. Issuance focused on medium- to long-term bonds for debt repayment purposes continued. The proportion of bonds with a credit rating of AA or higher was 92.2%, up 52.4 percentage points from the previous month.

The issuance amount of financial bonds increased by 0.2% to 8.4315 trillion KRW, and the issuance amount of ABS decreased by 45.7% to 60.9 billion KRW.

The issuance amount of commercial paper (CP) and short-term bonds in January was 108.1776 trillion KRW, down 10.8% from the previous month. CP issuance was 26.8426 trillion KRW, and short-term bond issuance was 81.335 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)