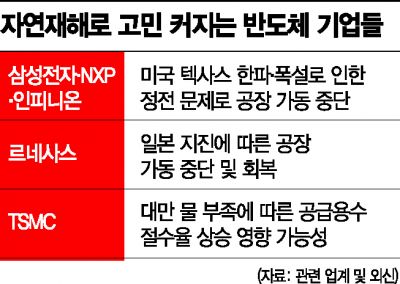

Samsung, NXP, Infineon US Plants Shut Down Due to US Cold Wave

Renesas Production Halted by Japan Earthquake...Normalization Takes Time

TSMC and Others Face Industrial Water Shortage Amid Taiwan Drought

Global Semiconductor Supply Strain Intensifies...Price Increase Concerns

[Asia Economy Reporters Su-yeon Woo and Hyun-jin Jeong] The global semiconductor industry has been hampered by unexpected natural disasters since the beginning of the year. Considering the nature of semiconductor factories that operate 24 hours nonstop, even a short-term shutdown is estimated to cause losses amounting to hundreds of billions of Korean won. With growing expectations for a semiconductor supercycle (long-term boom), the halting of semiconductor factories worldwide is expected to intensify the semiconductor shortage and consequent price increases.

According to the financial statements disclosed by Samsung Electronics on the 19th, the daily sales loss of Samsung Electronics due to the suspension of operations at its Austin plant in the U.S. caused by a recent record cold wave reached 10 billion KRW. Last year, the Austin plant's annual sales amounted to 3.9131 trillion KRW, and considering this, the estimated daily sales loss due to the shutdown is about 10.7 billion KRW.

Due to power shortages caused by the cold wave, Samsung Electronics' Austin plant stopped operations from 4 p.m. local time on the 16th. Austin Energy, the local power company, notified that the power supply interruption would last three days, but considering time needed for maintenance and preparation for restarting, the shutdown period could be longer. This is the first time since Samsung Electronics entered the semiconductor business that an entire plant has completely halted operations. Even if operations resume within ten days, losses are estimated to reach hundreds of billions of KRW, and if the shutdown extends beyond ten days, losses could exceed one trillion KRW.

Semiconductor Industry Hampered by Cold Waves, Earthquakes, and Droughts

In Japan, semiconductor production lines stopped due to an earthquake. Renesas, the third-largest automotive semiconductor manufacturer in Japan, resumed operations at its Ibaraki plant on the 16th after a strong earthquake struck Fukushima Prefecture on the 13th. Although operations have just restarted, it is expected that production capacity will not return to pre-earthquake levels until around the 21st. Japanese companies manufacturing semiconductor raw materials also temporarily halted production due to the earthquake. Shin-Etsu Chemical, which produces photoresist, an essential semiconductor material, stopped its plant operations to inspect equipment damage and is gradually resuming production.

In the U.S., record cold waves and heavy snowfall caused power shortages, leading local factories to declare full operational shutdowns. Along with Samsung Electronics, Dutch company NXP and German company Infineon also closed their facilities. As the cold wave is expected to continue through the weekend and pre-inspections are necessary before restarting, it may take some time before production resumes. Chris Caso, an analyst at U.S. investment bank Raymond James, stated, "Under normal circumstances, this would not have a significant impact, but given the current severe semiconductor supply shortage across the industry, such power outages will worsen supply and demand conditions."

Taiwan, home to many TSMC foundries leading the foundry industry, is increasingly troubled by drought. According to Taiwan media United Daily News Network, due to worsening water shortages, industrial water rationing rates in some areas including Hsinchu City are expected to rise from 7% to 11% starting on the 25th. Hsinchu City, known as Taiwan's Silicon Valley, hosts TSMC and many IT-related factories and companies. The United Daily News Network forecasted, "Concerns over water shortages could affect IC and panel production capacity," adding, "This will lead to continuous price increases." However, TSMC recently stated that it is continuously monitoring the water shortage situation and has prepared countermeasures, so the short-term impact on production plans will be minimal.

Concerns Over Semiconductor Price Increases Due to Supply Contraction

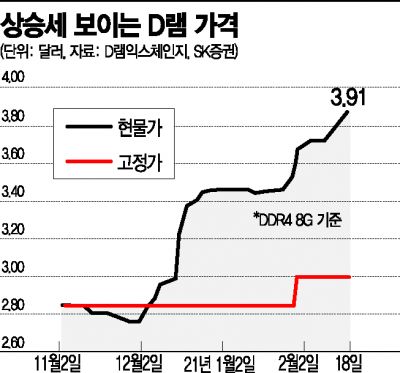

Concerns are rising that the speed of semiconductor product price increases will accelerate due to short-term supply disruptions. Since the end of last year, the semiconductor market has seen a sharp increase in demand, raising expectations for a supercycle over the next two years.

In the spot market, DRAM transaction prices have already surpassed the $4 mark in a short period. According to DRAMeXchange, on the 18th (local time), the spot price for PC DRAM (DDR4 8Gb standard) touched $4.10. Following the rebound in fixed DRAM prices last month after eight months, spot prices, which reflect market conditions earlier, continue to rise. Additionally, prices of semiconductor materials such as photoresist have recently increased by about 10% due to factory shutdowns, leading the industry to anticipate further semiconductor price increases caused by rising raw material costs.

Due to the global value chain structure of the semiconductor industry, a production halt in one location immediately impacts the overall global supply chain. McKinsey & Company cited the semiconductor industry as a representative example in its report last year on global supply chain disruptions caused by climate change.

The report analyzed, "Semiconductors are essential components required for all electronic devices, from computers to smartphones and electronic watches, and production is concentrated in regions with high climate risks." It added, "To reduce damage caused by supply interruptions due to climate change, measures such as dual sourcing or enhancing supplier resilience are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)