[Asia Economy Reporter Kim Eun-byeol] The Bank of Korea, which lowered the base interest rate to a record low of 0.50% per annum, is expected to maintain its rate freeze policy this month as well. Despite soaring stock and real estate prices under the ultra-low interest rate policy, it remains difficult to fully recover from the economic shock caused by COVID-19. Since households and companies have increased their borrowing to cover living expenses during the COVID-19 crisis, raising interest rates would increase debt burdens, making it inevitable to keep rates unchanged.

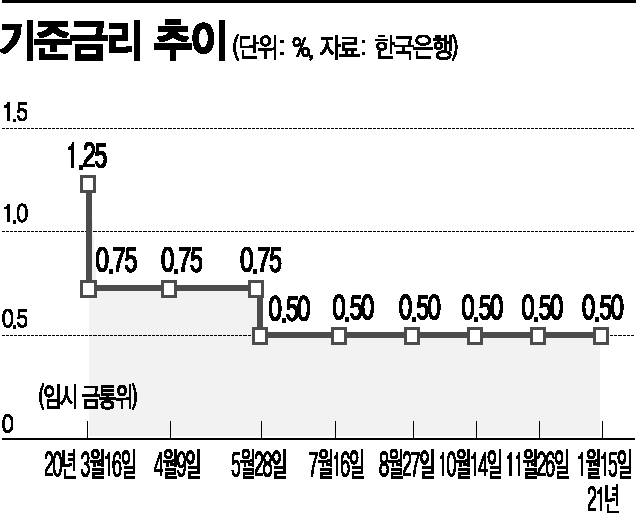

On the 21st, the financial market expects the Bank of Korea's Monetary Policy Committee (MPC) to hold a monetary policy meeting on the 25th and keep the base interest rate at the current 0.5% level. In response to the financial market turmoil caused by COVID-19, the Bank of Korea held an emergency MPC meeting on March 16 last year and cut the base rate from 1.25% to 0.75%, a 0.5 percentage point reduction. Subsequently, in the May MPC meeting, the rate was lowered once more to a record low of 0.50%. Since then, the rate has been held steady five times in July, August, October, November, and January of this year. If the rate is frozen this time as well, it will be the sixth consecutive rate freeze.

With the rollout of COVID-19 vaccines, expectations for economic recovery this year are growing. However, the resurgence of COVID-19 and the spread of variants overseas have increased uncertainty surrounding the real economy's recovery. Especially since employment and consumption indicators remain sluggish, the prevailing view is that the Bank of Korea will find it difficult to raise rates until the real economy's recovery is confirmed.

Attention is also focused on the Bank of Korea's economic outlook for this year, which will be announced alongside the base rate decision on the 25th. In November last year, the Bank projected this year's gross domestic product (GDP) growth rate at 3.0%. There is interest in whether the growth forecast will be revised upward, considering recent positive export prospects.

Major international institutions expect South Korea's economy to achieve growth rates around the 3% range this year. The International Monetary Fund (IMF) adjusted its growth forecast for Korea last month from 2.9% to 3.1%. The Asian Development Bank (ADB) projected a 3.3% growth rate in December last year. The government's growth forecast for this year is 3.2%.

As the government plans to provide the fourth round of disaster relief funds next month, making an additional supplementary budget inevitable, large-scale deficit bond issuance is expected, drawing attention to the Bank of Korea's response.

Gong Dong-rak, a researcher at Daishin Securities, said, "Since the beginning of the year, the bond market has felt that the Bank of Korea's support is physically necessary," adding, "Rather than targeting a specific interest rate to purchase government bonds, the Bank will likely intervene when the bond market becomes unstable enough to affect asset markets and increase corporate financing costs."

Governor Lee stated at last month's Monetary Policy Committee meeting, "If interest rate volatility increases, we will consider simple purchases of government bonds and other measures to stabilize the market." The market expects the Bank of Korea to announce, as it did last year, the scale and timing of government bond purchases. In September last year, the Bank announced plans to purchase government bonds totaling 5 trillion won in four rounds by the end of the year and subsequently carried out the purchases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)