Rapid Recovery of Chinese Economy After COVID-19

North American Freight Volume Estimated to Increase by 2.5% on Average This Year

Severe Congestion of Inland Container Movement in the US

[Asia Economy Reporters Yu Je-hoon and Lee Dong-woo] As container prices for export products soar to record highs, a logistics crisis for exports is becoming a reality. Export companies are struggling to secure containers even after paying premiums. Some companies are reluctantly shipping only some products by air freight to meet delivery deadlines. Even after securing scarce ship space, they are unable to load shipments. This is the irony faced by domestic export companies amid the global shipping market's 'empty container crisis.'

Export companies and the logistics industry express concerns that the shortage of empty containers and the resulting high freight rates, caused by the ongoing COVID-19 pandemic and increased demand for goods due to economic stimulus measures worldwide, may continue at least through the first half of this year, or as late as the third quarter.

Containers Stuck in the U.S. and Flowing to China

The root cause of the empty container crisis for domestic export companies lies in the simultaneous rapid recovery of China's economy after COVID-19 and congestion in the North American region. As countries worldwide implement economic stimulus, containers are being drawn into China, the 'world's factory,' while the ongoing pandemic disrupts the global container supply chain management (SCM), causing difficulties in retrieving containers sent to various countries.

Specifically, the increase in China-origin cargo bound for the U.S. West Coast is causing container supply disruptions in Asian countries such as South Korea and Vietnam. According to the Korea Maritime Institute, China's cargo volume to North America is estimated to increase by an average of 2.5% this year.

The impact of COVID-19 remains significant, especially in North America. According to the Daily Breeze, a California daily newspaper, as of the 12th of this month (local time), 853 port workers at the Los Angeles and Long Beach ports tested positive for COVID-19. This is an increase of about 150 from around 700 at the end of last month, tightening container supply further.

A representative from a domestic shipper company said, "The biggest cause is that empty containers sent to various countries are not being properly retrieved due to the ongoing COVID-19 situation," adding, "Countries like the UK, France, and Germany are making efforts, but congestion at ports persists, especially in the U.S., where containers are heavily stuck not only at ports but also inland."

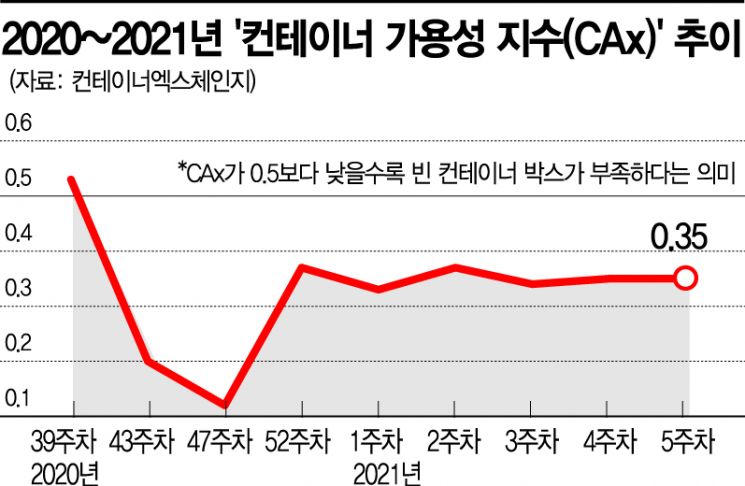

The empty container crisis, which had somewhat eased in mid-last month, is deepening again since the Chinese Lunar New Year. A representative from an export company supplying parts to overseas automakers said, "The container shortage, which had somewhat subsided, is intensifying again from mid-this month," adding, "Freight rates are high, and it is not easy to find empty containers, making it tight to meet export deadlines." A logistics industry representative assessed, "Recently, container imports and exports at Shanghai port have increased, somewhat improving supply, but it will take considerable time before this disperses back to countries like South Korea."

"Container Shortage Likely to Persist Until Mid-Year"

The problem is that this empty container shortage is likely to become a medium-term issue. The industry expects the shortage to continue at least until the first half of this year. In addition to COVID-19, uncontrollable adverse factors such as the recent cold wave hitting the U.S. have occurred, and global consumer consumption patterns are also changing.

An industry insider said, "Generally, after China's Lunar New Year each year, maritime cargo volume tends to stabilize downward, but recently, due to the development of online e-commerce, seasonal demand fluctuations have narrowed," adding, "I expect the trend of high freight rates and container shortages that persisted throughout last year to continue at least until mid-year."

Economic stimulus policies worldwide are also a complicating factor. While increased money supply boosts product consumption, it can accelerate container shortages.

A representative from the Korea Shipbuilding & Offshore Engineering Corporation said, "U.S. President Joe Biden is pushing a massive $1.9 trillion (about 2,100 trillion KRW) economic stimulus package, and G7 countries are also supporting accommodative monetary policies, which will significantly increase market liquidity for the time being," adding, "If product consumption increases again under these conditions, the container shortage is likely to continue in the medium to long term."

‘The Rich Get Richer, the Poor Get Poorer’ Amid Container Crisis

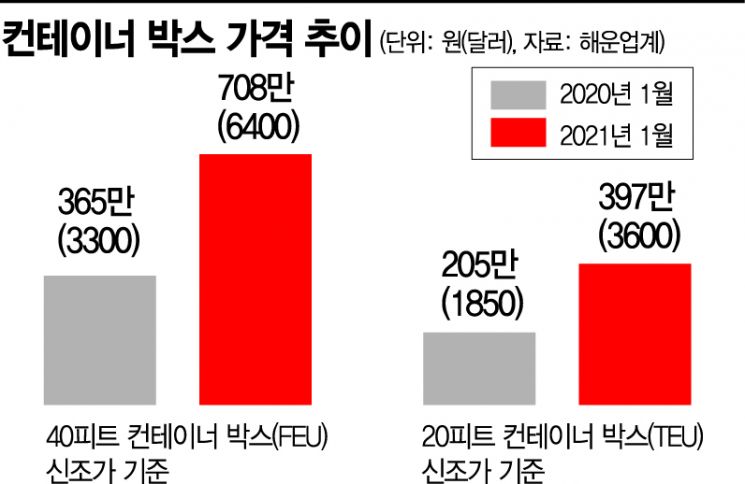

Meanwhile, the industry is concerned that the container shortage is deepening the gap between large shipping companies and small to medium-sized enterprises. South Korea's top shipping company, HMM, is scheduled to sequentially receive eight 16,000 TEU (1 TEU = one 20-foot container) container ships by mid-next month and will secure 43,000 40-foot containers at a rate of 10,000 per month. Additionally, it plans to order 17,000 more containers to secure volume in the second half of this year.

On the other hand, small and medium-sized shipping and forwarding companies are burdened by the purchase cost of over $6,000 per 40-foot container. Company A said, "If container prices rise further, we may have to give up exports for the time being."

Meanwhile, domestic small and medium export companies are facing a 'triple hardship' of container and vessel shortages plus high freight rates. The Shanghai Containerized Freight Index (SCFI) stood at 2,071.71 points as of the 19th, continuing its upward trend and hampering export companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)